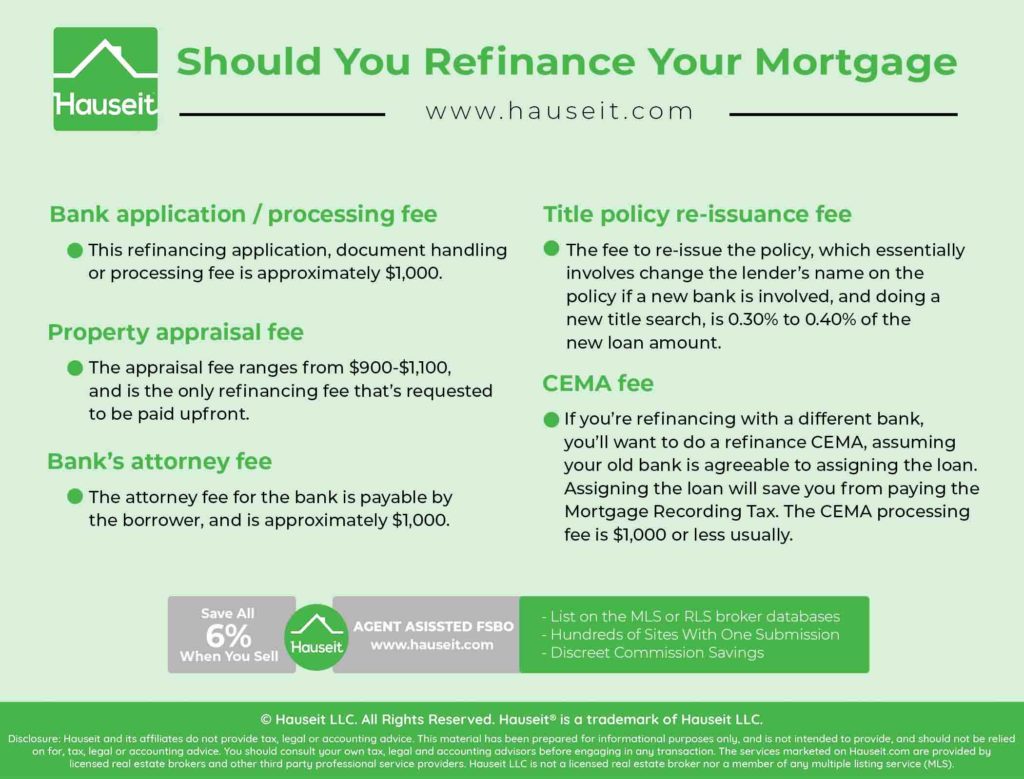

Should You Refinance Your Mortgage Hauseitв Nyc

Should You Refinance Your Mortgage Hauseitв Nyc If you anticipate problems making your payments: contact new york mortgage bank at (800) 212 1212 as soon as possible. if you seek an alternative to the upcoming changes to your interest rate and payment, the following options may be possible (most are subject to lender approval): refinance your loan or another lender;. The average interest rate for 30 year fixed mortgages was 6.09 percent on thursday, according to freddie mac, down from 6.2 percent last week and 7.19 percent a year ago. they had been as high as.

Should You Refinance Your Mortgage Hauseitв Nyc An often quoted rule of thumb says that if mortgage rates are lower than your current rate by 1% or more, it might be a good idea to refinance. but that's traditional thinking, like saying you. Reasons to refinance your mortgage. here are a few reasons why you may want to consider a mortgage refinance : to change your loan terms; take out cash and pay off debts; to lower your interest rate to help pay for improvements or renovations; you want to change your loan terms. changing the duration of your mortgage or interest rate to adjust. Getty. refinancing your mortgage could be a good idea if it will save you money or make paying your monthly bills easier. some experts say you should only refinance when you can lower your. You will have a higher interest rate: if your credit score is not great, or current interest rates are much higher than when you got your mortgage, refinancing will make your loan more costly overall.

