Life Insurance Statistics And Trends For 2024

Life Insurance Statistics And Trends For 2024 Choice Mutual Only 3% of americans correctly guessed the cost of a 10 year, $500,000 term life insurance policy for a healthy, 40 year old buyer. the largest percentage of respondents (28.4%) thought the cost. We compiled key life insurance statistics and trends for 2024, with data on ownership rates, industry growth, demographic breakdowns and average state payouts.

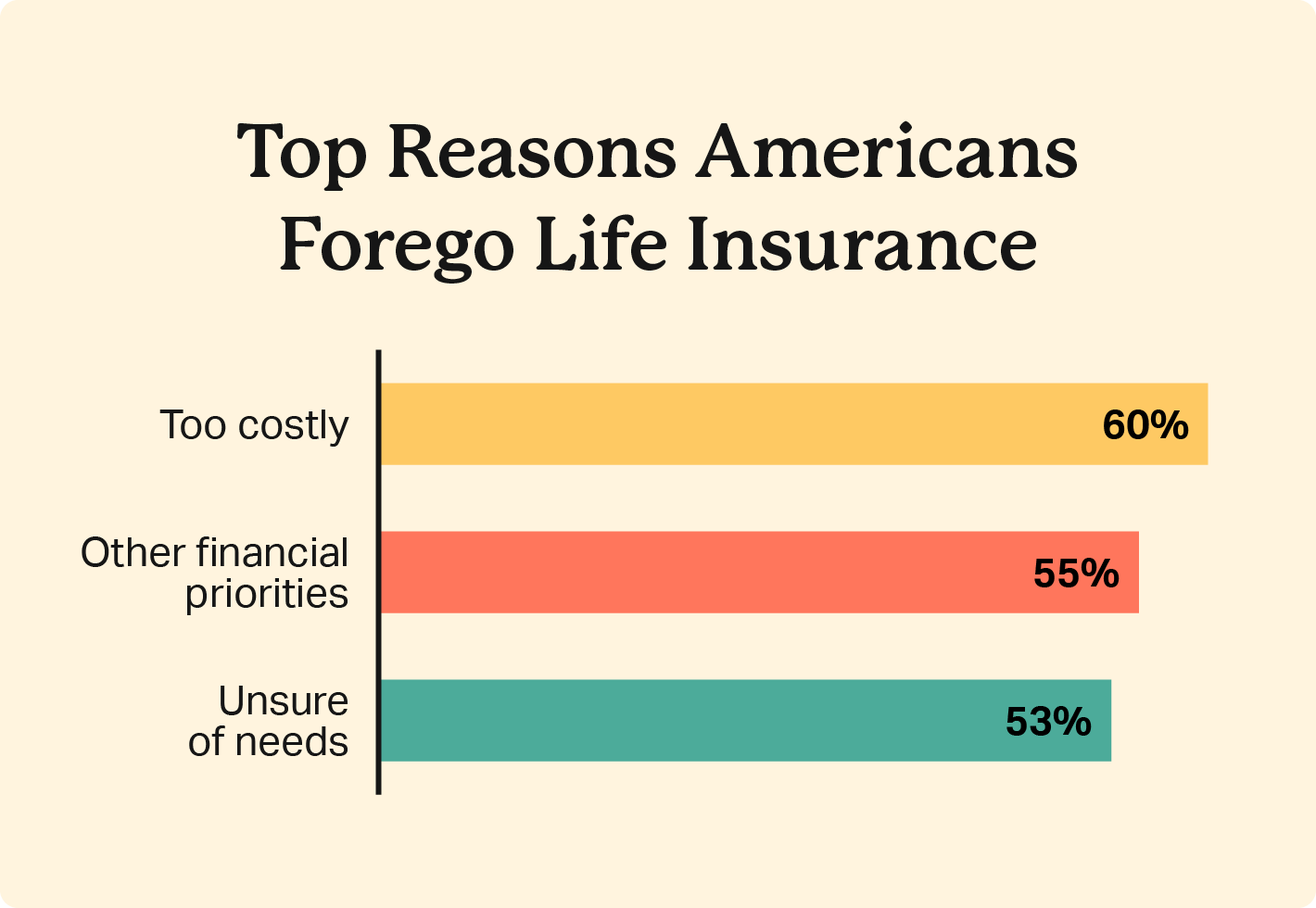

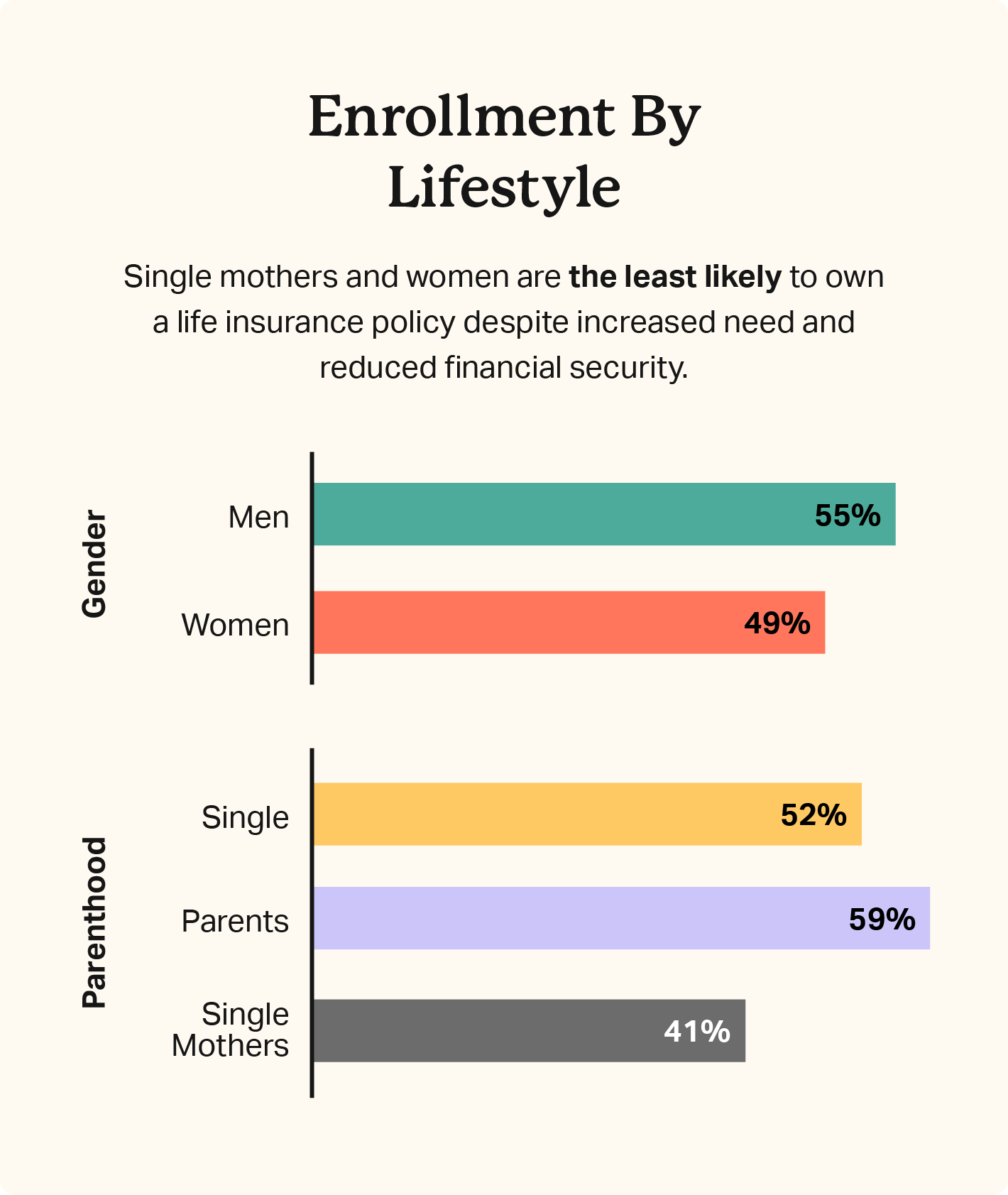

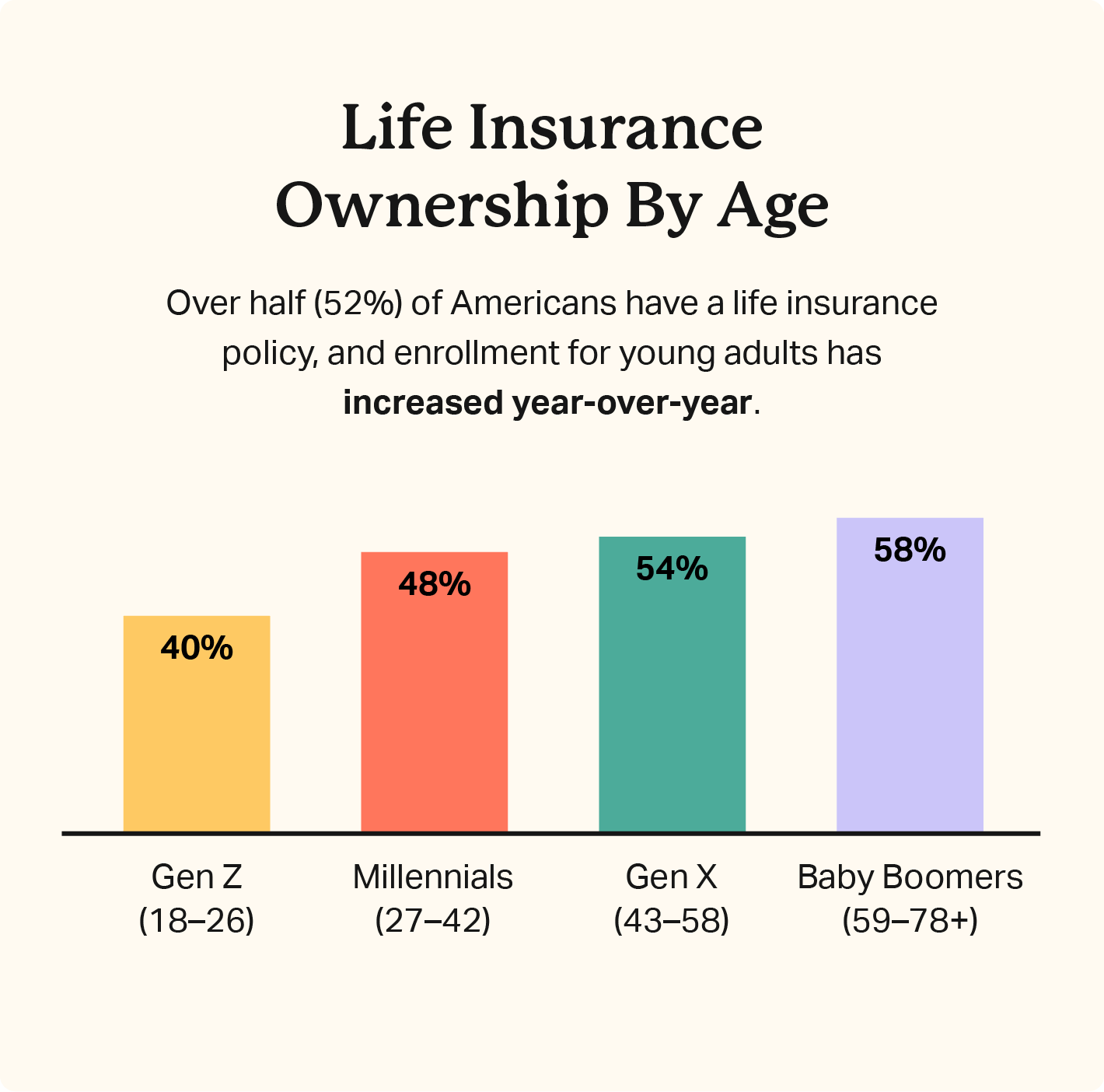

Life Insurance Statistics And Trends For 2024 56% of individuals with a household income of less than $50,000 don’t have (48%) or don’t have enough (8%) life insurance coverage, representing the largest need gap across income brackets. 39. 9. canada’s largest insurance company increased its assets by 34.3% in 2020. (source: statista, statista, forbes) hailed as the largest insurance company in canada, manulife financial boosted its worldwide assets considerably in 2020 to an eye watering $880.35 billion, up from $578.41 billion in 2014. Key takeaways. about half of american adults have life insurance coverage in 2024. 