Meals And Entertainment Deduction

юааmealsюаб юааentertainmentюаб Deductions Whatтащs New For 2021 2022 Beaird The meals and entertainment tax deductions have been a valuable way for many small business owners to reduce their tax liabilities each year. sadly, the value of the meal deduction will. The deduction for your non entertainment related meals is subject to the 50% limit on meals mentioned earlier. trip primarily for personal reasons if your trip was primarily for personal reasons, such as a vacation, the entire cost of the trip is a nondeductible personal expense.

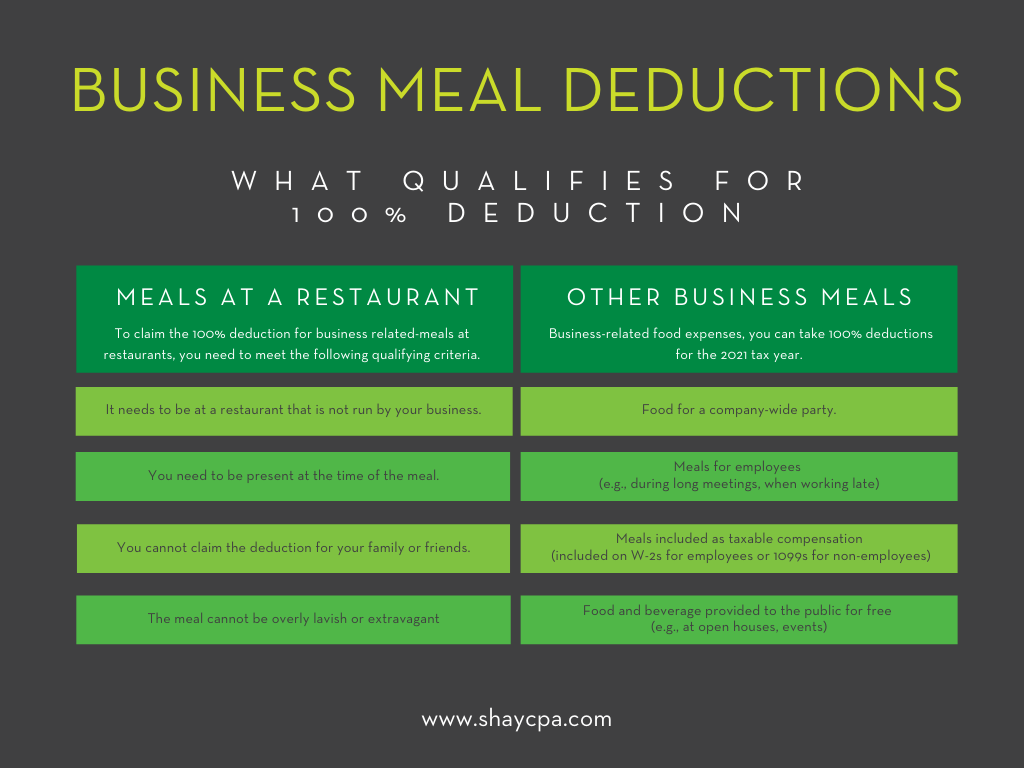

2022 Meal Entertainment Deductions Explained вђ Spiegel Accountancy Businesses can deduct the full cost of food and beverages from restaurants for business related purposes in 2021 and 2022. learn the qualifications, exceptions and recordkeeping rules for this tax benefit. As part of the consolidated appropriations act signed into law on december 27, 2020, the deductibility of meals is changing. food and beverages were 100% deductible if purchased from a restaurant in 2021 and 2022. but for purchases made in 2023 onwards, the rules revert back to how they were defined in the tax cuts and jobs act. Washington — the internal revenue service today urged business taxpayers to begin planning now to take advantage of the enhanced 100% deduction for business meals and other tax benefits available to them when they file their 2022 federal income tax return. Normally, any activity that is generally considered to be entertainment will be treated as subject to the limitation on deducting expenses under sec. 274 (a). however, a taxpayer’s trade or business must be considered.

