Meals And Entertainment Expenses In 2018 вђ Stephano Slack

Meals And Entertainment Expenses In 2018 вђ Stephano Slack Below is a summary of the highlights of the changes in meals and entertainment expense. the classification of your meals and entertainment expenses will impact your taxable income in 2018, if you have any questions concerning how your expenses should be categorized, please contact us. jay brooks, cpa [email protected] 610 687 1600. A deduction is allowed for ordinary and necessary expenses paid or incurred in carrying on any trade or business. taxpayers may deduct 50% of an otherwise allowable business meal expense if it meets the following requirements: expense is ordinary and necessary and paid or incurred during the tax year in carrying on any trade or business.

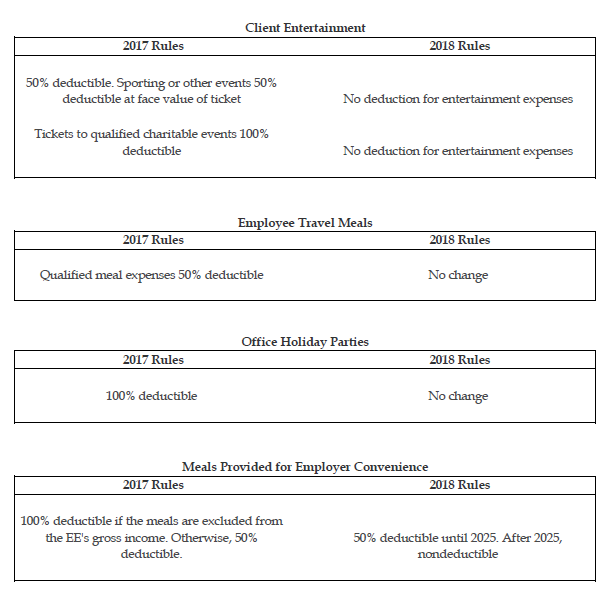

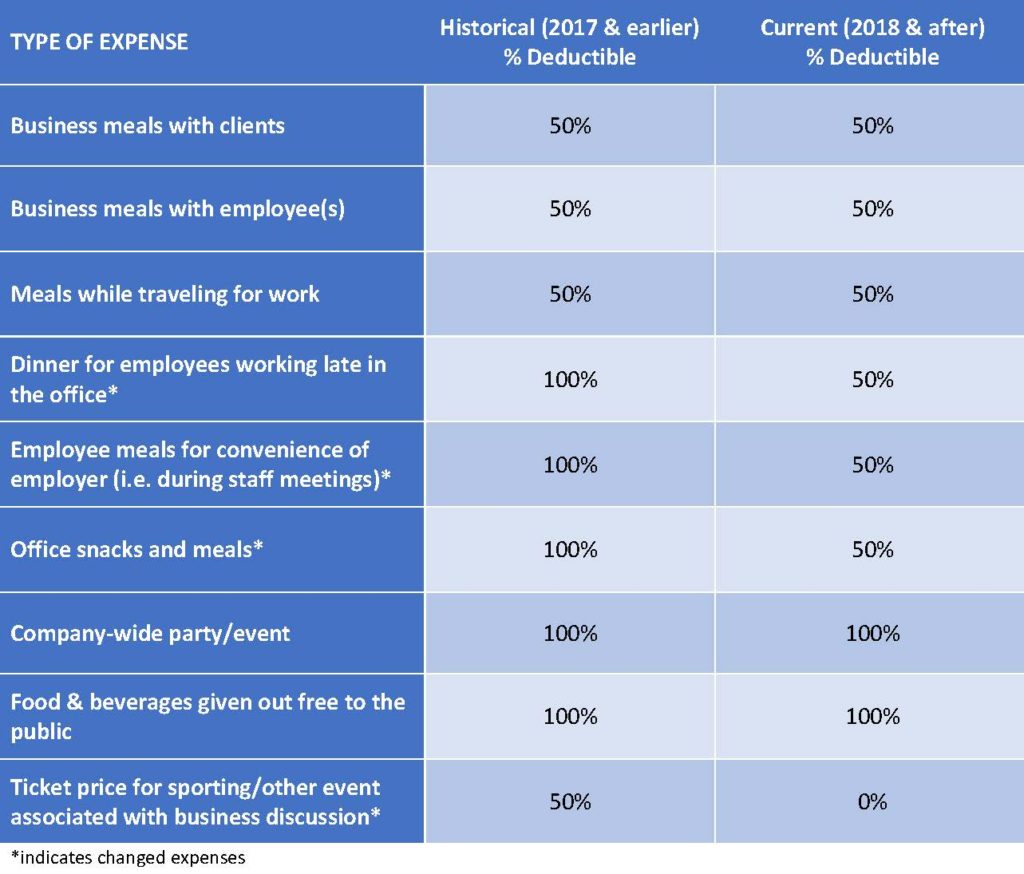

Business Meals And Entertainment Deductibility вђ Historical Vs Current The following chart summarizes the results of the tjca and its effect on meals and entertainment expenses. due to the various levels of deductibility, we recommend you make changes to your chart of accounts to separate out meals and entertainment and two separate expense items as well as a separate 100% deductible meals expense account if relevant to your company’s business expenses. Business entertainment expenses which were 50% deductible are no longer deductible beginning in 2018. items such as concert tickets, sporting event tickets, and golf fees are no longer deductible. also, meals and beverages on the same bill an entertainment event are not deductible. for example, use of a company box at a sporting event where the. For amounts incurred or paid after january 1, 2018, the deductions for entertainment expenses are disallowed, eliminating the subjective determination of whether such expenses are sufficiently business related; the current 50% limit on the deductibility of business meals is expanded to meals provided through an in house cafeteria or otherwise on the premises of the employer. Action required. under the tcja, entertainment expenses previously subject to a 50% limitation are now non deductible, and some formerly deductible meal expenses are now subject to a 50% limitation. these changes went into effect january 1, 2018. to get ahead of the record keeping and documentation that will be needed to file 2018 tax returns.

