Meals Entertainment Tax Deductions For 2024

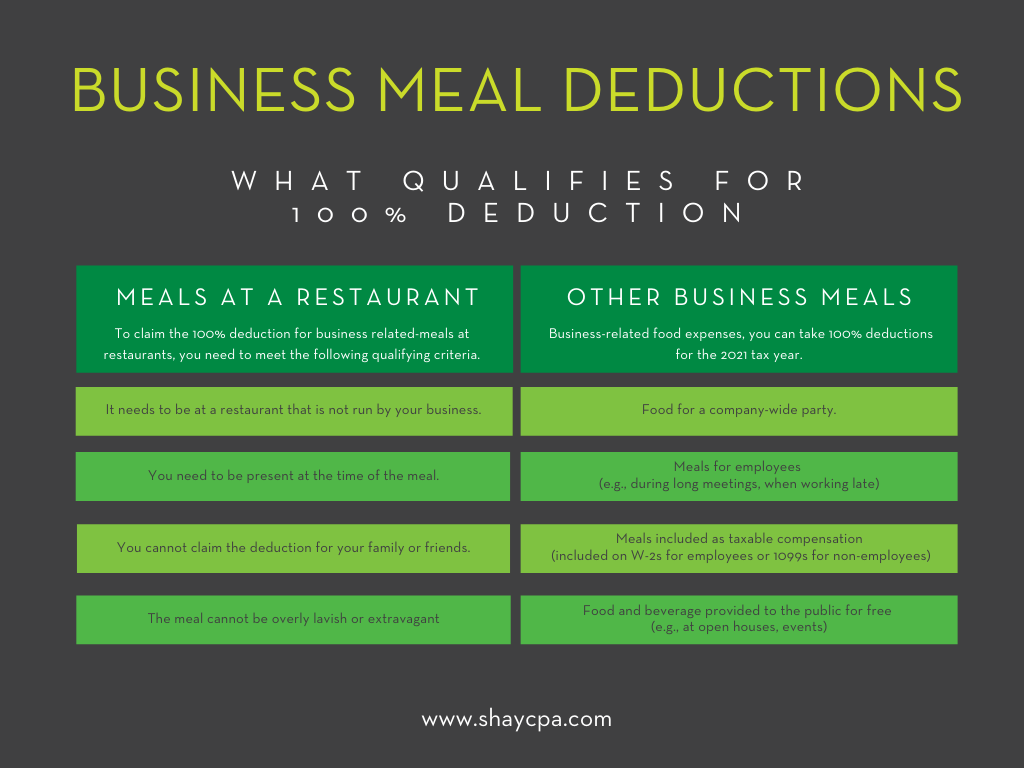

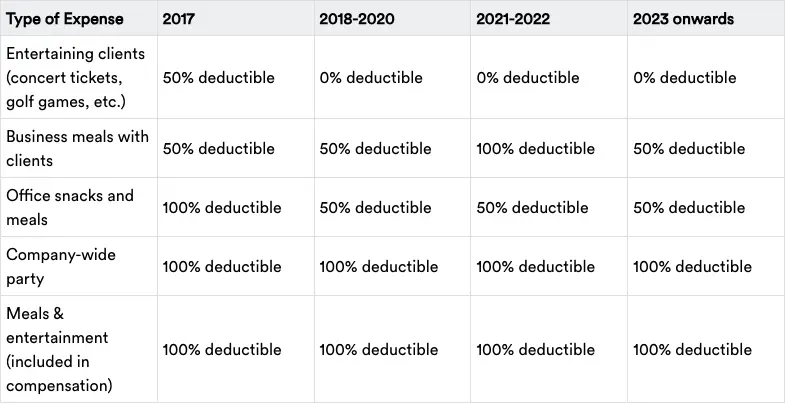

Meals Entertainment Tax Deductions For 2024 2023 meals and entertainment deduction. as part of the consolidated appropriations act signed into law on december 27, 2020, the deductibility of meals is changing. food and beverages were 100% deductible if purchased from a restaurant in 2021 and 2022. However, the tcja eliminated most entertainment expense deductions and reduced the deductible portion for meals to 50%. temporary changes in 2021 and 2022 allowed a 100% deduction for certain business meals, momentarily increasing potential tax savings. as of 2024, the landscape for these deductions has evolved yet again.

Are Business Meals Deductible In 2024 A Comprehensive Guide For Tax 50% deduction rules. after december 31, 2022, the deduction for business meals returns to the usual rate of 50% of the cost. the 50% deduction applies to non entertainment related meals, which means that meals combined with entertainment are generally not deductible. some situations where the 50% rule applies include:. Updated march 2024 knowing the meals and entertainment expenses you can and cannot write off for your small to mid sized business can be confusing. although the rules continue to change and expenses can range anywhere from 100% to 0% deductible, using this deduction can really help you save on your tax return. The deduction for your non entertainment related meals is subject to the 50% limit on meals mentioned earlier. trip primarily for personal reasons if your trip was primarily for personal reasons, such as a vacation, the entire cost of the trip is a nondeductible personal expense. Here are the key points: business related meals: you can generally deduct 50% of the cost of meals directly related to your business activities. this includes meals with clients, customers, and employees, provided there is a clear business purpose. employee meals: meals provided to employees, such as during office meetings or while traveling.

Meals And Entertainment Deductions In 2024 The Ray Group The deduction for your non entertainment related meals is subject to the 50% limit on meals mentioned earlier. trip primarily for personal reasons if your trip was primarily for personal reasons, such as a vacation, the entire cost of the trip is a nondeductible personal expense. Here are the key points: business related meals: you can generally deduct 50% of the cost of meals directly related to your business activities. this includes meals with clients, customers, and employees, provided there is a clear business purpose. employee meals: meals provided to employees, such as during office meetings or while traveling. This chart is based on the tax law in effect as of january 2024. wipfli llp does not undertake any obligation to update the chart for subsequent changes to the law. * for 2021 and 2022: 100% deduction for meals provided by restaurant or caterer for on site or takeout consumption. Entertainment expenses (meaning those of a type generally considered to be entertainment, amusement, or recreation) are fully nondeductible even if there is a business connection for the expense unless it falls into one of the exceptions listed below. the 50% disallowance rule limits the business deduction for certain otherwise deductible meals.

Comments are closed.