Ultimate Guide To Understanding Your Health Insurance

The Ultimate Guide To Understanding Health Insurance Bakeitem These insurance terms refer to different kinds of payments that consumers are responsible for. the amount you’ll pay varies from plan to plan: for instance, higher premiums often mean lower deductibles. learn what each term means by watching the short video, then read the customer scenarios to discover which plan makes sense for your life. Step 5: compare benefits. by this step, you'll likely have your options narrowed down to just a few plans. here are some things to consider next: check the scope of services. go back to that.

A Comprehensive Guide To Understanding Health Insurance Policies Health insurance policies are legally binding contacts, which can have a major impact on both your health and financial life, so understanding your coverage is extremely important. waiting until you are seriously ill or involved in an accident to investigate your health plan is major mistake. our guide will help you understand the basics of. Your total costs for health care: you pay a monthly bill to your insurance company (a "premium"), even if you don’t use medical services that month. you pay out of pocket costs, including a. deductible. the amount you pay for covered health care services before your insurance plan starts to pay. with a $2,000 deductible, for example, you pay. These are usually in the form of a percentage. for instance, let’s say you have a 10% coinsurance for a doctor’s visit that costs $100. you will pay $10 for every $100 your insurance pays for a doctor’s visit. out of pocket maximum: this is a cap on how much you’ll have to pay out of pocket for health care in one year. Deductible: the amount you pay before your insurance pays. for example, if your deductible is $1,000 annually, you pay those fees out of pocket first before insurance contributes. these deductibles can range from $0 to $5,000 depending on your plan. copays (defined below) do not go towards your deductible.

Ultimate Guide To Understanding Your Health Insurance These are usually in the form of a percentage. for instance, let’s say you have a 10% coinsurance for a doctor’s visit that costs $100. you will pay $10 for every $100 your insurance pays for a doctor’s visit. out of pocket maximum: this is a cap on how much you’ll have to pay out of pocket for health care in one year. Deductible: the amount you pay before your insurance pays. for example, if your deductible is $1,000 annually, you pay those fees out of pocket first before insurance contributes. these deductibles can range from $0 to $5,000 depending on your plan. copays (defined below) do not go towards your deductible. In the realm of health insurance, a deductible is the amount you pay out of pocket for medical services before your insurance plan starts to cover the costs. this concept is pivotal as it directly influences the total cost of your healthcare. deductibles represent a form of cost sharing between you and your insurance company and are. Contents. introduction: understanding your health insurance policy step 1: identify your plan type step 2: comprehend your coverage step 3: familiarize yourself with deductibles and co payments step 4: verify your network here is an example of how you can verify your network: step 5: grasp your maximum out of pocket costs here’s an example of.

Your Guide To Understanding Health Insurance Wellness In the realm of health insurance, a deductible is the amount you pay out of pocket for medical services before your insurance plan starts to cover the costs. this concept is pivotal as it directly influences the total cost of your healthcare. deductibles represent a form of cost sharing between you and your insurance company and are. Contents. introduction: understanding your health insurance policy step 1: identify your plan type step 2: comprehend your coverage step 3: familiarize yourself with deductibles and co payments step 4: verify your network here is an example of how you can verify your network: step 5: grasp your maximum out of pocket costs here’s an example of.

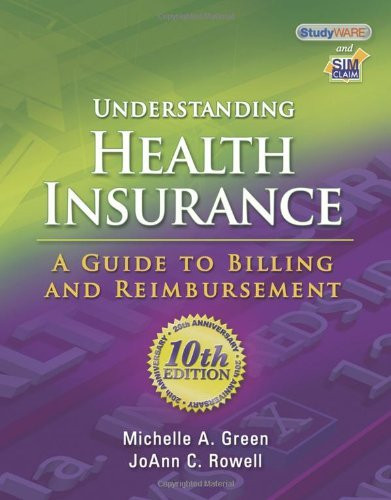

Understanding Health Insurance A Guide To Billing Reimbursement By

Comments are closed.