Meals And Entertainment Deductions For 2021 22 вђ Spiegel Acc

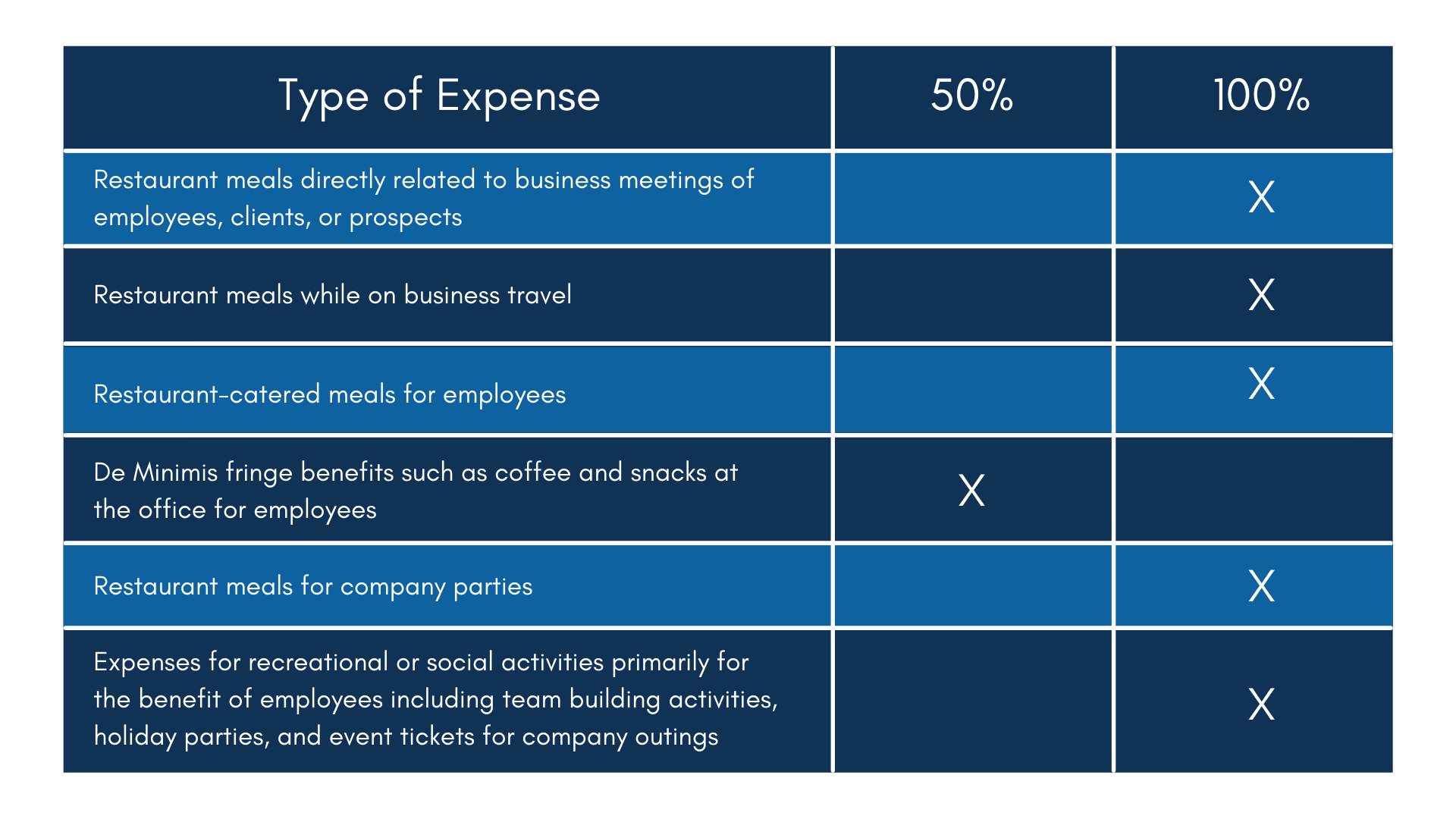

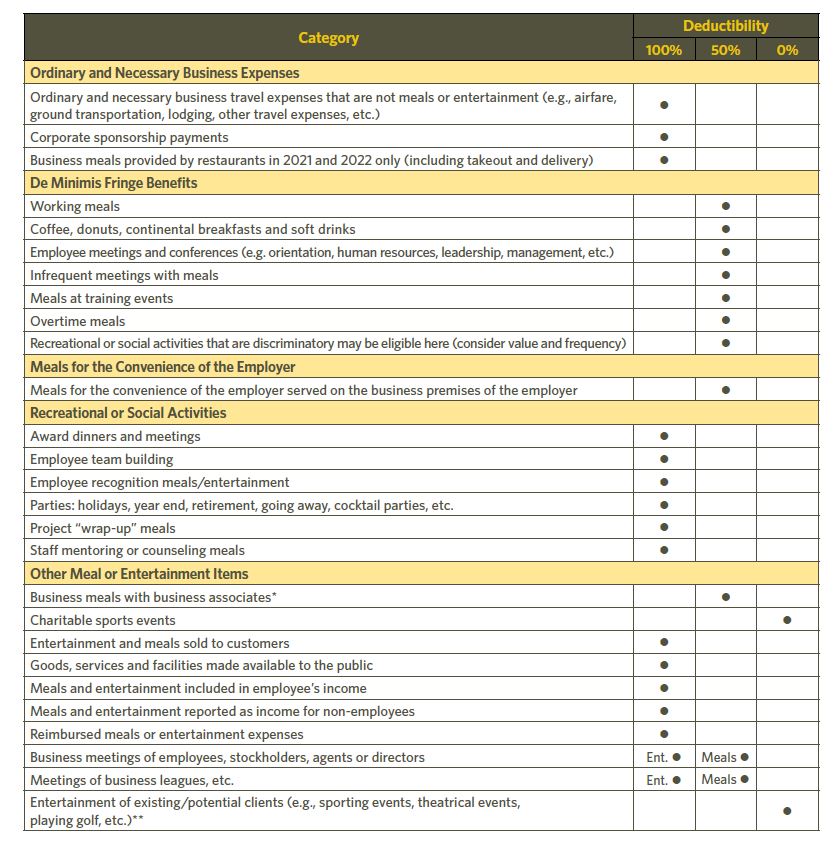

Meals And Entertainment Deductions For 2021 22 Spiegel Accountan Irs guidance on restaurant meals deductions. following the enactment of the caa, the irs released notice 2021 25 and notice 2021 63 to provide taxpayers with additional guidance on applying the temporary 100% meals deduction. meal expenses that don’t qualify for the 100% deduction still qualify for a 50% deduction as was previously allowed. This temporary rule had food and beverages 100% deductible if purchased from a restaurant in 2021 and 2022. however, for purchases made from 2023 onward, the rules revert to how they were defined in the tax cuts and jobs act. this means purchases for business related meals are back to only 50% deductible. entertainment expenses, like sporting.

Meals And Entertainment Deductions For 2021 22 вђ Spiegel Accoun Entertainment tax deduction. if you were deducting meals and entertainment in previous years, you might have noticed the deduction amounts have changed. the 2018 tax cuts and jobs act brought a few big changes to meals and entertainment deductions. the biggest one: entertainment expenses are no longer deudctible. but some things haven’t changed. Our updated guide to meals and entertainment deduction for 2021 provides the latest information in deductions effective january 1, 2021. read about it here. The law known as the tax cuts and jobs act (tcja), p.l. 115 97, significantly changed sec. 274 (a) by eliminating any deduction of expenses considered entertainment, amusement, or recreation. the tcja also extended the 50% deduction limitation for expenses related to food and beverages to those provided by employers to employees in some instances. The cca eliminated this limit for food or beverages provided by a restaurant if the expense is incurred between december 31, 2020, and january 1, 2023. in other words, meals expenses will not be limited to 50% for any expenses incurred in calendar years 2021 and 2022 if purchased at a restaurant. the irs defines a “restaurant” as a business.

