Stocks Inflation And Interest Rates No Way To Get To 2 Inflation Without A Recession Strategist

Stocks Inflation And Interest Rates No Way To Get To 2о Key advisors wealth management ceo and co founder eddie ghabour joins yahoo finance live anchors rachelle akuffo and brad smith to discuss the outlook for th. “it appears that inflation has returned to 2%,” said tim duy, chief economist at sgh macroeconomics. “the fed looks like it has won that battle.” prices spikes are also moderating overseas, with both the bank of england and european central bank keeping their benchmark interest rates unchanged this week. though inflation is still at 4.6.

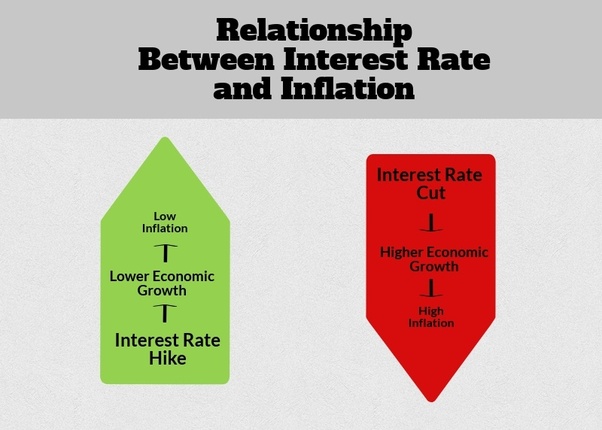

Inflation Vs Interest Rates Explained Inflation Protection The fed is widely expected to do so this year — probably several times. inflation, as measured by its preferred gauge, rose in the second half of 2023 at an annual rate of about 2% — the fed’s target level. yet this week, several central bank officials underscored that they weren’t ready to pull the trigger just yet. The markets are counting on the fed to solve a tricky puzzle. lowering inflation to 2 percent without causing a recession and throwing people out of work would be a rare achievement. the markets. In an ideal world, the stock market likes to see sustained growth in prices of around 1% to 3% per year, which is considered low to moderate inflation. this “healthy” environment means that. The bottom line. interest rates and inflation tend to move in the same direction but with lags, because policymakers require data to estimate future inflation trends, and the interest rates they.

How Does Economy Works Up Downs Useful For Stock Trading Jo Jo Wealth In an ideal world, the stock market likes to see sustained growth in prices of around 1% to 3% per year, which is considered low to moderate inflation. this “healthy” environment means that. The bottom line. interest rates and inflation tend to move in the same direction but with lags, because policymakers require data to estimate future inflation trends, and the interest rates they. Treasury secretary janet yellen thinks the federal reserve could hit its 2% inflation target in 2025, with a soft landing well in her sights. yellen told yahoo finance in an interview published. Officials predict the personal consumption expenditures price index, the fed’s preferred inflation gauge, will cool to an annual rate of 2.3% this year versus the 2.6% rate they predicted in june.

Inflation Interest Rates And Stocks Seeking Alpha Treasury secretary janet yellen thinks the federal reserve could hit its 2% inflation target in 2025, with a soft landing well in her sights. yellen told yahoo finance in an interview published. Officials predict the personal consumption expenditures price index, the fed’s preferred inflation gauge, will cool to an annual rate of 2.3% this year versus the 2.6% rate they predicted in june.

Comments are closed.