Should You Refinance Your Mortgage Calculate Your Answer Getty. refinancing your mortgage could be a good idea if it will save you money or make paying your monthly bills easier. some experts say you should only refinance when you can lower your. You will have a higher interest rate: if your credit score is not great, or current interest rates are much higher than when you got your mortgage, refinancing will make your loan more costly overall. Without factoring in taxes and insurance, let’s take a look at how a mortgage rate that’s 1% lower could impact your monthly payment. based on this data from our mortgage calculator, you could save $156.83 a month by reducing your rate 1%. consider these savings over 30 years, and you could save $56,458.80 in interest. Let’s say you take out a 30 year, $400,000 mortgage with a fixed rate of 7.2% on your first home in portland, or. your monthly interest, and principal payment will be around $2,635. a year later, interest rates drop to 6.3%, so you decide to refinance. your new monthly interest and principal payment will be reduced to approximately $2,435.

Should You Refinance Your Mortgage A Homeowner S Guide To Helocs And M Without factoring in taxes and insurance, let’s take a look at how a mortgage rate that’s 1% lower could impact your monthly payment. based on this data from our mortgage calculator, you could save $156.83 a month by reducing your rate 1%. consider these savings over 30 years, and you could save $56,458.80 in interest. Let’s say you take out a 30 year, $400,000 mortgage with a fixed rate of 7.2% on your first home in portland, or. your monthly interest, and principal payment will be around $2,635. a year later, interest rates drop to 6.3%, so you decide to refinance. your new monthly interest and principal payment will be reduced to approximately $2,435.

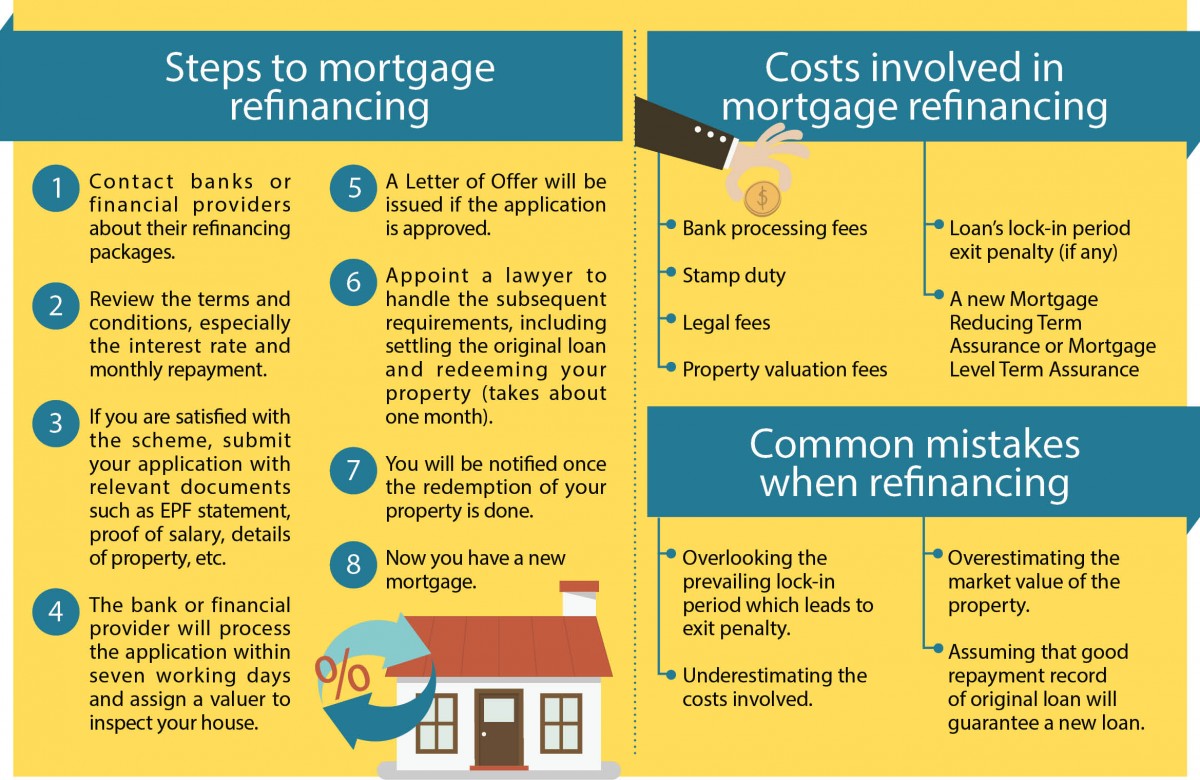

Should You Refinance Your Property Edgeprop My

Comments are closed.