42% of americans say they either need life insurance or need more of it. women are less likely to have life insurance; 46% of women have life insurance in 2024, compared to 57% of men, the largest disparity in over a decade. the most common reasons people don’t. Globally, the l&a sector’s 2023–2024 premium growth drivers are projected to fuel a divergence between advanced and emerging markets (figure 3). 41 the impact of inflation on discretionary consumer spending will likely pressure individual life insurance sales in the united states and europe, while regulatory headwinds may weigh on advanced asia. 42 conversely, the growing middle class with.

Life Insurance Statistics And Trends For 2024 Key takeaways. about half of american adults have life insurance coverage in 2024. 42% of americans say they either need life insurance or need more of it. women are less likely to have life insurance; 46% of women have life insurance in 2024, compared to 57% of men, the largest disparity in over a decade. the most common reasons people don’t. Globally, the l&a sector’s 2023–2024 premium growth drivers are projected to fuel a divergence between advanced and emerging markets (figure 3). 41 the impact of inflation on discretionary consumer spending will likely pressure individual life insurance sales in the united states and europe, while regulatory headwinds may weigh on advanced asia. 42 conversely, the growing middle class with. Success drivers will include enhanced customer experience that boosts trust and loyalty, rapid product innovation, increasing up sell and cross sell opportunities, and identification of new revenue streams. read our new report, insurance top trends 2024, to explore strategic insights and tactical use cases to help ensure profitable growth and. Average household life insurance coverage in canada has been rising steadily, from $423,000 in 2018 to $474,000 in 2022, an increase of 12.1%. in quebec, a similar trend was observed, with an increase of 12.7% over the same period, with average life insurance coverage rising from $347,000 in 2018 to $391,000 in 2022.

Top Life Insurance Statistics And Trends In 2024 вђ Forbes Advisor Uk Success drivers will include enhanced customer experience that boosts trust and loyalty, rapid product innovation, increasing up sell and cross sell opportunities, and identification of new revenue streams. read our new report, insurance top trends 2024, to explore strategic insights and tactical use cases to help ensure profitable growth and. Average household life insurance coverage in canada has been rising steadily, from $423,000 in 2018 to $474,000 in 2022, an increase of 12.1%. in quebec, a similar trend was observed, with an increase of 12.7% over the same period, with average life insurance coverage rising from $347,000 in 2018 to $391,000 in 2022.

Comments are closed.