Income Tax Accounting Fall 2024 Chapter 4 Lo 4 8 Educator Expenses

Educator Expenses Deduction 2024 Van Lilian Income tax accounting, fall 2024, chapter 4, lo 4 8, educator expenses. Chapter 4, deduction for educator expenses.

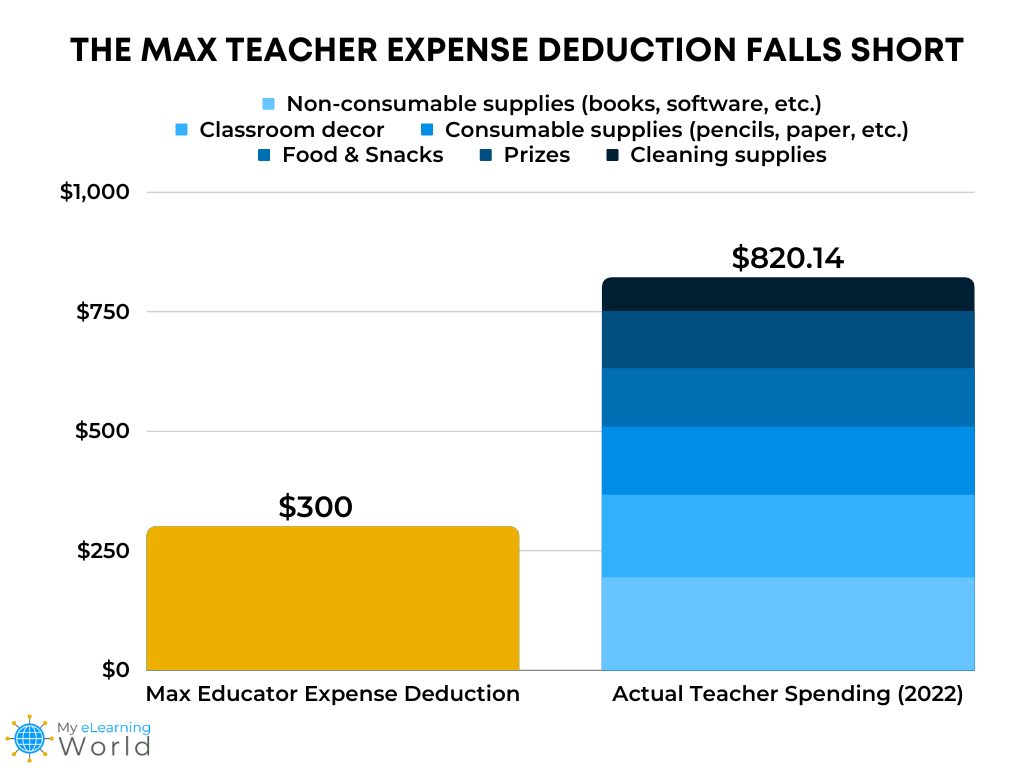

Income Tax Calculator 2024 Excel Image To U For the upcoming tax season (i.e., the 2024 tax year, returns filed in early 2025), the maximum educator expense deduction is $300. if you are an eligible educator (more on that later), you can. Refunds received after 2023 but before your income tax return is filed. if anyone receives a refund after 2023 of qualified education expenses paid on behalf of a student in 2023 and the refund is paid before you file an income tax return for 2023, the amount of qualified education expenses for 2023 is reduced by the amount of the refund. The content specific to low income housing credits previously included in tx 3.3.6 chapter 13: income tax accounting for foreign currency effects—updated march. Expenses the taxpayer incurred while purchasing educational items as a professional working in primary or secondary schools can be entered on screen 4: line 11 in drake21 and future. this amount was limited to $250 each for the taxpayer and spouse in 2021 and prior. the limit is adjusted to $300 each for taxpayer and spouse starting in 2022.

025518641 Income Tax Chapter 4 Income Tax Schemes Accountingо The content specific to low income housing credits previously included in tx 3.3.6 chapter 13: income tax accounting for foreign currency effects—updated march. Expenses the taxpayer incurred while purchasing educational items as a professional working in primary or secondary schools can be entered on screen 4: line 11 in drake21 and future. this amount was limited to $250 each for the taxpayer and spouse in 2021 and prior. the limit is adjusted to $300 each for taxpayer and spouse starting in 2022. Apply. see maximum depreciation deduction in chapter 5. what’s new for 2024. section 179 deduction dollar limits. for tax years be ginning in 2024, the maximum section 179 expense de duction is $1,220,000. this limit is reduced by the amount by which the cost of section 179 property placed in serv ice during the tax year exceeds $3,050,000. The essential accounting for income taxes is to recognize tax liabilities for estimated income taxes payable, and determine the tax expense for the current period. before delving further into the income taxes topic, we must clarify several concepts that are essential to understanding the related income tax accounting. the concepts are noted below.

Comments are closed.