This Is The Fastest Way To Get Out Of Debt

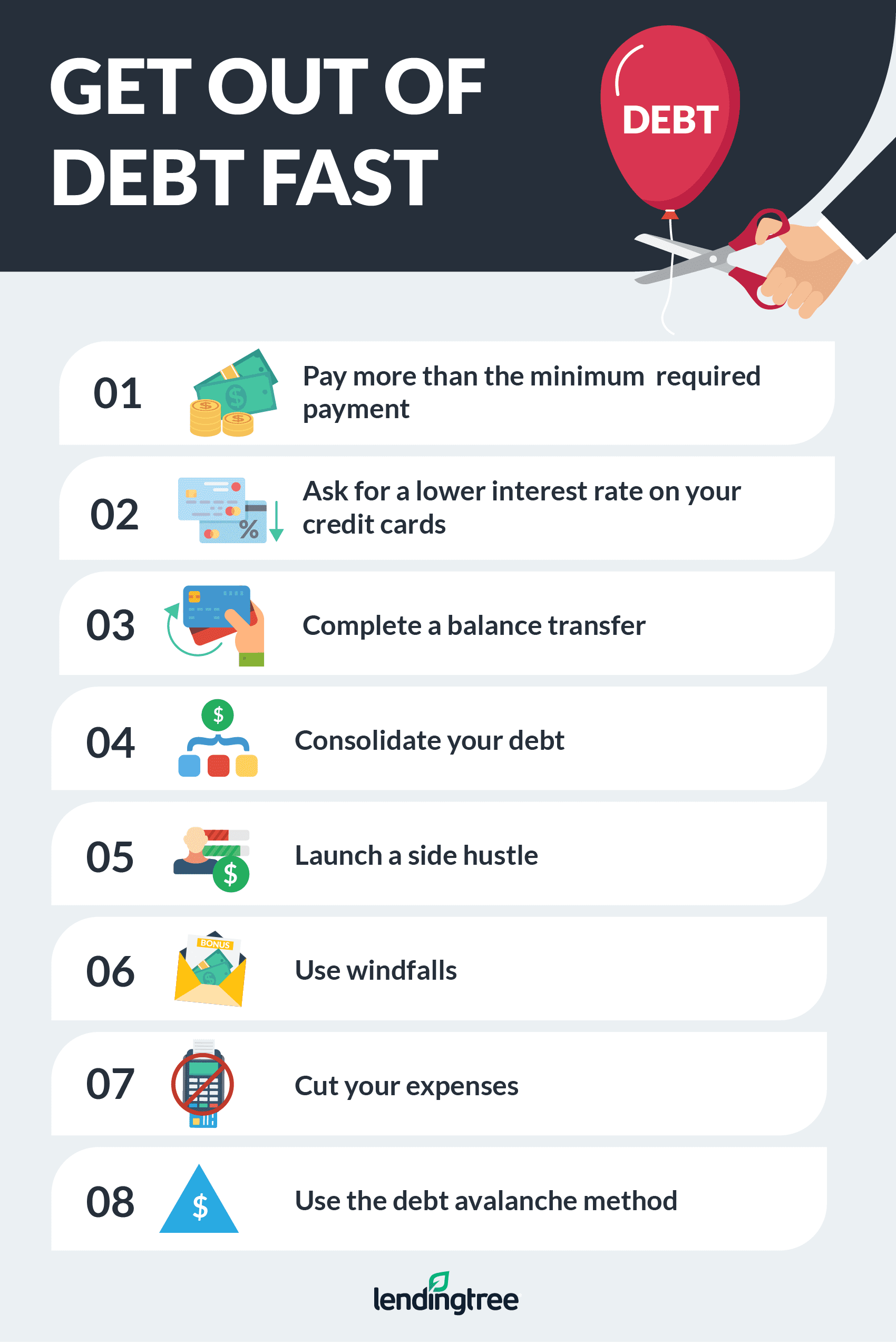

How To Get Out Of Debt Fast 8 Resolutions Lendingtree The best way to pay off debt depends on how much you owe, your income and your preferences. this might help you get out of debt faster and save you money over the long run by wiping out the. Related: how to get out of debt: a step by step guide for 2024. 3. create a livable but bare bones budget. making a budget is one of the best ways to get a handle on your finances, and a livable but bare bones budget is a powerful tool than can help you pay off your debt fast. to create one, follow these steps:.

How To Get Out Of Debt Fast The Science Backed Way 1. list out your debt details. creating a plan to get out of debt requires focus and specificity. that means taking a hard look at all of your debt. for each outstanding balance, list out the. 1. set up a payment plan. how to attract clients and succeed. credit card debt. get a secured credit card. 2. apply for a medical credit card. 3. consider other credit options. It’s the best (and fastest) way to pay off your debt—especially if you’re juggling multiple debts. here’s how it works: 1. list all your debts from smallest to largest, ignoring the interest rates. 2. make minimum payments on all your debts, except the smallest—that’s the one you’ll attack. Paying more than the minimum can speed up the time it takes to get out of debt. by increasing your payment amount, you will be increasing the overall rate at which your debt declines and reducing.

Get Out Of Debt Fast 5 Repayment Strategies That Make It Easy Debt It’s the best (and fastest) way to pay off your debt—especially if you’re juggling multiple debts. here’s how it works: 1. list all your debts from smallest to largest, ignoring the interest rates. 2. make minimum payments on all your debts, except the smallest—that’s the one you’ll attack. Paying more than the minimum can speed up the time it takes to get out of debt. by increasing your payment amount, you will be increasing the overall rate at which your debt declines and reducing. You’ll need all of this to determine the next steps in debt payments. 2. inspect your spending. once you know your debt to the dollar, the next focus should be your expenses other than debt. How to get out of credit card debt: 1. find a payment strategy. 2. look into debt consolidation. 3. talk with your creditors. 4. look into debt relief. 5. lower your living expenses.

:max_bytes(150000):strip_icc()/digging-out-of-debt_final-b14f7e15866443b3a3b87745ea178ef8.png)

How To Get Out Of Debt In 8 Steps You’ll need all of this to determine the next steps in debt payments. 2. inspect your spending. once you know your debt to the dollar, the next focus should be your expenses other than debt. How to get out of credit card debt: 1. find a payment strategy. 2. look into debt consolidation. 3. talk with your creditors. 4. look into debt relief. 5. lower your living expenses.

How To Get Out Of Debt Faster

Comments are closed.