Infographic What Is Title Insurance And Why Is It Needed Capital

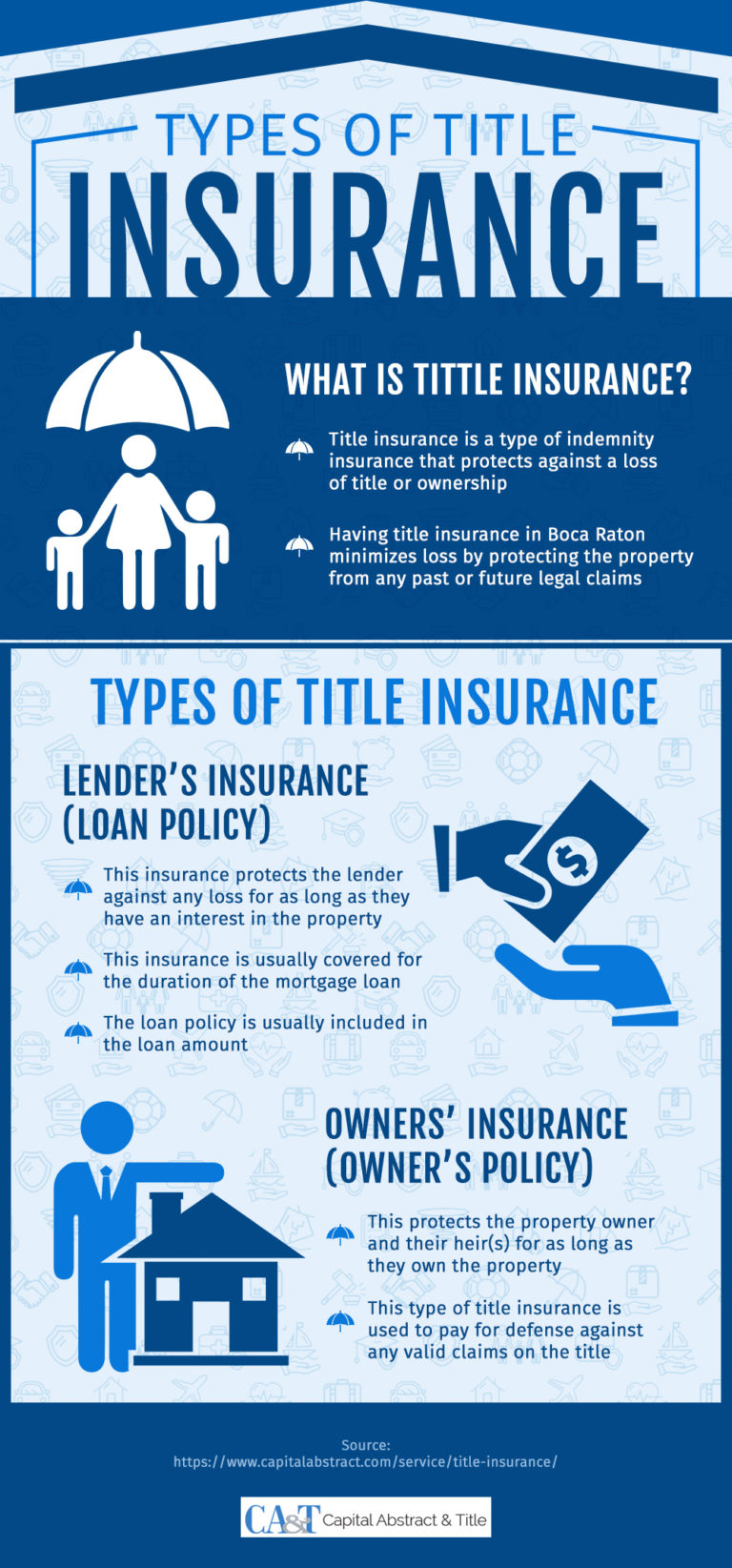

Infographic What Is Title Insurance And Why Is It Needed Capital The infographic below looks at title insurance and the different types that are available in the market to protect property owners against loss of title or ownership. title insurance is a kind of indemnity that safeguards ownership rights or title of a property. two main types of title insurance are lender’s insurance and owner’s insurance. This infographic titled ‘what is title insurance’ explains the meaning, scope, and benefits of a title insurance. title insurance is a type of indemnity insurance that protects against the loss of title or ownership of a property due to a past claim or fault in the original property deed. it minimizes the holder’s loss from … continue reading "infographic : title insurance — scope.

