What Is The Fdcpa A Brief Summary On How It Works For Consumers

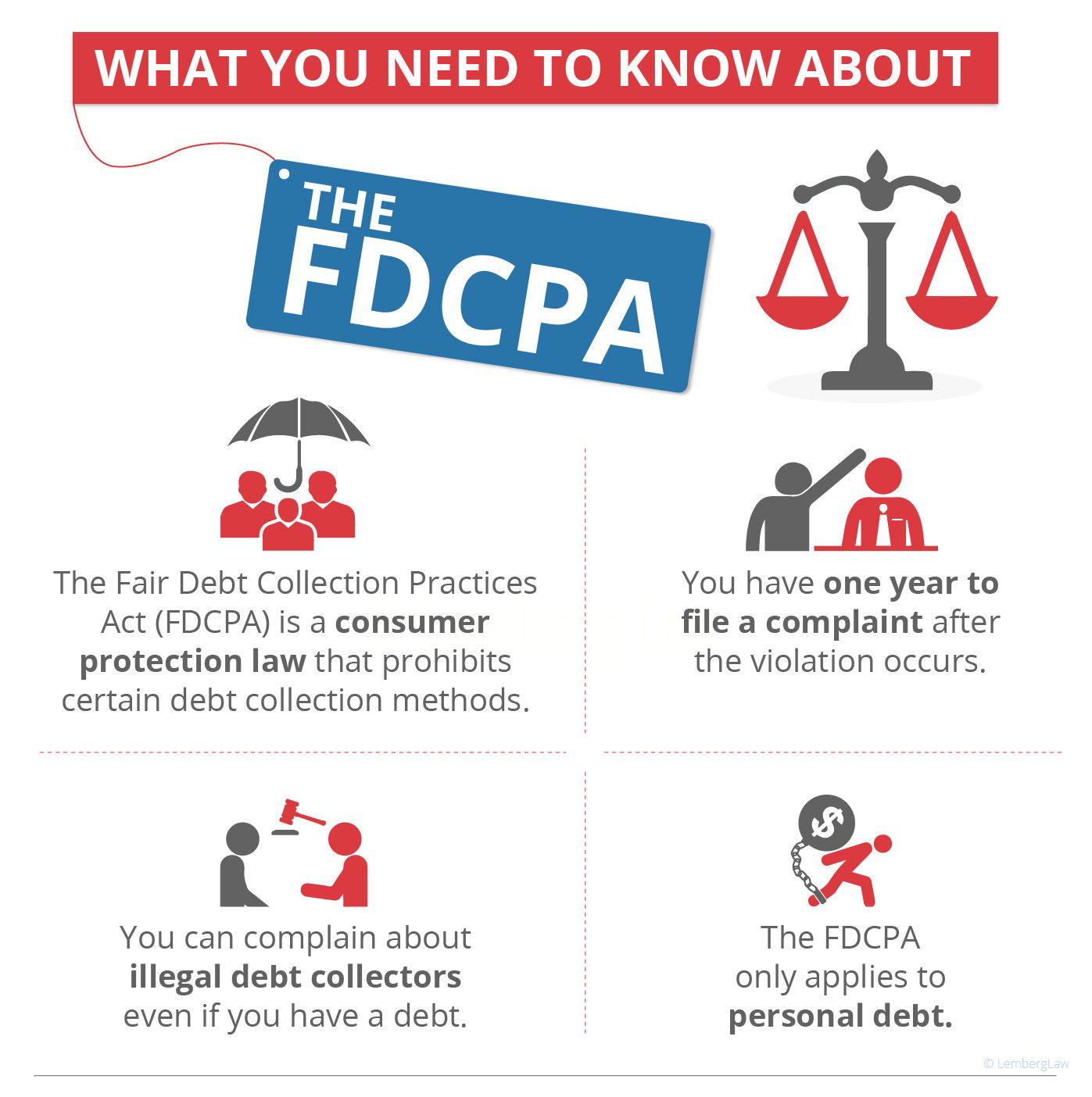

What Is The Fdcpa A Brief Summary On How It Works For Consumers The fdcpa stands for the fair debt collection practices act. it is a federal statute (15 u.s.c. 1692) signed into law in 1977 that is designed to rein in abusive debt collection tactics. it applies only to third party debt collectors. the fdcpa stands for the fair debt collection practices act and is codified in 15 u.s.c. 1692. The fair debt collection practices act specifies that debt collectors cannot contact debtors at inconvenient times. that means they should not call before 8 a.m. or after 9 p.m. unless the debtor.

