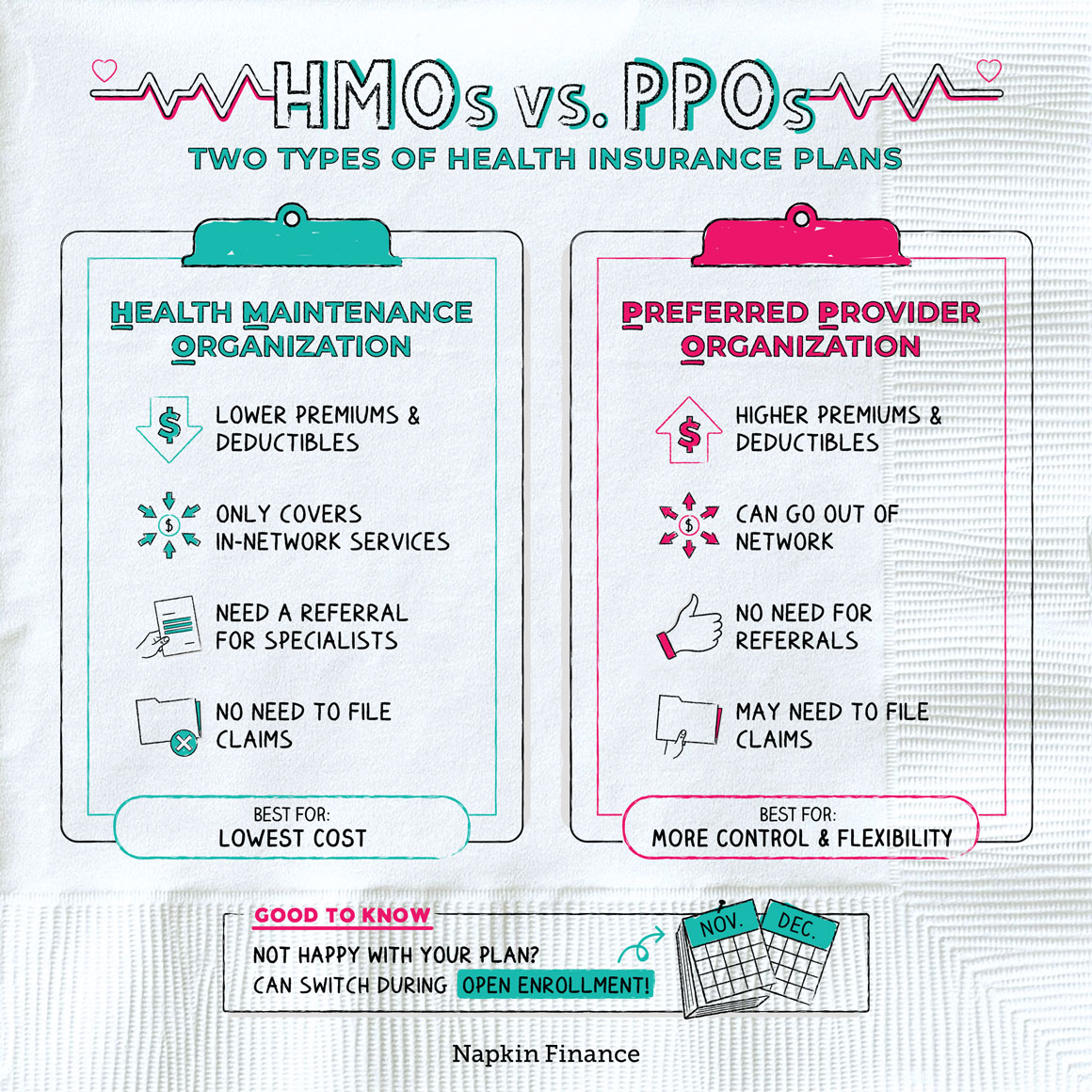

What Is The Difference Between An Hmo And A Ppo Health Insurance Plan In The Usa

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical Cheaper health insurance rates: hmo plans are usually a lower cost alternative to ppos. the average hmo rate is $427 monthly for an affordable care act (aca) plan for someone who is 30 years old. The price difference depends on the ppo health plan. you may still receive a negotiated rate on an out of network provider — or you could get stuck paying the entire bill. unlike an hmo, a ppo doesn’t restrict coverage to a specific service area. if you get ill or injured while traveling and must use an out of network provider, your ppo.

Hmo Vs Ppo Health Insurance Plans вђ Napkin Finance An hmo is a type of health insurance plan that's designed to lower your medical costs. you select a primary care doctor from a network of providers who helps coordinate your health care needs, referring you to specialists if necessary. Updated september 11, 2023.the majority of people who have health care insurance obtain it through their employers during open enrollment, though only a small minority understands the complexities of insurance well enough to feel like they made an empowered choice. this handy guide will help you understand the key differences between ppo and hmo plans and how to make the right choice for you. The main differences between hmos and ppos are affordability and flexibility. cost. hmos are more budget friendly than ppos. hmos usually have lower monthly premiums. both may require you to meet. Hmo and ppo dental and medical plans are also similar in their payment structures when it comes to deductibles, coinsurance and copays. there is one main difference between a ppo dental plan and ppo medical plans — some ppo dental plans include an annual maximum, which is the most your plan will pay for covered services in a year. once that.

Comments are closed.