What Is A Trust Fund How It Works Types How To Set One Up

Trust Fund Meaning Types Pros Cons How To Set Up A common collective trust fund is a trust fund managed by a bank or trust company. it combines assets for multiple investors, often pooling assets from things like profit sharing, pension, and employee stock bonus plans. these funds are very similar to mutual funds and are commonly held in employer retirement plans. Some of these include: alter ego trust: this trust allows the settlor, aged 65 or older, to receive all the income during their lifetime. this person is also the only one who can receive income or.

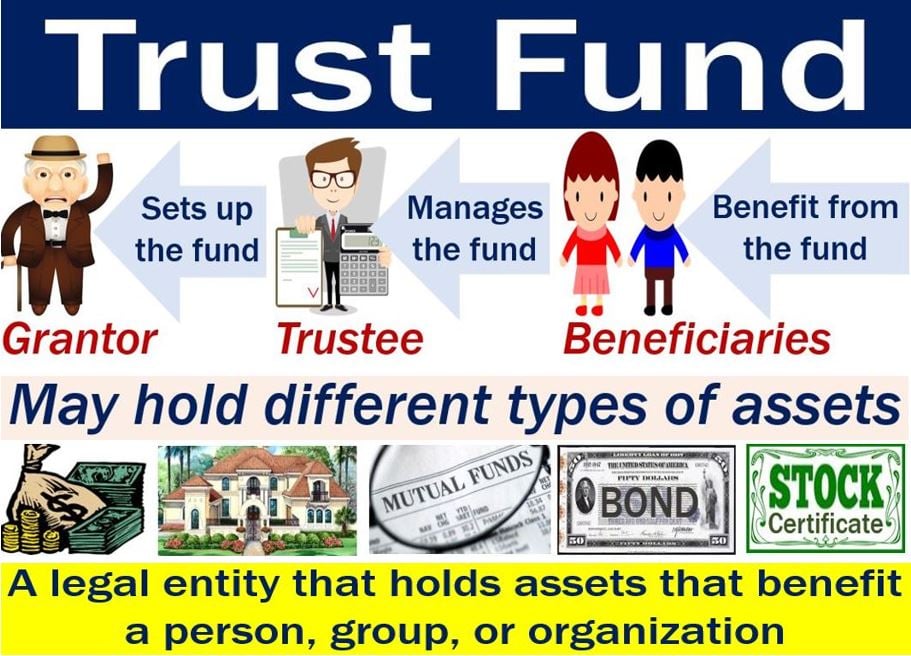

What Is A Trust Fund How Does It Work Market Business News A trust fund is a legal entity that holds property and assets and can provide financial, tax, and legal protections. a grantor sets it up and funds it with money or assets. one or more. A trust fund is a financial account in which the assets of a trustor are held with the trustee as the custodian, for the benefit of a designated beneficiary. the trustor, often called grantor, is the owner of the assets and the person who establishes the trust fund. the trustor transfers ownership of assets to be held by the trustee. The term trust fund refers to assets that are held in a trust. in essence, the trust has funds or assets that are created by a grantor, managed by a trustee and eventually distributed to beneficiaries. assets that can fund a trust vary and could include one or more of the following: cash. stocks and bonds. real estate. A trust fund is the actual account or legal entity that holds the trust's assets; a trust is the legal agreement that creates the fund [0] cornell law school . trust fund .

What Is A Trust Fund вђ How It Works Types How To Set One Up Estate The term trust fund refers to assets that are held in a trust. in essence, the trust has funds or assets that are created by a grantor, managed by a trustee and eventually distributed to beneficiaries. assets that can fund a trust vary and could include one or more of the following: cash. stocks and bonds. real estate. A trust fund is the actual account or legal entity that holds the trust's assets; a trust is the legal agreement that creates the fund [0] cornell law school . trust fund . It is an estate planning tool that keeps your assets in a trust managed by a neutral third party or trustee. a trust fund can include money, property, stock, a business, or a combination of these. the trustee holds onto the trust fund until the time comes to pass the assets on to your chosen recipients. trust funds provide for more control and. A trust fund is a legal entity that holds assets until an intended recipient is able to receive them. this may be when the recipient reaches a certain age or after the previous owner of the assets.

Comments are closed.