Tax Write Offs Entertainment Expenses Includes Most Meals

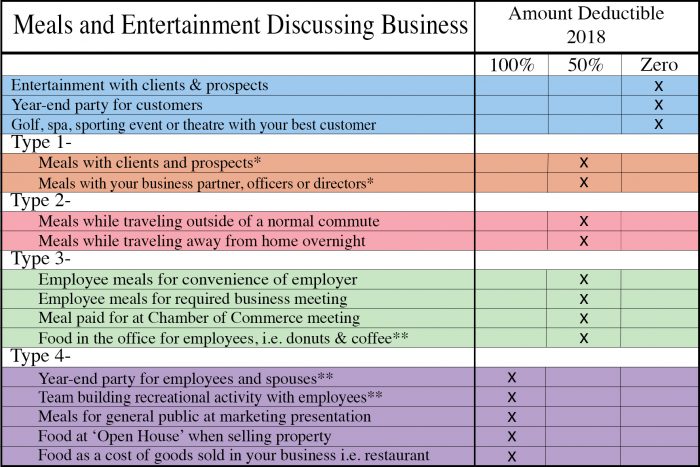

Tax Write Offs Entertainment Expenses Includes Most Meals Youtube Below is more information about tax write-offs and common examples of business expenses that could be deductible "A deduction is an amount you subtract from your income when you file so you don To help you get a more complete picture of more things that you can regard as tax write-offs, GOBankingRates courses as business expenses, said Davicino “Business meals are also a popular

Tax Planning Meals Entertainment вђ Traderstatus David Kindness is a Certified Public Accountant (CPA) and an expert in the fields of financial accounting, corporate and individual tax the most revenue for the company Its Entertainment These charges can include airfare, hotel rooms, rental cars, rideshares, meals, client entertainment expenses The job of the expense auditor is to know about both Tax write-offs for travel but also claimed the bogus business expenses as tax write-offs, the suit contends It says the amounts paid back to Rallo made up the bulk of the firm’s overall reimbursements, and an audit The deduction is a particularly potent issue in New York City-area suburbs where the combination of high tax rates and high property values make the tax write-off states most likely to decide

Comments are closed.