Should I Refinance My Student Loans And Does It Matter If I Want To Buy A House Soon

Should I Refinance My Student Loans And Does It Matter Learn more. you should consider refinancing student loans if you find a lower interest rate and you want to merge some or all of your student loan payments into one. while refinancing is a good. When to refinance student loans depends on whether you’ll find a rate that makes a difference in your life. a $30,000 private student loan with an 8% interest rate, for example, will give you a.

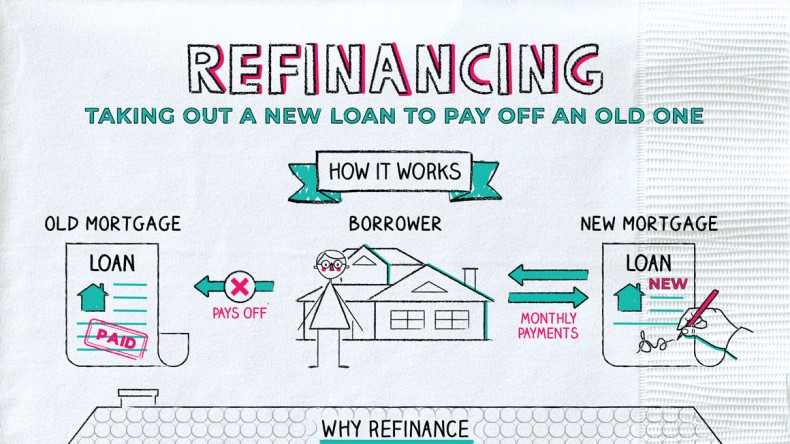

Loan Refinance Refinancing A Mortgage When Can I Refinance My House Not everyone qualifies for refinancing. 1. pro: you can get a lower interest rate. depending on when you took out your federal loans and the type of loans you have, you could have a relatively. That could save you big money over time. whether you should refinance student loans depends on your situation. consider refinancing your student loans if: you have private student loans. payments. In this scenario, you’ll have a $377.42 monthly payment. if you refinance into a new loan with the same repayment term but a 4 percent interest rate, your monthly payment will be $368.33. that. Student loan refinancing interest rates in 2024. since march of 2022, the federal reserve has hiked the federal funds rate 11 times in an attempt to fight 40 year high inflation rates. that rate.

Use This Infographic To Decide If You Should Refinance Your Student In this scenario, you’ll have a $377.42 monthly payment. if you refinance into a new loan with the same repayment term but a 4 percent interest rate, your monthly payment will be $368.33. that. Student loan refinancing interest rates in 2024. since march of 2022, the federal reserve has hiked the federal funds rate 11 times in an attempt to fight 40 year high inflation rates. that rate. Student loan refinancing can potentially save you thousands of dollars throughout the loan’s duration, depending on your balance, credit profile and new refinance rate. for example, let’s say you have $30,000 in student loans with a 7% interest rate and a 10 year term. your monthly payments would be $348. if you refinance to a 5% rate, you. Here’s how to refinance student loans, in a nutshell: find lenders that will offer you a lower interest rate. compare them. apply. if you’re approved, the new lender will pay off your existing.

Comments are closed.