If You Analyze Markets Visualcapitalist Com

Using Our Visualizations Visual Capitalist In 1964, the average tenure of a company on the s&p 500 was 33 years, but this is projected to fall to an average of just 12 years by the year 2027 according to consulting firm innosight. at this churn rate, it’s expected that 50% of the s&p 500 could turnover between 2018 2027. for established companies, this is a sign of the times. Wanted to make a quick video on a new website i came across called visualcapitalist.com, which has infographics, data visualizations, and other helpful metri.

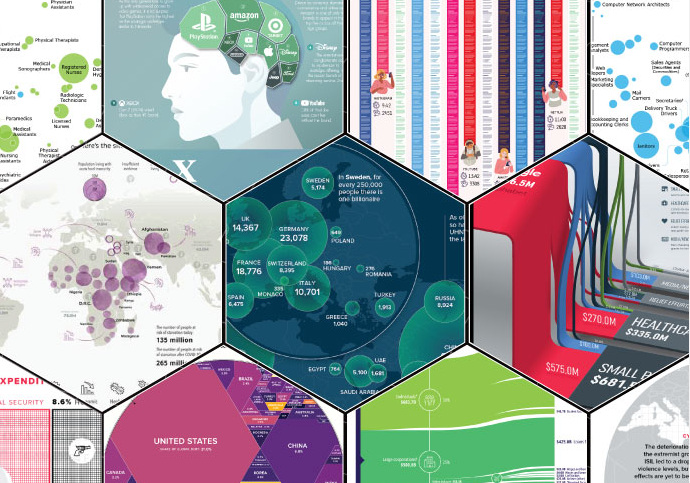

Visual Capitalist On Twitter Special Feature These 6 Powerful Join the 375,000 subscribers who receive our daily email *. rich visual content for the modern investor. visual capitalist is a new way to discover business opportunities and learn about investment trends. Introducing the $100 billion square. in the above data visualization, we even the playing field by using a common denominator to put the world’s money and markets all on the same scale and canvas. in fact, the entire annual gdp of cuba could fit in one square ($97 billion), and the greek economy would be roughly two squares ($203 billion). The last time the u.s. labor market was this strong was in 1969. unemployment fell to 3.3%, incomes were soaring to historic levels, and inflation was rising at a fast clip. like today, the federal reserve was tightening monetary policy to stifle inflation. yet much of the wage increases were washed out by rising consumer prices. In between those benchmarks is the total of the world’s money, depending on how it is defined. this includes the global supply of all coinage and banknotes ($5 trillion), the above ground gold supply ($7.8 trillion), the narrow money supply ($28.6 trillion), and the broad money supply ($80.9 trillion). all figures are in the equivalent of us.

Subscribe To Visual Capitalist For Free 100t World Economy Visual The last time the u.s. labor market was this strong was in 1969. unemployment fell to 3.3%, incomes were soaring to historic levels, and inflation was rising at a fast clip. like today, the federal reserve was tightening monetary policy to stifle inflation. yet much of the wage increases were washed out by rising consumer prices. In between those benchmarks is the total of the world’s money, depending on how it is defined. this includes the global supply of all coinage and banknotes ($5 trillion), the above ground gold supply ($7.8 trillion), the narrow money supply ($28.6 trillion), and the broad money supply ($80.9 trillion). all figures are in the equivalent of us. 2.7%. 2.3%. note: the oecd and imf measure inflation with the consumer price index (cpi), whereas the u.s. federal reserve measures inflation using personal consumer expenditures (pce). to combat inflation, the federal reserve is looking to raise interest rates. this encourages people to spend less and save more. Deflation. deflation is the fall in prices of goods and services in the economy. in many cases, its main causes are demand shortfalls, reduced output, or an excess of supply. for households, spending may stall as consumers wait for prices to fall. in turn, declining prices may lead to a lag in growth for businesses.

Comments are closed.