Is Consumer Reports Tax Deductible

Tax Deductible Definition Expenses Examples Make a tax deductible donation to help fund our independent and nonprofit testing programs. $35. $50. $100. other. consumer reports is an expert, independent, nonprofit organization whose mission. Consumer reports is a nonprofit, tax exempt charitable organization under section 501(c)(3) of the internal revenue code. donations are tax deductible as allowed by law. about us donate.

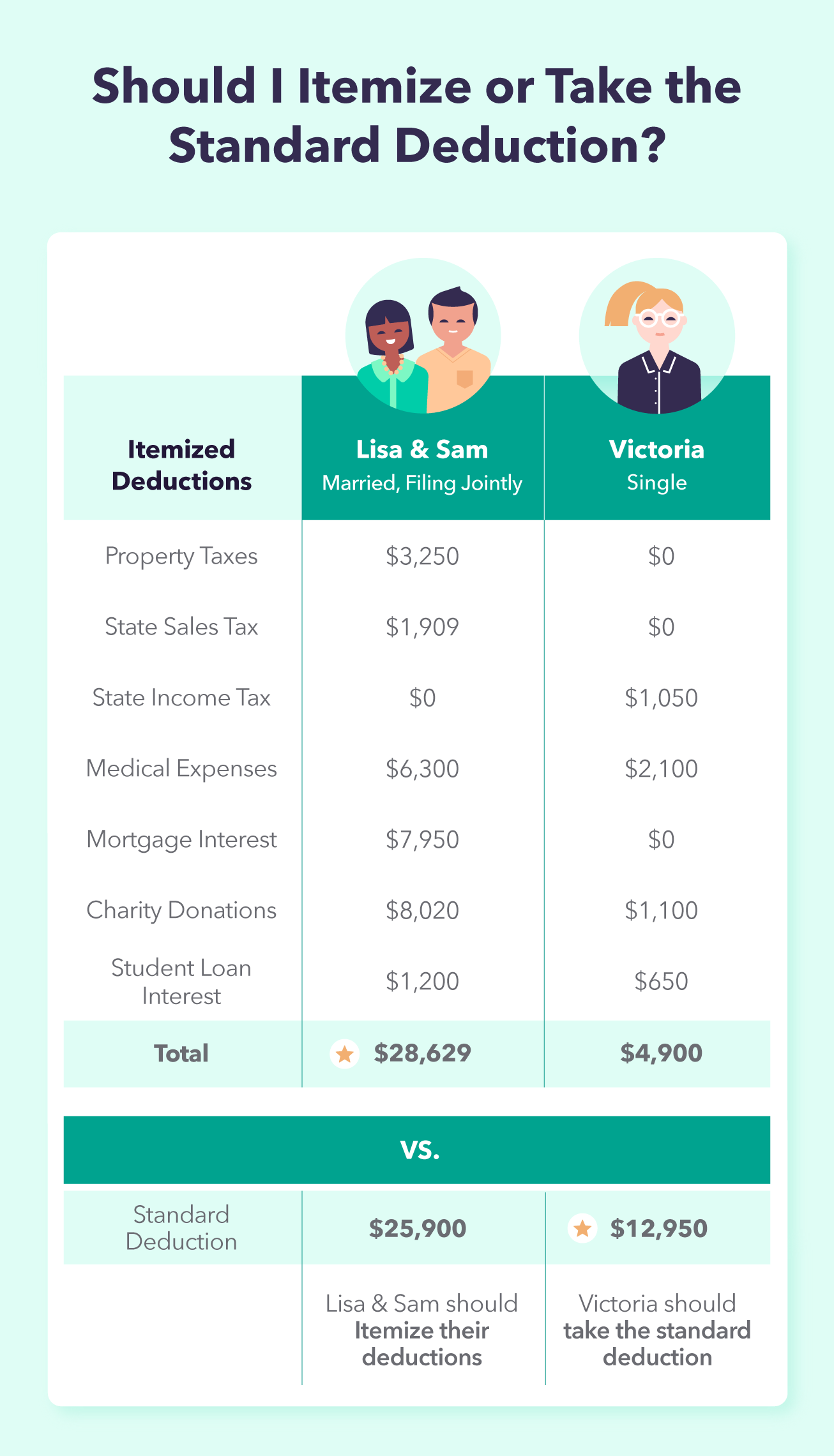

What Purchases Are Tax Deductible A Quick Guide Cpa Firm Accounting This charity's score is 100%, earning it a four star rating. if this organization aligns with your passions and values, you can give with confidence. this overall score is calculated from multiple beacon scores, weighted as follows: 74% accountability & finance, 10% leadership & adaptability, 16% culture & community. Thank you for considering a tax deductible gift to consumer reports. your contribution helps save lives and makes everyday life better. your support makes it possible for cr to test, rate, and. More on taxes from consumer reports. • use valuation tools. some charities provide valuation guides on their websites to help you figure out how big a tax deduction you should claim. you can. That pledge you made doesn't become deductible until you actually give the money. when you agree to contribute $10 per month during a fund raising drive, only the monthly payments you make during the tax year can be deducted on that year's return. you cannot claim $120 if you only paid $40 during the year.

What Are Tax Deductions And Credits 20 Ways To Save Mint More on taxes from consumer reports. • use valuation tools. some charities provide valuation guides on their websites to help you figure out how big a tax deduction you should claim. you can. That pledge you made doesn't become deductible until you actually give the money. when you agree to contribute $10 per month during a fund raising drive, only the monthly payments you make during the tax year can be deducted on that year's return. you cannot claim $120 if you only paid $40 during the year. Nonprofit explorer includes summary data for nonprofit tax returns and full form 990 documents, in both pdf and digital formats. the summary data contains information processed by the irs during the 2012 2019 calendar years; this generally consists of filings for the 2011 2018 fiscal years, but may include older records. A charitable donation is a gift of money or goods to a tax exempt organization that can reduce your taxable income. to claim a deduction for charitable donations on your taxes, you must have.

Comments are closed.