Melvin Capital Investments Where Is The Gme Short Seller Now

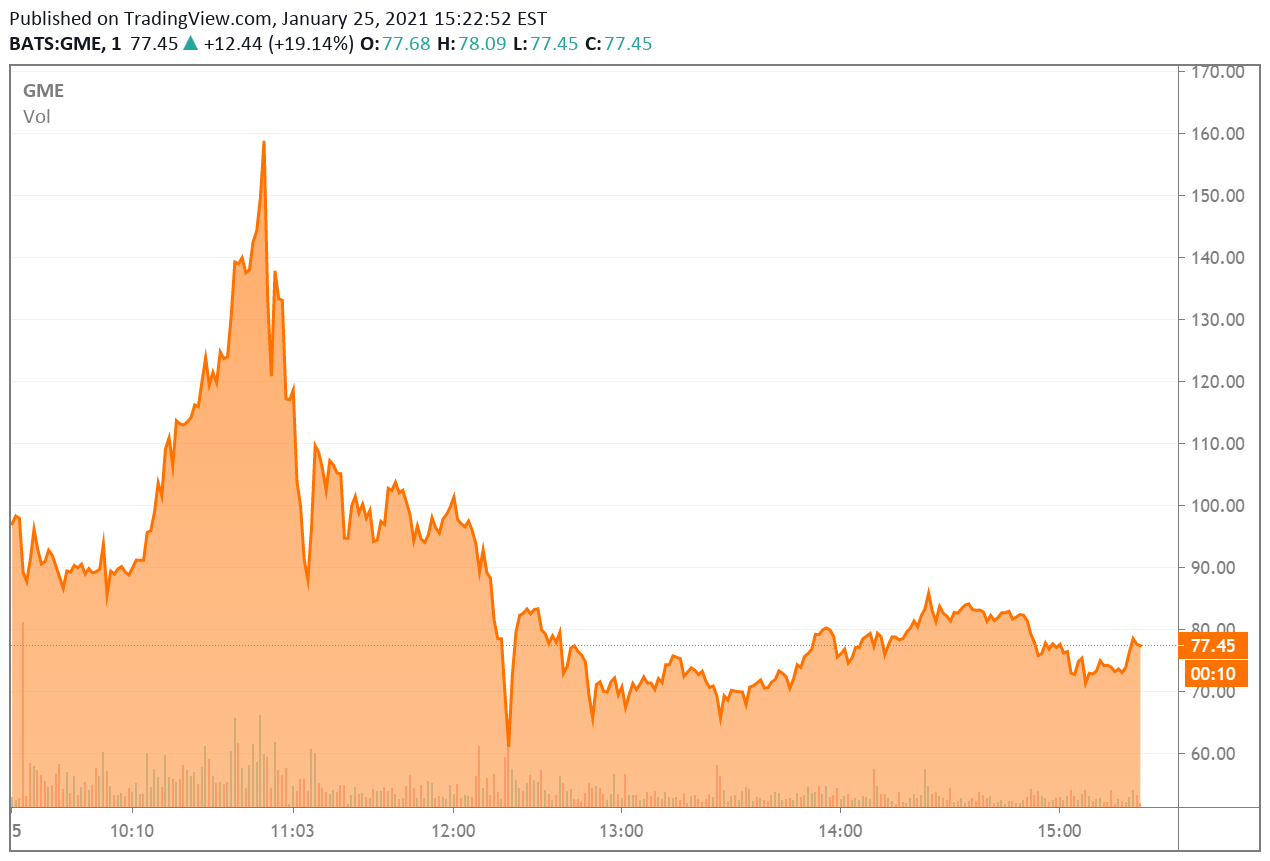

Melvin Capital Investments Where Is The Gme Short Seller Now The hedge fund was shorting gme big time and believed that its brick and mortar model was antiquated. at gme’s peak, melvin capital’s valuation sank 53 percent. the hedge fund reportedly. Melvin capital, the hedge fund run by gabe plotkin that struggled with heavy losses last year as it reeled from wrong way bets on gamestop, is shutting down, according to a letter sent to.

Melvin Capital Investments Where Is The Gme Short Seller Now The hedge fund, which managed $7.8 billion as of april, said it expects to return all of its capital to investors by late july. melvin capital had managed $12.5 billion at the start of last year. Aug 15, 2022 6:23 am edt. melvin capital lost 57% of its capital due to its short position in gamestop, which skyrocketed during the “meme rally” of january 2021. the sec is investigating. Melvin capital and citron research closed their short positions on gamestop stock after the company's massive rally formed an extraordinary short squeeze. the former ate a huge loss when it ended. Melvin took an emergency cash injection of $2.75bn from two other hedge funds — $750m from cohen’s point72 asset management and $2bn from ken griffin’s citadel — to deal with the losses.

Hedge Funds Citadel Point72 Putting 2 75b In Melvin Capital Hit By Melvin capital and citron research closed their short positions on gamestop stock after the company's massive rally formed an extraordinary short squeeze. the former ate a huge loss when it ended. Melvin took an emergency cash injection of $2.75bn from two other hedge funds — $750m from cohen’s point72 asset management and $2bn from ken griffin’s citadel — to deal with the losses. Gme. gamestop corporation (nyse: gme) short seller melvin capital management lp said monday it had received $2.75 billion in investment from hedge funds citadel and point72. what happened: while. The goliaths are some familiar real life figures: gabe plotkin, founder of the hedge fund melvin capital, who bets against gamestop; steve cohen, plotkin’s mentor; ken griffin, the founder of.

Gabe Plotkin Of Melvin Capital Short Seller Of Gamestop Gme On Gme. gamestop corporation (nyse: gme) short seller melvin capital management lp said monday it had received $2.75 billion in investment from hedge funds citadel and point72. what happened: while. The goliaths are some familiar real life figures: gabe plotkin, founder of the hedge fund melvin capital, who bets against gamestop; steve cohen, plotkin’s mentor; ken griffin, the founder of.

Comments are closed.