юааmealsюаб юааentertainmentюаб юааdeductionsюаб Whatтащs New юааfor 2021юаб 2022 Beaird The law known as the tax cuts and jobs act (tcja), p.l. 115 97, significantly changed sec. 274 (a) by eliminating any deduction of expenses considered entertainment, amusement, or recreation. the tcja also extended the 50% deduction limitation for expenses related to food and beverages to those provided by employers to employees in some instances. The cca eliminated this limit for food or beverages provided by a restaurant if the expense is incurred between december 31, 2020, and january 1, 2023. in other words, meals expenses will not be limited to 50% for any expenses incurred in calendar years 2021 and 2022 if purchased at a restaurant. the irs defines a “restaurant” as a business. Entertainment expenses (meaning those of a type generally considered to be entertainment, amusement, or recreation) are fully nondeductible even if there is a business connection for the expense unless it falls into one of the exceptions listed below. the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. A guide to meals and entertainment deductions. the rules have changed since the 2017 tax cuts and jobs act. the balance is part of the dotdash meredith publishing family. the meals and entertainment tax deduction has changed since the tax cuts and jobs act of 2017 was enacted. here’s what you need to know when it comes to these tax breaks.

2022 Meal Entertainment Deductions Explained вђ Spiegel Accountancy Entertainment expenses (meaning those of a type generally considered to be entertainment, amusement, or recreation) are fully nondeductible even if there is a business connection for the expense unless it falls into one of the exceptions listed below. the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. A guide to meals and entertainment deductions. the rules have changed since the 2017 tax cuts and jobs act. the balance is part of the dotdash meredith publishing family. the meals and entertainment tax deduction has changed since the tax cuts and jobs act of 2017 was enacted. here’s what you need to know when it comes to these tax breaks.

2021 Meals And Entertainment Deduction Guide Larson Gross

Comments are closed.