Mortgages Santander Uk

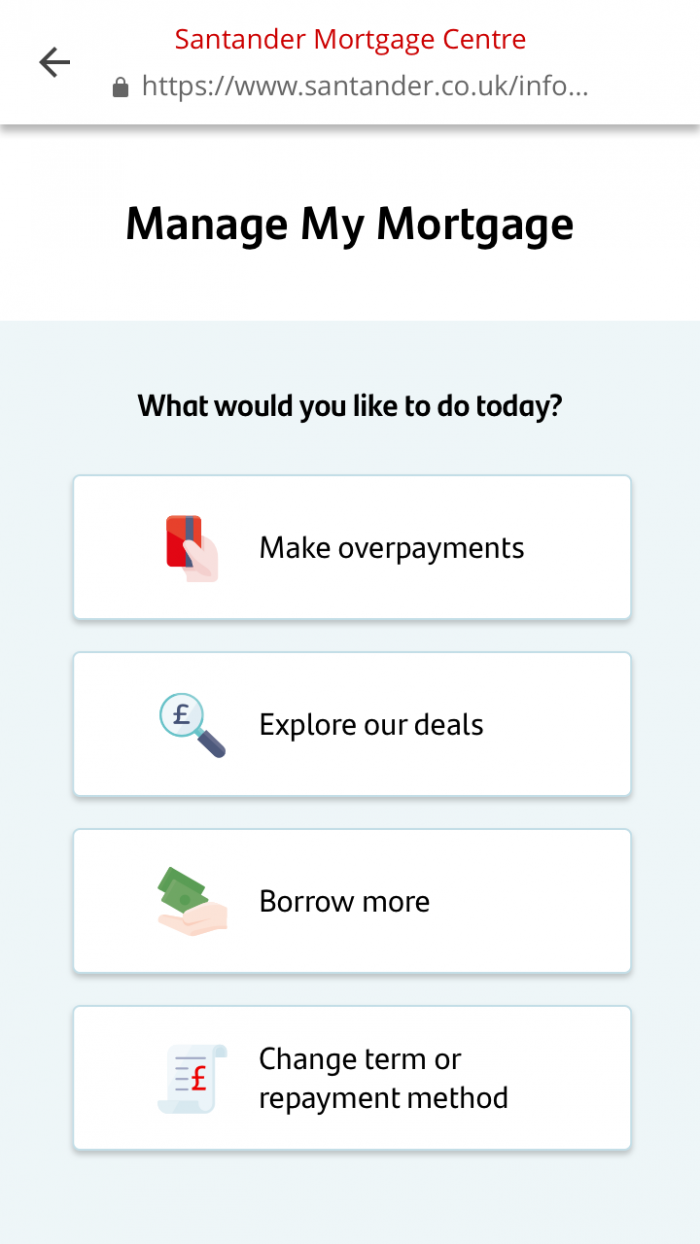

Mortgages Santander Uk Existing santander mortgage customers. find and accept a new deal. make changes. borrowing more money. moving home. managing online. later life mortgages if you’re aged 55 or over, you could consider a later life mortgage to pay off an existing mortgage, or to release some equity from your home. provided by legal & general home finance. The overall cost for comparison is 6.7% aprc representative. a mortgage of £80,000 payable over 9 years would require 60 monthly payments of £892.33 and 48 monthly payments of £946.45. this is based on an initial fixed rate for 5 years at 60% loan to value at 4.24% and then our standard variable rate, currently 7.25% for the remaining 4 years.

Mortgages Santander Uk Santander mortgage rates. compare the latest santander mortgage rates with nerdwallet uk. santander offers fixed and tracker mortgage rates to first time buyers and homemovers, as well as. Santander first time buyer mortgages. santander offers first time buyer mortgages up to 95% loan to value (ltv), meaning that it’s possible to get a mortgage with a 5% deposit. one thing to note. Santander is one of the biggest mortgage lenders in the uk. in 2022, it had an 11.3% share of the mortgage market, a slight increase from 11.1% in 2021, according to uk finance data. when we checked in september 2023, there were 134 mortgages available from santander. Santander is one of the biggest – and best known – mortgage lenders in the uk with more than 14 million customers. the bank lent more than £1.75 billon in home loans last year.

Comments are closed.