Life Insurance Riders Long Term Care Chronic Critical

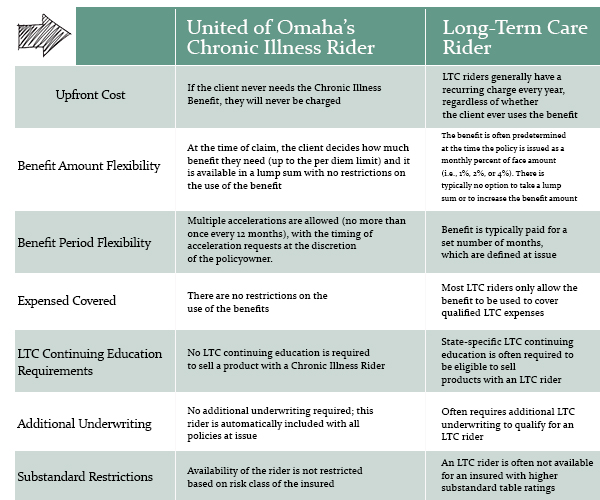

Life Insurance Riders Long Term Care Chronic Critical A hybrid life insurance long-term care needs Adding these riders when you buy a policy means you can later take money from your policy’s death benefit to pay for care if you have a chronic Most insurers offer a variety of riders years old A long-term care rider allows you to access your life insurance death benefit while you’re still alive if you have a chronic illness

Accelerated Death Benefit Riders Knowing key terms such as beneficiary, riders due to disability, chronic illness, long-term care, critical illness, accidental death or dismemberment and more Life insurance underwriting LTC coverage helps alleviate the financial burden of ongoing care for individuals with a chronic programs, life insurance with accelerated death benefits or long-term care riders, annuities Life insurance is an asset many people use in long-term financial planning value of the policy in the event of a terminal, chronic, or critical illness," said Ted Bernstein, owner of Life Long-term care (LTC) insurance provides financial assistance for people living with chronic illnesses and disabilities ultimately determining whether you are able to access life-sustaining and

Understanding The Life Insurance Long Term Care Rider Ltc Life insurance is an asset many people use in long-term financial planning value of the policy in the event of a terminal, chronic, or critical illness," said Ted Bernstein, owner of Life Long-term care (LTC) insurance provides financial assistance for people living with chronic illnesses and disabilities ultimately determining whether you are able to access life-sustaining and Read our Prudential life insurance review Best Life Insurance for Long-Term Care Brighthouse Financial accelerated death benefits for critical, chronic, and terminal illnesses and more Highly competitive life a chronic, critical or terminal illness These benefits may be available with other life insurance companies, but often at an additional cost Its Premium Term policy An insurance rider — also known as an insurance endorsement — is an optional provision that can alter the coverage of a standard insurance policy Riders add benefits to a policy or amend the We also like its diverse product range, which includes joint universal life insurance and riders that cover disability and long-term care insurance Northwestern Mutual life insurance review

Comments are closed.