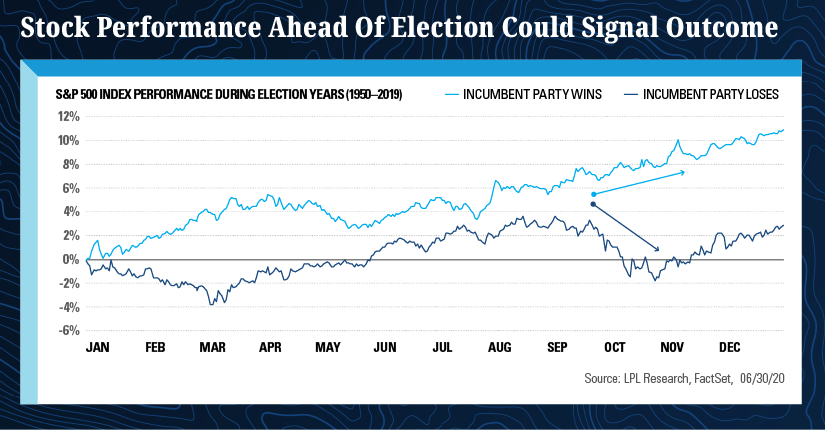

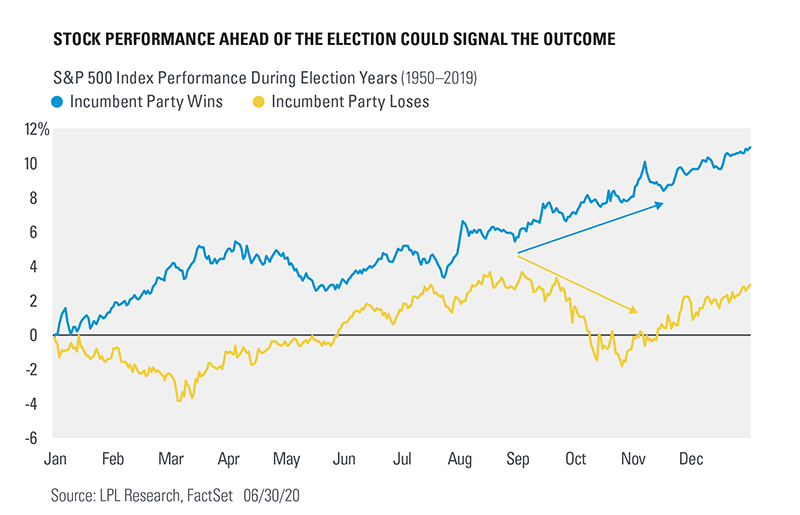

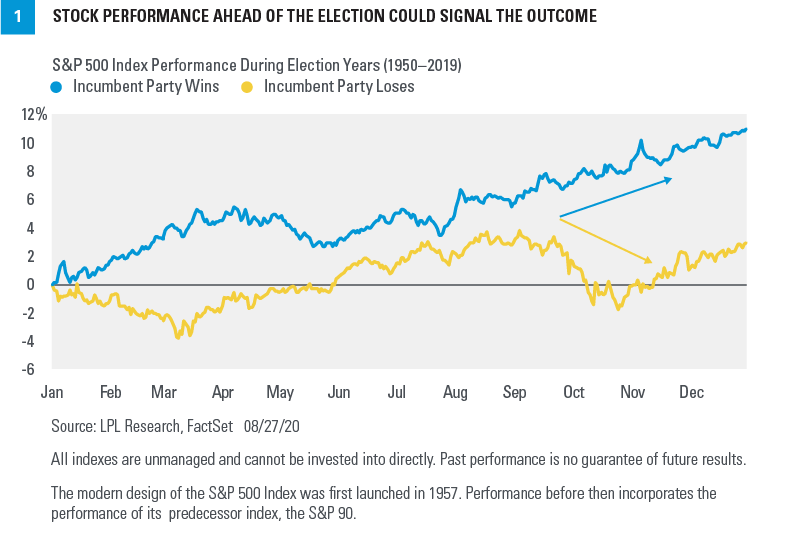

Stock Performance Ahead Of The Election Could Signal The Outcome

Election 2020 And The Importance Of Stock Performance Since 1952, the s&p 500 has averaged only a 7% gain during u.s. presidential election years, compared to 16.8% in the year prior to an election year (and just shy of 10% average overall). Given the two leading candidates in the 2024 election both have experience in the white house, investors can also take a look at how the stock market has performed during trump's four years as.

Lpl Research S Midyear Outlook 2020 1. tax cuts. if republicans sweep the november election, the 2017 tax cuts and jobs act—which reduced corporate and individual tax rates, and expires at the end of 2025—may be extended and potentially enhanced. morgan stanley strategists project that the act’s extension could add about $1.6 trillion to federal deficits over the next decade. So far, the stock market in this 2024 election year has performed better than average. as of july 11, the s&p 500 has returned 17%, and through the first half of the year, it jumped 14.5%. this is. Amid still high prices and interest rates, dim consumer moods may be a disadvantage for the incumbent party’s presidential candidate. equity sector performance suggests—at least for now—that some investors may be positioning their portfolios for a gop win. election years tend to bring equity index gains and market volatility, with 2024. Emelia fredlick sep 10, 2024. election day is tuesday, nov. 5, and the uncertainty can present pitfalls for investors. “there are a lot of emotions involved,” says dan lefkovitz, a strategist.

Election Preview Part Ii A Trump Second Termвђ Upside And Risks Lpl Amid still high prices and interest rates, dim consumer moods may be a disadvantage for the incumbent party’s presidential candidate. equity sector performance suggests—at least for now—that some investors may be positioning their portfolios for a gop win. election years tend to bring equity index gains and market volatility, with 2024. Emelia fredlick sep 10, 2024. election day is tuesday, nov. 5, and the uncertainty can present pitfalls for investors. “there are a lot of emotions involved,” says dan lefkovitz, a strategist. The historical stock market trends during u.s. presidential election years reveal a fascinating interplay between politics and market performance, shedding light on strategic investment decisions. Lynch and anderson noted that while a strong stock market performance for the full year before an election has also been heavily correlated with success for the incumbent party, it hasn’t always.

Comments are closed.