Meals And Entertainment Deductions For 2021 22 вђ Spiegel Accountancy

Meals And Entertainment Deductions For 2021 22 Spiegel Accoun Income tax act s. 67.1. in general, expenses incurred in order to earn business or property income are tax deductible. however, there are limitations on some expenses, including meals and entertainment. most of the time, the amount that can be deducted for food, beverages and entertainment is 50% of the lesser of. the actual cost, or. The real rule for travel meals. the reality is, just like with regular meals and entertainment expenses, the cost of meals while traveling for business typically falls under the 50% deduction rule. yes, even if you’re miles away from your office, dining alone and discussing business deals on the phone, the cost will still only be 50% deductible.

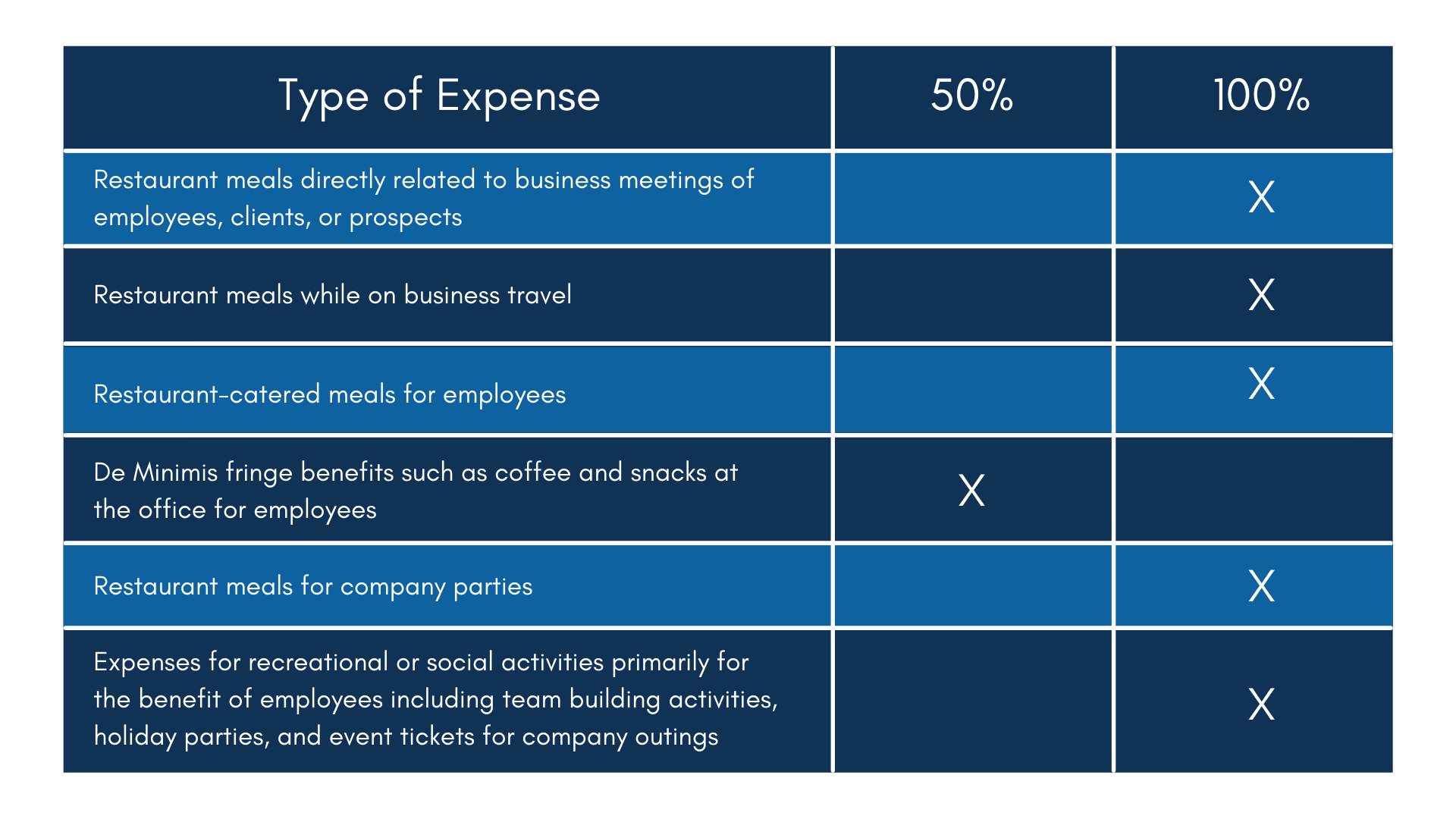

Meals And Entertainment Deductions For 2021 22 Spiegel Accoun Meal deductions: the 50% conundrum. effective january 1, 2023, the tax treatment of business meals has returned to its pre pandemic status, reinstating the 50% deductibility limit for most business meal expenses. this means that only 50% of qualifying meal expenses are now eligible for tax deduction, marking a change from the temporary 100%. In 2023, the deductions for meal and entertainment expenses change back to the tax rules under the tax cuts and jobs act of 2017 (tcja), reverting back from…. The objective of the temporary deduction was to stimulate the restaurant industry. in 2023, however, the deductions for business meals and entertainment have reverted to the values outlined in the 2017 tax cuts and jobs act (tcja): most business meals are now 50% deductible instead of 100% deductible as they were in 2021 and 2022. A national team dedicated to changing the game in 2024, the cpa firms of acquavella, chiarelli, shuster, llp, spiegel accountancy corp., and cathedral accountancy llp combined their practices to form cathedral cpas & advisors. our brand is about redefining solutions to bring our clients fresh thinking and new ideas that move their business forward. we are.

юааmealsюаб юааentertainmentюаб юааdeductionsюаб Whatтащs New юааfor 2021юаб 2022 Beaird The objective of the temporary deduction was to stimulate the restaurant industry. in 2023, however, the deductions for business meals and entertainment have reverted to the values outlined in the 2017 tax cuts and jobs act (tcja): most business meals are now 50% deductible instead of 100% deductible as they were in 2021 and 2022. A national team dedicated to changing the game in 2024, the cpa firms of acquavella, chiarelli, shuster, llp, spiegel accountancy corp., and cathedral accountancy llp combined their practices to form cathedral cpas & advisors. our brand is about redefining solutions to bring our clients fresh thinking and new ideas that move their business forward. we are. Entertainment expenses (meaning those of a type generally considered to be entertainment, amusement, or recreation) are fully nondeductible even if there is a business connection for the expense unless it falls into one of the exceptions listed below. the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. Entertainment tax deduction. if you were deducting meals and entertainment in previous years, you might have noticed the deduction amounts have changed. the 2018 tax cuts and jobs act brought a few big changes to meals and entertainment deductions. the biggest one: entertainment expenses are no longer deudctible. but some things haven’t changed.

Meals Entertainment Deduction 2022 5 Must Know Tips Flyfin Entertainment expenses (meaning those of a type generally considered to be entertainment, amusement, or recreation) are fully nondeductible even if there is a business connection for the expense unless it falls into one of the exceptions listed below. the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. Entertainment tax deduction. if you were deducting meals and entertainment in previous years, you might have noticed the deduction amounts have changed. the 2018 tax cuts and jobs act brought a few big changes to meals and entertainment deductions. the biggest one: entertainment expenses are no longer deudctible. but some things haven’t changed.

Comments are closed.