This Infographic Helps You Decide If You Should Refinance Stu

This Infographic Helps You Decide If You Should Refinance This infographic helps you decide whether or not it’s a viable option for you. when you refinance your student loan, you basically take on a new loan with a new, lower rate. A credit score in the 700s or 800s shows that you're trustworthy, and will get you the lowest interest rates. it's also important to show lenders you have a steady income and stable job history. if you don't meet these requirements, you can get a refinanced loan with a co signer who does.

This Infographic Helps You Decide If You Should Refinance You can refinance with low income, provided your debt to income ratio, or dti, is solid. dti is the amount of money you owe relative to your income. the required debt to income ratio for student. If you’re using a screen reader and are having problems using this website, please call 800 722 0333 for assistance. Decide if a student loan refinance is right for you. 2. check rates with multiple lenders. 3. choose a lender and your loan terms. 4. gather documents and fill out the application. 5. keep paying your loans as you wait for approval. In general, you’ll need to have a credit score in the mid to high 600s, a debt to income ratio of less than 43 percent and a source of steady income to refinance a student loan, but the.

Here S How To Decide If You Should Refinance Cnet Decide if a student loan refinance is right for you. 2. check rates with multiple lenders. 3. choose a lender and your loan terms. 4. gather documents and fill out the application. 5. keep paying your loans as you wait for approval. In general, you’ll need to have a credit score in the mid to high 600s, a debt to income ratio of less than 43 percent and a source of steady income to refinance a student loan, but the. For example, let’s say you currently owe $60,000 in student loans with a 7% interest rate and a 10 year repayment term. if you refinance to a 10 year term but secure a 5% interest rate, you. Refinance your student loans. and believe in life after debt. competitive fixed rates2. absolutely no fees. no origination fees, pre payment, or late fees. lower your monthly payment with flexible terms that fit your budget.*. you may pay more interest over the life of the loan if you refinance with an extended term.

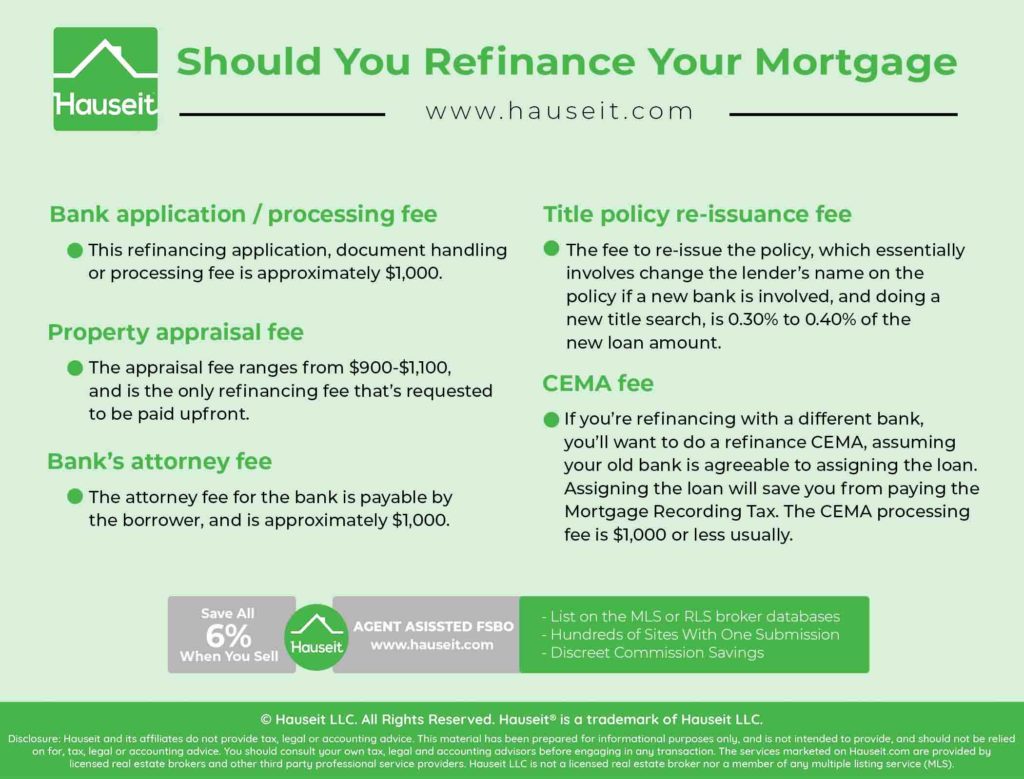

Should You Refinance Your Mortgage Hauseitв Nyc For example, let’s say you currently owe $60,000 in student loans with a 7% interest rate and a 10 year repayment term. if you refinance to a 10 year term but secure a 5% interest rate, you. Refinance your student loans. and believe in life after debt. competitive fixed rates2. absolutely no fees. no origination fees, pre payment, or late fees. lower your monthly payment with flexible terms that fit your budget.*. you may pay more interest over the life of the loan if you refinance with an extended term.

Comments are closed.