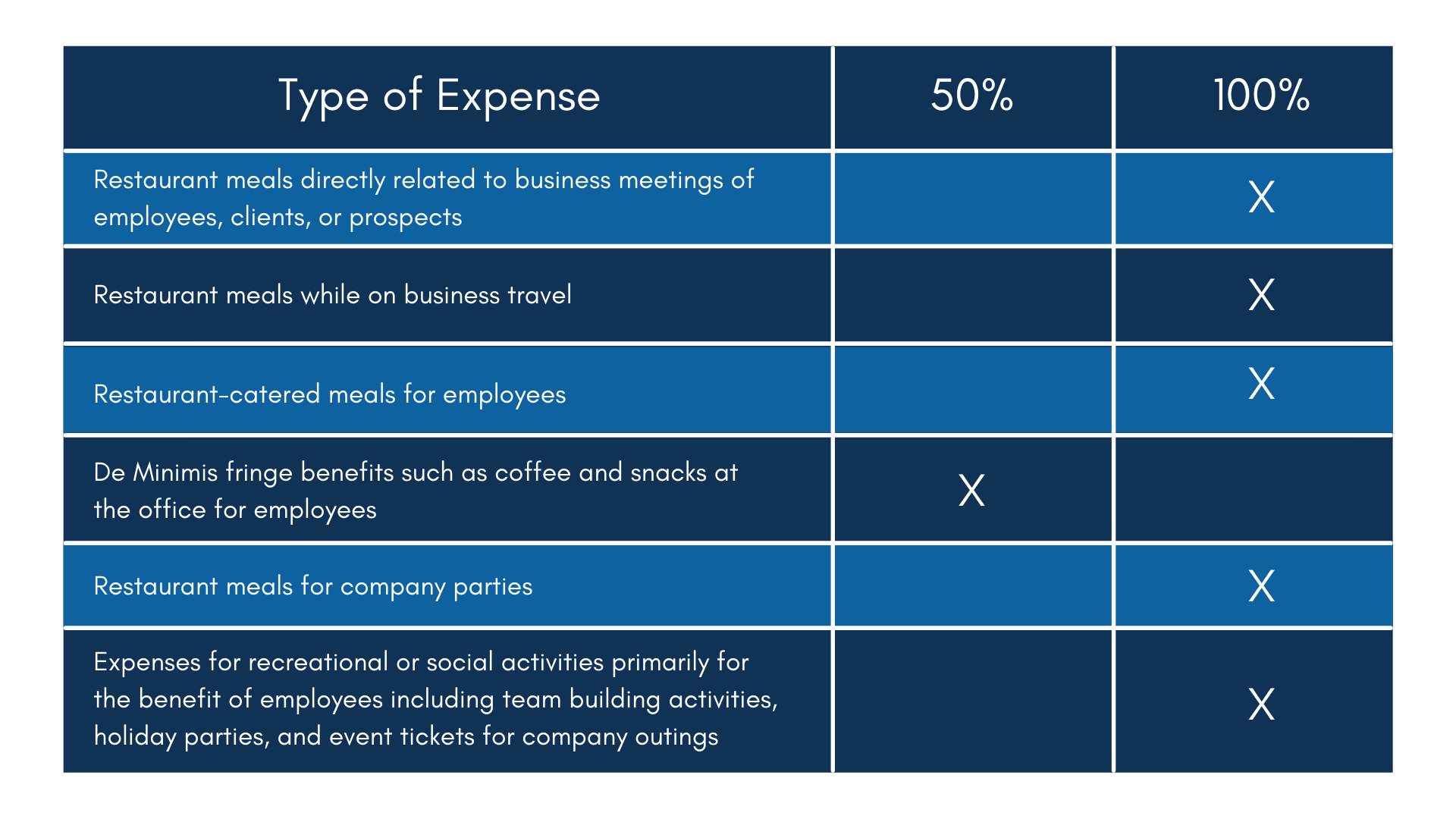

Meals And Entertainment Deduction Shay Cpa Washington — the internal revenue service today urged business taxpayers to begin planning now to take advantage of the enhanced 100% deduction for business meals and other tax benefits available to them when they file their 2022 federal income tax return. Normally, any activity that is generally considered to be entertainment will be treated as subject to the limitation on deducting expenses under sec. 274 (a). however, a taxpayer’s trade or business must be considered. Business meal expenses are generally 50% deductible, while entertainment expenses are no longer deductible. the internal revenue service (irs) has issued final regulations that clarify the business expense deduction for meals and entertainment, providing further guidance under the tcja. exceptions and special rules. The meals and entertainment tax deduction has changed since the tax cuts and jobs act of 2017 was enacted. here’s what you need to know when it comes to these tax breaks.

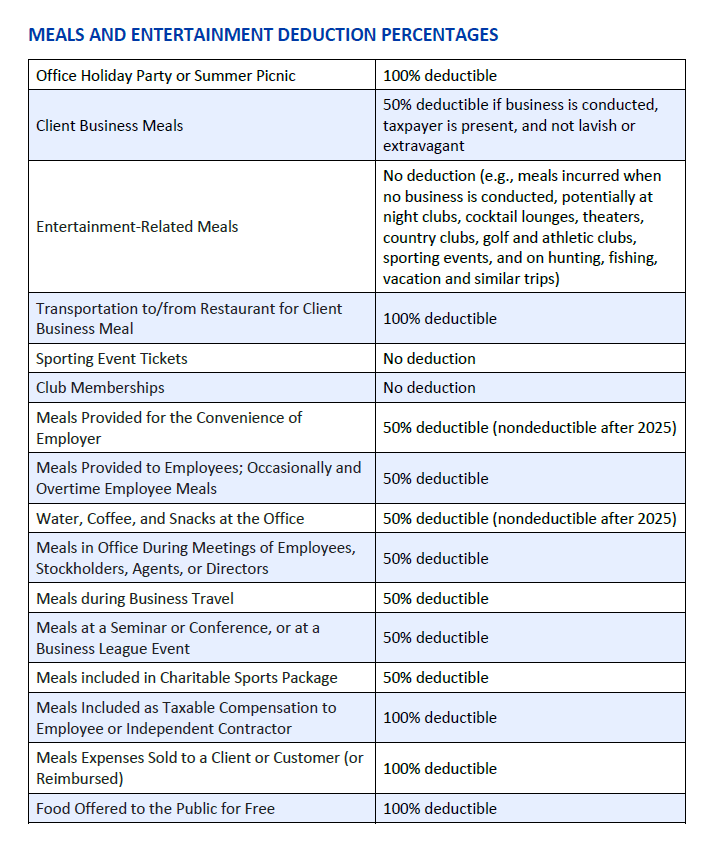

Meal And Entertainment Deductions For 2023 2024 Business meal expenses are generally 50% deductible, while entertainment expenses are no longer deductible. the internal revenue service (irs) has issued final regulations that clarify the business expense deduction for meals and entertainment, providing further guidance under the tcja. exceptions and special rules. The meals and entertainment tax deduction has changed since the tax cuts and jobs act of 2017 was enacted. here’s what you need to know when it comes to these tax breaks.

Meals Entertainment Deduction Percentages Thompson Greenspon Cpa

Comments are closed.