What Is The Fdcpa The federal trade commission uses the fdcpa to block debt agencies from using abusive, unfair or deceptive practices to collect from consumers. though the law is clear, many collectors don’t play by the rules and complaints against them abound. in house vs. third party debt collectors. The fair debt collection practices act is a federal law that governs practices by third party debt collectors — those who buy a delinquent debt from an original creditor, like a credit card company. Ion with the collection of a debt. among its provisions, the fdpca prohibits collectors from: (1) harassing, oppressing, or abusing consumers; (2) utilizing false, deceptive, or misleading representations or means when collecting or attempting to collect; and (3) using unfair or unco. The fair debt collection practices act (fdcpa), pub. l. 95 109; 91 stat. 874, codified as 15 u.s.c. § 1692 –1692p, approved on september 20, 1977 (and as subsequently amended), is a consumer protection amendment, establishing legal protection from abusive debt collection practices, to the consumer credit protection act, as title viii of.

What Is The Fdcpa What Does It Mean For Consumers Finn 59 Off Ion with the collection of a debt. among its provisions, the fdpca prohibits collectors from: (1) harassing, oppressing, or abusing consumers; (2) utilizing false, deceptive, or misleading representations or means when collecting or attempting to collect; and (3) using unfair or unco. The fair debt collection practices act (fdcpa), pub. l. 95 109; 91 stat. 874, codified as 15 u.s.c. § 1692 –1692p, approved on september 20, 1977 (and as subsequently amended), is a consumer protection amendment, establishing legal protection from abusive debt collection practices, to the consumer credit protection act, as title viii of. On july 27, 2022, the bureau released frequently asked questions on the electronic communication and unusual or inconvenient time and place provisions in the debt collection rule. on october 29, 2021, the bureau released a guidance document on how to disclose the validation information in the itemization table on the model validation notice. The fair debt collection practices act was passed by congress and signed into law by president jimmy carter in 1977. it was a response to unscrupulous debt collection practices, including harassment, abuse, and misleading claims. prior to the establishment of the fdcpa, there were no laws or procedures to address these ruthless practices.

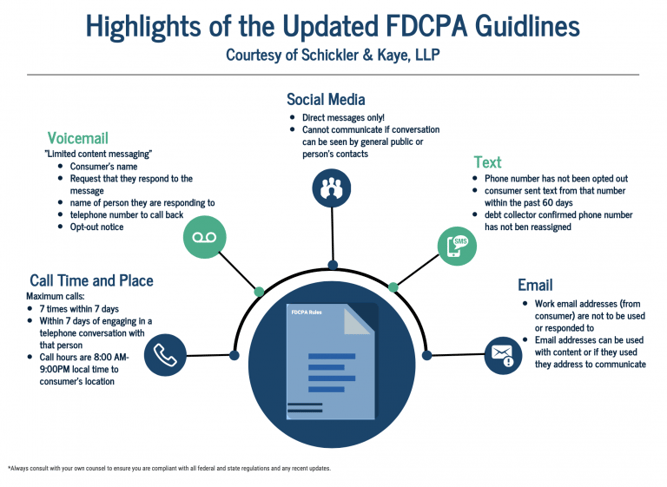

Highlights Of Updated Fdcpa Guidance On july 27, 2022, the bureau released frequently asked questions on the electronic communication and unusual or inconvenient time and place provisions in the debt collection rule. on october 29, 2021, the bureau released a guidance document on how to disclose the validation information in the itemization table on the model validation notice. The fair debt collection practices act was passed by congress and signed into law by president jimmy carter in 1977. it was a response to unscrupulous debt collection practices, including harassment, abuse, and misleading claims. prior to the establishment of the fdcpa, there were no laws or procedures to address these ruthless practices.

Comments are closed.