Passbook For Sukanya Samriddhi Account Features Allonmoney

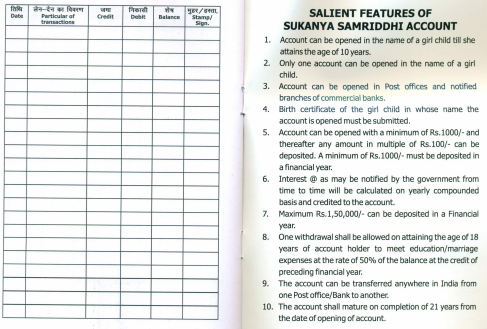

Passbook For Sukanya Samriddhi Account Features Allonmoney Passbook page2 passbook page3 passbook page4 passbook page5 features of sukanya samriddhi scheme. you can deposit money into the account only in the multiple of 100. i.e. 1000,2000,5000 and so on. but you cannot deposit 1250,1350 etc. any bank or it’s branch failing to comply with the rules of ssa will attract penal action. For 2015 2016, interest rate has been increased to 9.2%. interest rate will keep on changing every year and indian government will notify on the same. check out maturity amount calculated @9.2% interest rate. investing rs. 1,50,000 will earn you rs. 80,06,463. is the income earned taxable: the most important benefit of sukanya samriddhi yojana.

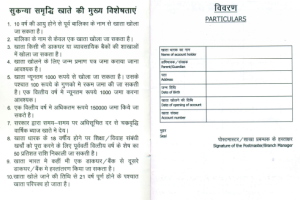

Passbook For Sukanya Samriddhi Account Features Allonmoney Account can be closed prematurely in case of the death of the account holder. the money accumulated through this scheme will be used for the development of infrastructure. during the launch of this yojana, passbooks to five girls were given who have opened the account under this scheme. check out how sukanya samriddhi account passbook looks like. Sukanya samridhi account returns. currently, the ssy interest rate is 8.2% p.a. you can deposit up to rs.1.5 lakh towards the account in a year. given in the table below is an example of how much you would receive at maturity for rs.1 lakh contributions made annually for 15 years. check your credit score now. opening balance (rs.). Sukanya samriddhi yojana features. account operation: managed by parents until girl turns 10, then by the girl at 18. deposits: rs. 500 to rs. 1.5 lakh annually, in multiples of rs. 100. Step 4: visit the bank and submit the transfer application. step 5: for proof of identification and address, you will have to submit your kyc. step 6: you will get a new passbook which will have the outstanding balance from your account. step 7: the bank will then activate the account. sukanya samriddhi top pages.

Passbook For Sukanya Samriddhi Account Features Allonmoney Sukanya samriddhi yojana features. account operation: managed by parents until girl turns 10, then by the girl at 18. deposits: rs. 500 to rs. 1.5 lakh annually, in multiples of rs. 100. Step 4: visit the bank and submit the transfer application. step 5: for proof of identification and address, you will have to submit your kyc. step 6: you will get a new passbook which will have the outstanding balance from your account. step 7: the bank will then activate the account. sukanya samriddhi top pages. The sukanya samriddhi account is designed to provide a bright future for your girl child. it offers a high interest rate of 8.2% and tax benefits under 80c. conveniently invest in this scheme online through hdfc bank. instantly transfer funds from a linked savings account or set up standing instructions for automatic debit. Working of sukanya samriddhi yojana account. sukanya samriddhi yojana is a long term scheme where a deposit of a minimum of inr 250 and a maximum of inr 1.5 lakhs can be made in a year. the tenure of the scheme is 21 years and it can be purchased for a girl child who is aged 10 years or less. lets us take this example:.

Passbook For Sukanya Samriddhi Account Features Allonmoney The sukanya samriddhi account is designed to provide a bright future for your girl child. it offers a high interest rate of 8.2% and tax benefits under 80c. conveniently invest in this scheme online through hdfc bank. instantly transfer funds from a linked savings account or set up standing instructions for automatic debit. Working of sukanya samriddhi yojana account. sukanya samriddhi yojana is a long term scheme where a deposit of a minimum of inr 250 and a maximum of inr 1.5 lakhs can be made in a year. the tenure of the scheme is 21 years and it can be purchased for a girl child who is aged 10 years or less. lets us take this example:.

Comments are closed.