Irs Meal Deduction 2024 Windy Kakalina

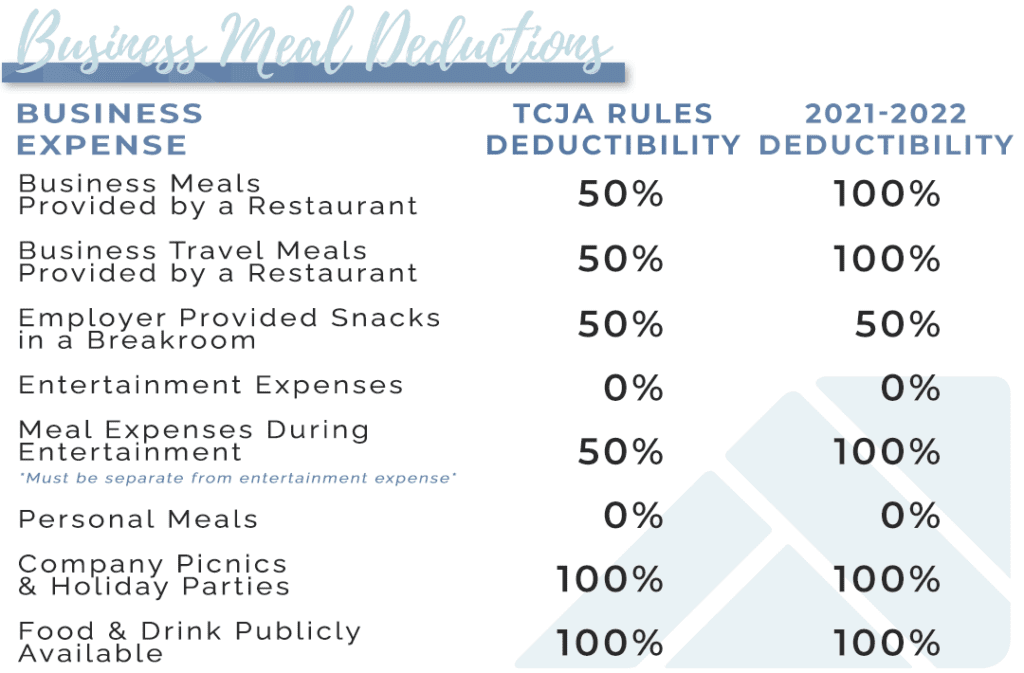

Irs Meal Deduction 2024 Windy Kakalina Amount of standard meal allowance. the standard meal allowance is the federal m&ie rate. for travel in 2023, the rate for most small localities in the united states is $59 per day. most major cities and many other localities in the united states are designated as high cost areas, qualifying for higher standard meal allowances. If you were deducting meals and entertainment in previous years, you might have noticed the deduction amounts have changed. the 2018 tax cuts and jobs act brought a few big changes to meals and entertainment deductions. the biggest one: entertainment expenses are no longer deudctible. but some things haven’t changed. here’s a summary table.

Irs Standard Deduction 2024 Married Windy Kakalina However, the tcja eliminated most entertainment expense deductions and reduced the deductible portion for meals to 50%. temporary changes in 2021 and 2022 allowed a 100% deduction for certain business meals, momentarily increasing potential tax savings. as of 2024, the landscape for these deductions has evolved yet again. Tax tip 2022 91, june 14, 2022 — the irs encourages businesses to begin planning now to take advantage of tax benefits available to them when they file their 2022 federal income tax return. this includes the enhanced business meal deduction. Notice 2023 68. section 1. purpose. this annual notice provides the 2023 2024 special per diem rates for taxpayers to. use in substantiating the amount of ordinary and necessary business expenses incurred. while traveling away from home, specifically (1) the special transportation industry meal. and incidental expenses (m&ie) rates, (2) the. 50% deduction rules. after december 31, 2022, the deduction for business meals returns to the usual rate of 50% of the cost. the 50% deduction applies to non entertainment related meals, which means that meals combined with entertainment are generally not deductible. some situations where the 50% rule applies include:.

Comments are closed.