List Of Vehicles Over 6000 Lbs That Qualify For Irs Tax Benefit In

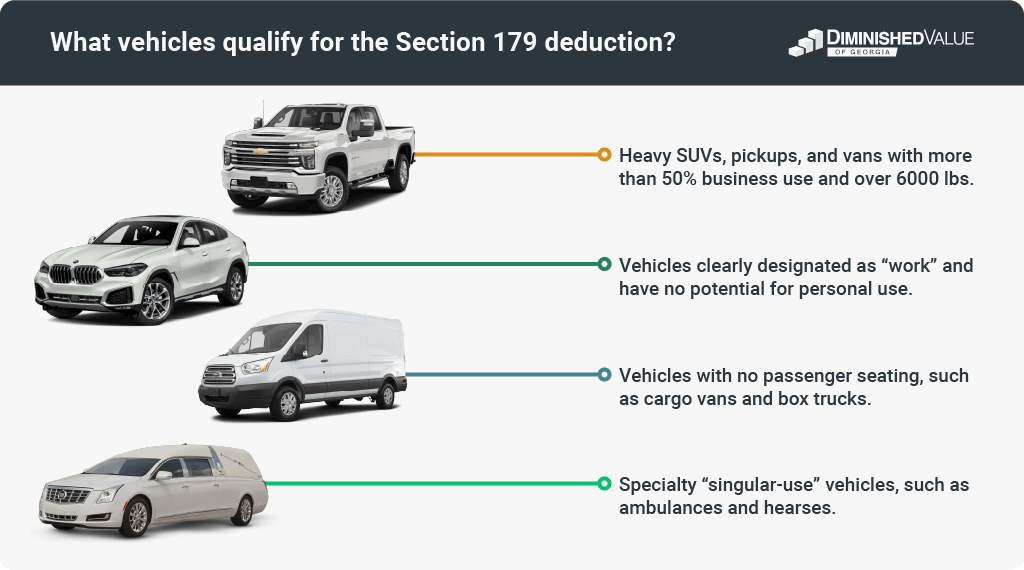

List Of Vehicles Over 6000 Lbs That Qualify For Irs Tax Benefit In 2024 Under the section 179 tax deduction: heavy suvs, pickups, and vans over 6000 lbs. and mainly used for business can get a partial deduction and bonus depreciation. typical work vehicles without personal use qualify. cargo vans and box trucks with no passenger seating can qualify. This tax incentive allows businesses to deduct the full purchase price of qualifying equipment and vehicles over 6000 lbs in the year of acquisition, providing a significant financial advantage. staying informed about the irs guidelines and qualifying vehicles is crucial to taking full advantage of this deduction. in this comprehensive guide.

List Of Vehicles Over 6000 Lbs That Qualify For The Irs ођ What vehicles qualify for the section 179 deduction in 2024? eligible vehicles for the section 179 tax write off include: • heavy suvs*, pickups, and vans (over 6,000 lbs. gvwr, more than 50% business use) • obvious non personal “work” vehicles (dump truck, backhoe, farm tractor, etc.) • delivery use vehicles (cargo vans, box trucks). Section 179 deduction vehicle list 2023 2024. as a small business owner, the quest to minimize tax liabilities is a high priority. one effective strategy to achieve this goal is the acquisition of a business vehicle weighing more than 6000 pounds, presenting a compelling avenue for substantial tax deductions. particularly, section 179 vehicles. Here is a list of the 15 best selling 2024 suvs with a gvwr greater than 6,000 pounds that may qualify for section 179 deductions. make and model. gvwr (pounds) jeep grand cherokee grand cherokee. Key takeaways. qualifying vehicles must be more than 50% of the vehicle’s use for business purposes. the ever popular section 179 expensing option increases to $1.2 million for 2024 for farmers and other small businesses that buy under $3,050,000 in total equipment. section 179 applies to business assets with a depreciation schedule that is.

Comments are closed.