Why Should We Teach Everyone How To Use Money Nurjakhon Makhmudova Andijan Development Center

Teaching Children About Money Healthy Life Essex Developing financial literacy involves learning and practicing skills related to budgeting, managing, and paying off debts, and more. it means understanding and using credit and investment. Everfi, a digital instructional company, offers a free seven session program for high school financial literacy. students take interactive, self guided lessons in topics like banking, budgeting.

Why Video Games Are Good For You Mahkamjon Matkabulov Andijan The national center for education statistics indicates that the high school dropout rate (the percentage of people ages 16 through 24 who are not enrolled in school and have not earned a high school credential) was about 6% in 2015. 2. the center’s high school report card focuses on each state’s financial literacy education policy because. Savings: record the amount of money that you’re able to save each month, whether it’s in cash, cash deposited into a bank account, or money that you add to an investment account or retirement. The money smart for young adults (msya) instructor led curriculum provides participants with practical knowledge, skills building opportunities, and resources they can use to manage their finances with confidence. instructors can use it to deliver unbiased, relevant, and accurate financial education whether they are new or experienced trainers. The plc is transforming leadership development by making it easy and affordable to get personalized, socialized, contextualized, and trackable learning experiences. the need for leadership.

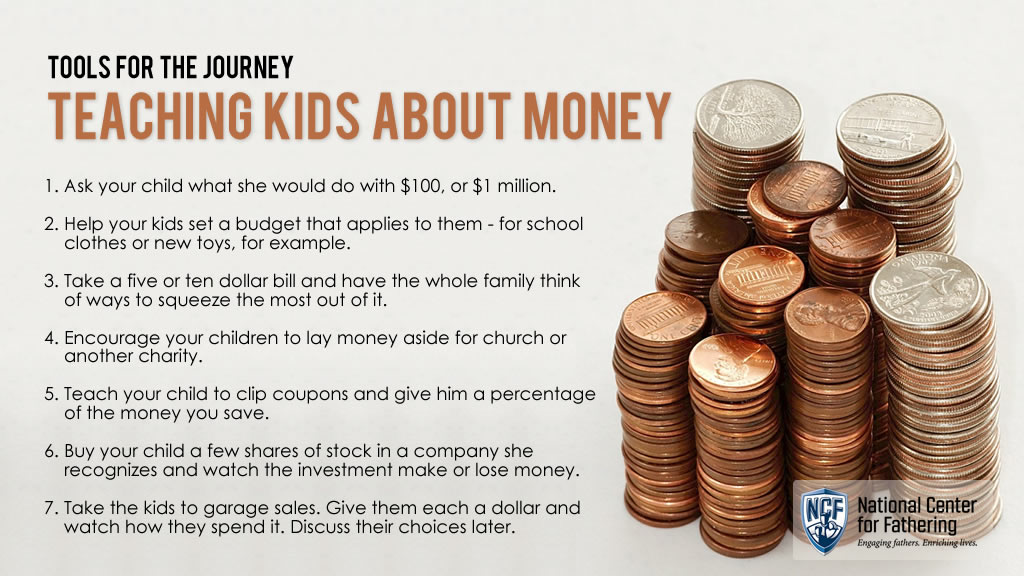

Teaching Kids About Money National Center For Fathering The money smart for young adults (msya) instructor led curriculum provides participants with practical knowledge, skills building opportunities, and resources they can use to manage their finances with confidence. instructors can use it to deliver unbiased, relevant, and accurate financial education whether they are new or experienced trainers. The plc is transforming leadership development by making it easy and affordable to get personalized, socialized, contextualized, and trackable learning experiences. the need for leadership. For more ideas on teaching your kids about money, check out our resources for parents. we are also working to help schools or communities provide youth with more access to hands on learning around financial education. if this interests you, feel free to share our k 12 financial education guide with your local school. In the market, you make or lose money depending on the purchase and sale price of whatever you buy. if you buy a stock at $10 and sell it at $15, you make $5. if you buy at $15 and sell at $10.

Why You Need To Teach Your Kids How To Manage Money For more ideas on teaching your kids about money, check out our resources for parents. we are also working to help schools or communities provide youth with more access to hands on learning around financial education. if this interests you, feel free to share our k 12 financial education guide with your local school. In the market, you make or lose money depending on the purchase and sale price of whatever you buy. if you buy a stock at $10 and sell it at $15, you make $5. if you buy at $15 and sell at $10.

Teaching Money To Kids How To Teach Counting Money In First Grade

Comments are closed.