2018 Tax Reform Impact On Meals Entertainment Travel For amounts incurred or paid after january 1, 2018, the deductions for entertainment expenses are disallowed, eliminating the subjective determination of whether such expenses are sufficiently business related; the current 50% limit on the deductibility of business meals is expanded to meals provided through an in house cafeteria or otherwise on the premises of the employer. Action required. under the tcja, entertainment expenses previously subject to a 50% limitation are now non deductible, and some formerly deductible meal expenses are now subject to a 50% limitation. these changes went into effect january 1, 2018. to get ahead of the record keeping and documentation that will be needed to file 2018 tax returns. According to the canada revenue agency (cra), when it comes to claiming expenses for food, beverages, and entertainment, there is a maximum limit of 50% of the least of the following amounts: the actual expense incurred, or an amount that is considered reasonable based on the circumstances. this 50% limit applies in situations where the. 100 percent expenses for goods, services, and facilities you or your business makes available to the general public. 100 percent of the cost of any entertainment or recreation expenses included as part of the employee’s compensation and reported as such on the employee’s w 2. meals. business related meals have long been a deductible expense.

Changes To The Deductibility Of Meals And Entertainment Expenses According to the canada revenue agency (cra), when it comes to claiming expenses for food, beverages, and entertainment, there is a maximum limit of 50% of the least of the following amounts: the actual expense incurred, or an amount that is considered reasonable based on the circumstances. this 50% limit applies in situations where the. 100 percent expenses for goods, services, and facilities you or your business makes available to the general public. 100 percent of the cost of any entertainment or recreation expenses included as part of the employee’s compensation and reported as such on the employee’s w 2. meals. business related meals have long been a deductible expense.

Comments are closed.