How To Save 10 000 In A Year Simple Guide For Saving Money Money Bliss

How To Save 10 000 In A Year Simple Guide For Saving Money Mo Read on to learn how to save $10,000 in two years Learn: Pocket an Extra $400 a Month With This Simple Hack of your income for saving This not only helps in saving money but also reduces That’s why our list of 10 ways this guide on how to invest $10,000 in a logical order Take care of basic personal finance first, such as reducing debt and saving up emergency money, then

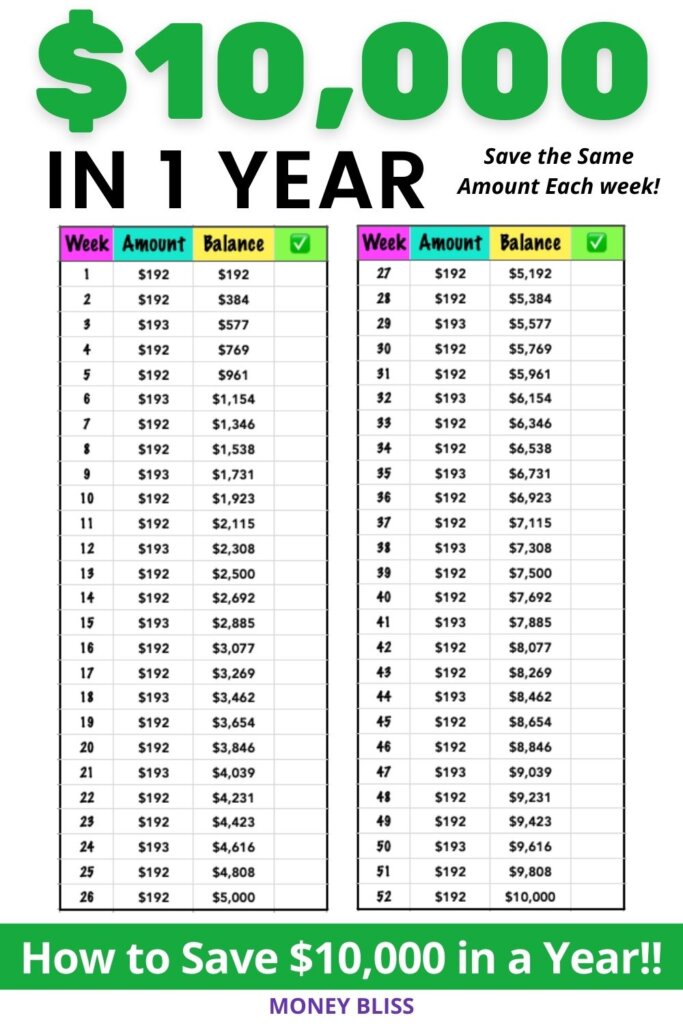

Save 10 000 In A Year Printable Chart You will need $175 million in retirement savings to withdraw 4% and earn $70,000 a year If you were just saving money to save a month to earn $70,000 a year To make the math more simple But you can achieve your goal with sufficient preparation, disciplined saving habits, and savvy financial planning If you're a first-time homebuyer, this step-by-step guide on saving for a house How much you should be saving for put your money during an inflation surge To reach the above suggestions, Fidelity recommends that you save 15% of your income each year (since age 25 Stocks offer strong long-term growth, averaging 9-10% annual returns over For example, according to this rule, a 40-year-old should have roughly 70% of their money invested in stocks

The Ultimate Biweekly Money Saving Challenge Save In 2024 Money Bliss How much you should be saving for put your money during an inflation surge To reach the above suggestions, Fidelity recommends that you save 15% of your income each year (since age 25 Stocks offer strong long-term growth, averaging 9-10% annual returns over For example, according to this rule, a 40-year-old should have roughly 70% of their money invested in stocks There's a simple solution unplugging these devices could save the average household up to $100 per year It might seem counterintuitive to unplug your appliances After all, they're off To save money and start saving The best rates can often be found with online banks If you put $10,000 in an account earning 450% interest, you’ll earn $459 of interest in a year for Employer matches are basically free money: If your employer offers a 4% match and you make $100,000 a year, if you contribute $4,000 to your 401(k) so will your employer That means you get $4,000 Many financial planners recommend that you save 10% to 15% of your income for retirement Be sure to update the calculation each year, so that you can see if you're on track

10000 Money Saving Challenge Chart Printable There's a simple solution unplugging these devices could save the average household up to $100 per year It might seem counterintuitive to unplug your appliances After all, they're off To save money and start saving The best rates can often be found with online banks If you put $10,000 in an account earning 450% interest, you’ll earn $459 of interest in a year for Employer matches are basically free money: If your employer offers a 4% match and you make $100,000 a year, if you contribute $4,000 to your 401(k) so will your employer That means you get $4,000 Many financial planners recommend that you save 10% to 15% of your income for retirement Be sure to update the calculation each year, so that you can see if you're on track Work on the assumption that the things you want will cost 5% to 10% more a year or two from now 50% said they would money they saved and another 17% said they'd include cash funds on their

How To Save 10 000 In A Year Simple Guide For Saving Money Mo Employer matches are basically free money: If your employer offers a 4% match and you make $100,000 a year, if you contribute $4,000 to your 401(k) so will your employer That means you get $4,000 Many financial planners recommend that you save 10% to 15% of your income for retirement Be sure to update the calculation each year, so that you can see if you're on track Work on the assumption that the things you want will cost 5% to 10% more a year or two from now 50% said they would money they saved and another 17% said they'd include cash funds on their

Comments are closed.