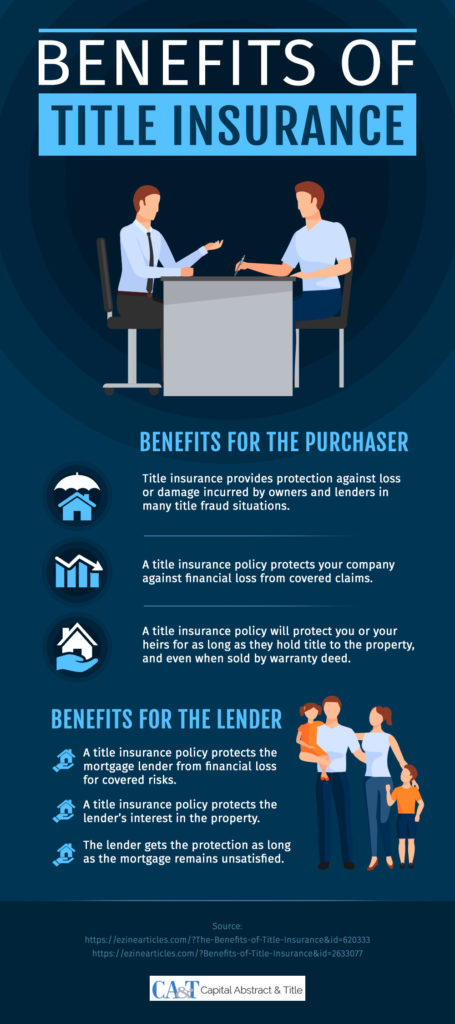

Title Insurance Why A Home Buyer Needs It Infographic Title The cost of title insurance varies depending on the property’s value, the province you live in, and the insurance provider. on average, title insurance premiums range from $250 to $400. while this is a one time fee, it provides coverage for as long as you, your spouse, or (with some policies) heirs own the property. Title insurance is paid for via a one time fee, or premium, that provides coverage for as long as you own the property. generally speaking, title insurance covers you in the event of: title fraud. Title insurance is a policy that covers third party claims on a property that don’t show up in the initial title search and arise after a real estate closing. a third party is someone other than. Lender's title insurance secures their financial interest in the property up to the registered amount of the mortgage, protecting them from risks that include title defects, mortgage unenforceability and losses due to title fraud. always check your closing documents to make sure your property has title insurance for both you and your lender.

How Much Does Title Insurance Cost Rocket Mortgage Title insurance is a policy that covers third party claims on a property that don’t show up in the initial title search and arise after a real estate closing. a third party is someone other than. Lender's title insurance secures their financial interest in the property up to the registered amount of the mortgage, protecting them from risks that include title defects, mortgage unenforceability and losses due to title fraud. always check your closing documents to make sure your property has title insurance for both you and your lender. That said, it can run you as little as $250. and a bonus is that you only pay the premium once: title insurance is a one time fee, and it’s valid for the entire time you own your property. another advantage of title insurance is that you can pass it on to your spouse, heirs, or children. this can save a lot of time, money, and headaches for. Title insurance is a policy that covers mortgage lenders or homeowners against losses related to the title, or ownership of the property. say, for instance, you buy a home and there's a hidden.

Infographic Why You Should Buy Title Insurance Capital Abstract Tit That said, it can run you as little as $250. and a bonus is that you only pay the premium once: title insurance is a one time fee, and it’s valid for the entire time you own your property. another advantage of title insurance is that you can pass it on to your spouse, heirs, or children. this can save a lot of time, money, and headaches for. Title insurance is a policy that covers mortgage lenders or homeowners against losses related to the title, or ownership of the property. say, for instance, you buy a home and there's a hidden.

Comments are closed.