Life Insurance Vs Annuity Key Differences Pros Cons

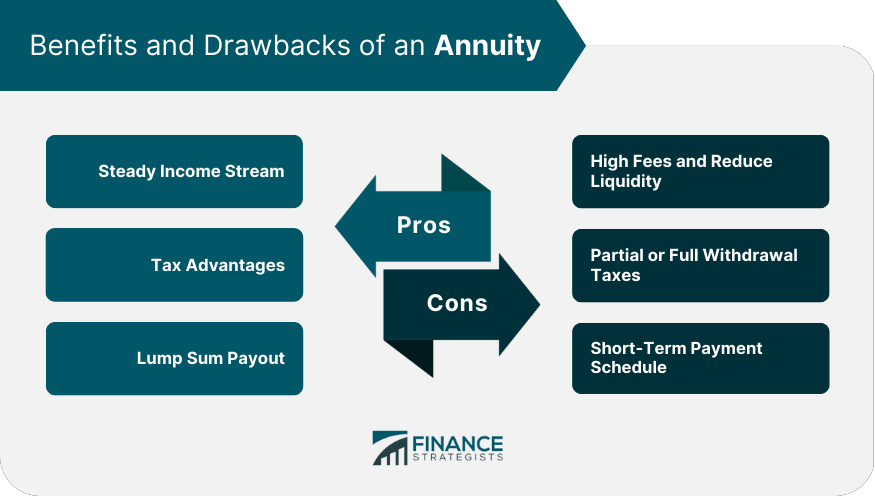

Life Insurance Vs Annuity Key Differences Pros Cons Annuity vs. life insurance: an overview. life insurance is primarily used to pay your heirs when you pass away, while an annuity grows your savings and pays you income while you’re still alive. Generally speaking, life insurance is better suited for short term protection. at the same time, annuities provide a steady income stream over a long period and are more suitable for retirement planning. life insurance is usually lower cost and offers policyholders more flexibility with liquidity options.

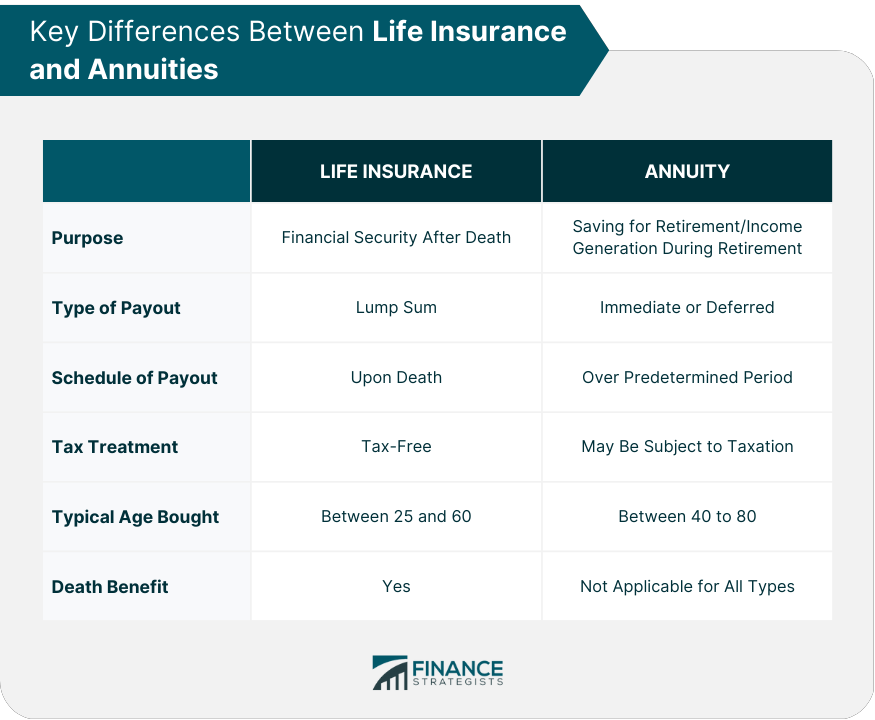

Life Insurance Vs Annuity Key Differences Pros Cons While annuities offer an income stream for the contract’s owner while living, life insurance offers a cash payout to the policyholder’s heirs on his or her death. annuities may be purchased in. Annuities are designed to provide guaranteed income in the event you live longer than expected. conversely, life insurance is designed to create income for your heirs in the event of your untimely death. annuities and life insurance both provide you and your family with financial protection, but on opposite ends of the longevity spectrum. Annuities vs. life insurance: key differences. you may want to consider both annuities and life insurance for your long term financial plan. essentially, you purchase life insurance in the event you die sooner than expected and you buy an annuity in the event you live past your retirement savings. both options have their benefits and downsides. Life insurance vs. annuity. the chief difference between life insurance and annuities is that life insurance provides a cash benefit for your loved ones after you die. in contrast, annuities provide you with a lifetime income until you die. both include death benefits.

The Important Difference Between Annuities And Life Insurance вђ Artof Annuities vs. life insurance: key differences. you may want to consider both annuities and life insurance for your long term financial plan. essentially, you purchase life insurance in the event you die sooner than expected and you buy an annuity in the event you live past your retirement savings. both options have their benefits and downsides. Life insurance vs. annuity. the chief difference between life insurance and annuities is that life insurance provides a cash benefit for your loved ones after you die. in contrast, annuities provide you with a lifetime income until you die. both include death benefits. Life insurance offers a death benefit and requires ongoing premiums, focusing on protection, while annuities convert savings into retirement income, often with greater investment growth potential. each has distinct tax benefits, costs, and access to funds, tailored to different financial needs and life stages. Both annuity and life insurance contracts are insurance issued financial products designed for individuals either in or approaching retirement. whereas annuities specialize in providing a steady income during retirement, life insurance offers financial protection to your beneficiaries if you were to pass away.

Life Insurance Vs Annuity Which Is Right For You Life insurance offers a death benefit and requires ongoing premiums, focusing on protection, while annuities convert savings into retirement income, often with greater investment growth potential. each has distinct tax benefits, costs, and access to funds, tailored to different financial needs and life stages. Both annuity and life insurance contracts are insurance issued financial products designed for individuals either in or approaching retirement. whereas annuities specialize in providing a steady income during retirement, life insurance offers financial protection to your beneficiaries if you were to pass away.

Comments are closed.