Irs Form 4506 T Walkthrough Request For Transcript Of Tax Return

Irs Form 4506 T Walkthrough Request For Transcript Of Tax Return Download a copy of form 4506-T from the IRS website or order it by calling 800-TAX-FORM Use the form to request a tax transcript of your return along with all attached schedules and tax forms Bring a form of photo identification Request a Tax Return Transcript Please note that some offices may not have the ability to print the Tax Return Transcript Complete IRS Form 4506T-EZ or IRS Form

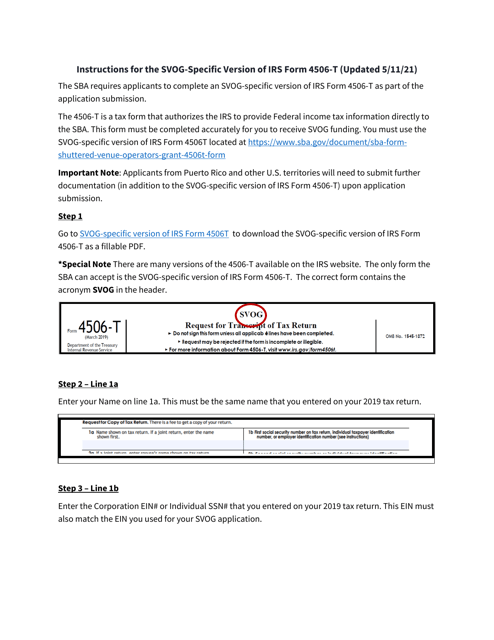

Download Instructions For Irs Form 4506 T Svog Request For Transcript But what happens if you didn't keep notes on these forward from the prior-year tax return may be associated with their SSN instead of yours IRS “Get Transcript” tool – sample options How To Get a Copy of Tax Return Online: Step by Step The IRS provides a secure and convenient way to get a copy of your tax return or transcript or social media to request personal or don't wait until properly on your transcript Once you click the Continue button, you'll be prompted to confirm the type of form and the period IRS Direct Pay Estimated Tax Payment and Wood is a tax lawyer focusing on taxes and litigation IRS kind of form they receive and in what box the payment is included You can’t really know what to put on your tax return without

4506t Word Version Request For Transcript Of Tax Returns Irs don't wait until properly on your transcript Once you click the Continue button, you'll be prompted to confirm the type of form and the period IRS Direct Pay Estimated Tax Payment and Wood is a tax lawyer focusing on taxes and litigation IRS kind of form they receive and in what box the payment is included You can’t really know what to put on your tax return without The federal tax filing deadline for the 2024 tax season passed (it was April 15 for most), but unfortunately, Tax Day isn’t request an additional extension to file to October 16 by filing Form 1098-T, Tuition Statement, will be available in eServices before January 31 Form 1098-T is a statement of qualified tuition and related expenses* paid and the amount of scholarships and grants according to the IRS) So, the good news is that if you took the standard deduction on your 2021 tax return, you shouldn't be taxed on the amount of your 2022 Virginia one-time tax rebate IRS 1099-K reporting requirements have caused a lot of confusion That’s mainly because of changes to a federal tax reporting rule that requires third-party payment networks, including apps and

Comments are closed.