Level Ii Concept The Camels Approach To Analyzing A Bank

Level Ii Concept The Camels Approach To Analyzing A Bank Youtube Subscribe now: ift cfasign up for level ii free trial now: ift.world cfalevel2 for more videos, notes, practice questions, moc. Limitations of the camels approach. previously, we mentioned that an analyst using the camels approach to examine a bank undertakes analysis and assigns a numerical rating of 1 through 5 to each component. a rating of 1 is the best rating. it shows the best practices in risk management and performance and generating the least concern for.

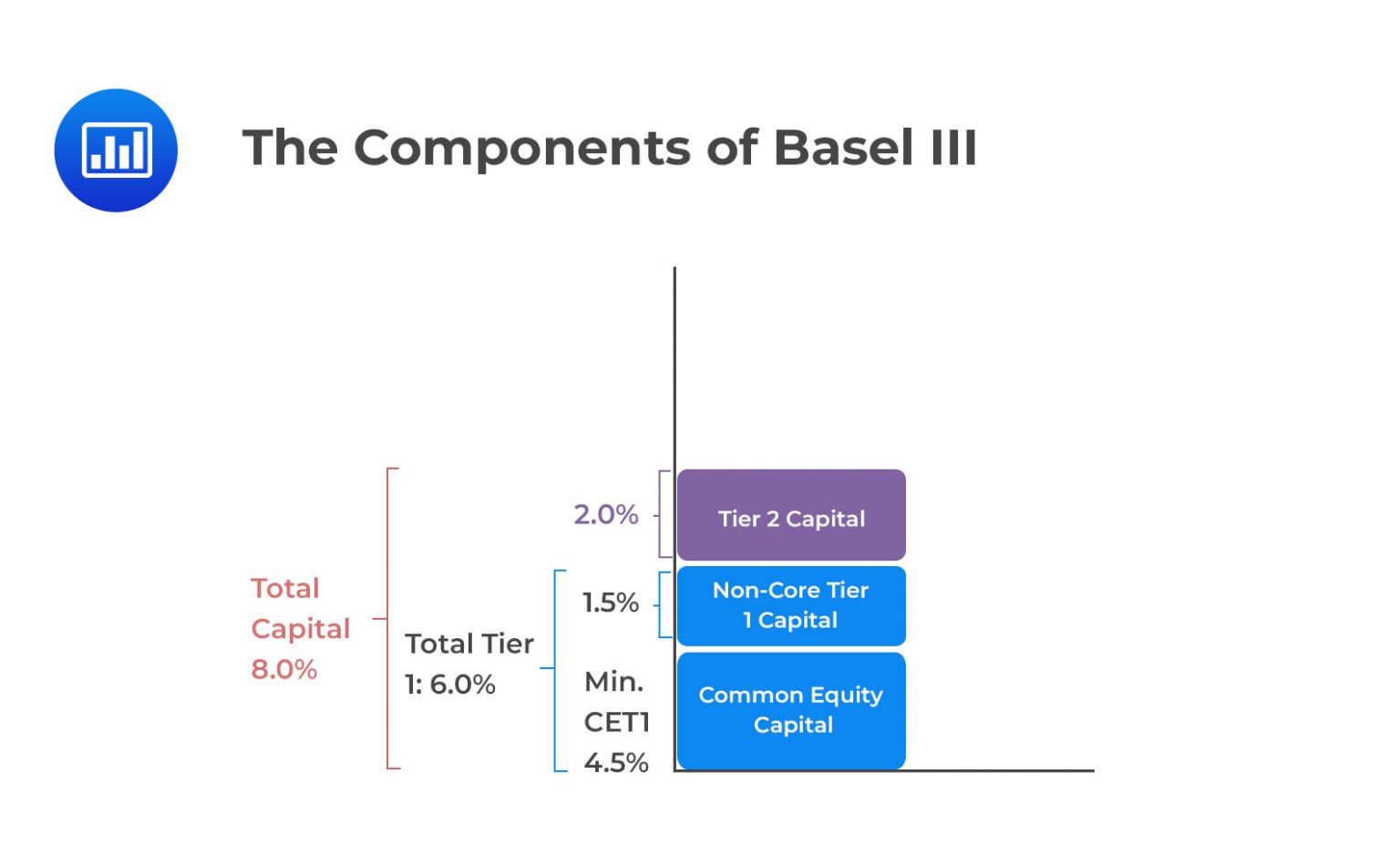

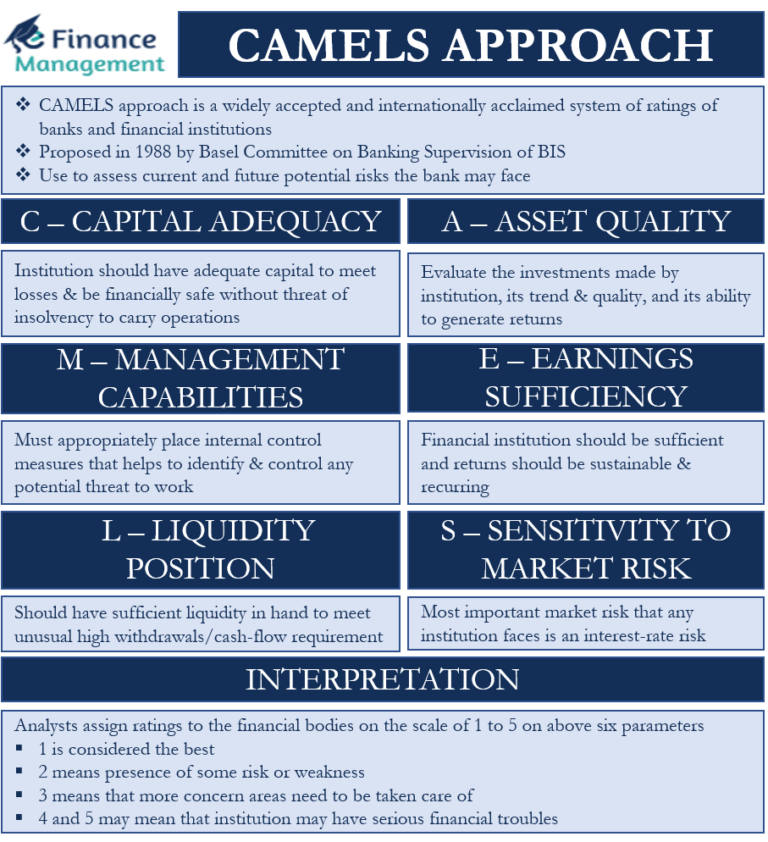

The Camels Approach Cfa Frm And Actuarial Exams Study Notes Explain the camels (capital adequacy, asset quality, management, earnings, liquidity, and sensitivity) approach to analyzing a bank, including key ratios and its limitations analyze a bank based on financial statements and other factors describe other factors to consider in analyzing a bank. The credit policies and overall risk management processes of a bank impact its asset quality. the three major asset categories for a bank are: 1. loans – generally the largest component of overall assets. the quality of loans depends on: creditworthiness of borrowers – high creditworthiness implies high asset quality. Example 2: capital adequacy. part of ivana’s analysis focuses on company abc, which is a global commercial bank, its camels rating, risk management practices, and performance. first, she examines the company’s capital adequacy based on the vital capital ratios in the following exhibit. Subject 2. analyzing a bank: the camels approach pdf download. camels is a recognized international rating system that bank supervisory authorities use in order to rate financial institutions according to six factors represented by its acronym. supervisory authorities assign each bank a score on a scale. a rating of one is considered the best.

Camels Approach Meaning Methodology Importance And Limitations Example 2: capital adequacy. part of ivana’s analysis focuses on company abc, which is a global commercial bank, its camels rating, risk management practices, and performance. first, she examines the company’s capital adequacy based on the vital capital ratios in the following exhibit. Subject 2. analyzing a bank: the camels approach pdf download. camels is a recognized international rating system that bank supervisory authorities use in order to rate financial institutions according to six factors represented by its acronym. supervisory authorities assign each bank a score on a scale. a rating of one is considered the best. Camels approach is a widely accepted and internationally acclaimed system of ratings of banks and financial institutions. it was proposed in 1988 by the basel committee on banking supervision of the bis (bank of international settlements). analysts and regulatory bodies use this approach to measure the risk and performance of financial. C. explain the camels (capital adequacy, asset quality, management, earnings, liquidity, and sensitivity) approach to analyzing a bank, including key ratios and its limitations; d. describe other factors to consider in analyzing a bank; e. analyze a bank based on financial statements and other factors; f.

Comments are closed.