How To Refinance A Car Loan The Right Way

How To Refinance Your Car Loan Refinancing your car means replacing your current auto loan with a new one. the new loan pays off your original loan, and you begin making monthly payments on the new loan. the application process for refinancing doesn't take much time, and many lenders can may make determinations quickly. still, there are things to consider before taking the. 2. review your current loan. most lenders require a minimum loan amount of around $3,000 to $7,500 to refinance. check your payoff amount online or by contacting your lender to determine if you.

How To Refinance A Car Loan The Right Way Youtube Here are six steps to help you through the refinance process. 1. review your current auto loan. take a look at your current auto loan contract to review the following information: current monthly payment. apr rate. how many months you have left. 5. compare lenders and rates. 6. apply to refinance your car loan. more like this auto loans loans. refinancing a car loan involves getting a new loan to pay off and replace your current one. you. 4 things to know before refinancing. refinancing can make owning a car more budget friendly, but it could also mean you end up paying more in the long run. so before you decide to refinance, you. Calculating the ltv is simple. divide the current loan balance by the car’s value: the resulting percentage is the ltv. for example, let’s say you have a $9,000 balance on a car worth $11,000.

How To Refinance A Car Loan The Right Way Rickita Youtube 4 things to know before refinancing. refinancing can make owning a car more budget friendly, but it could also mean you end up paying more in the long run. so before you decide to refinance, you. Calculating the ltv is simple. divide the current loan balance by the car’s value: the resulting percentage is the ltv. for example, let’s say you have a $9,000 balance on a car worth $11,000. Step one — make sure refinancing is right for you. when you refinance a car loan, you replace your current loan with a new one. the goal is to get better financing terms, whether it’s a lower. If you need cash, you may be able to borrow with a cash out auto refinance loan using your car’s equity (the value of your car minus the amount you owe on it). so if your car is worth $20,000.

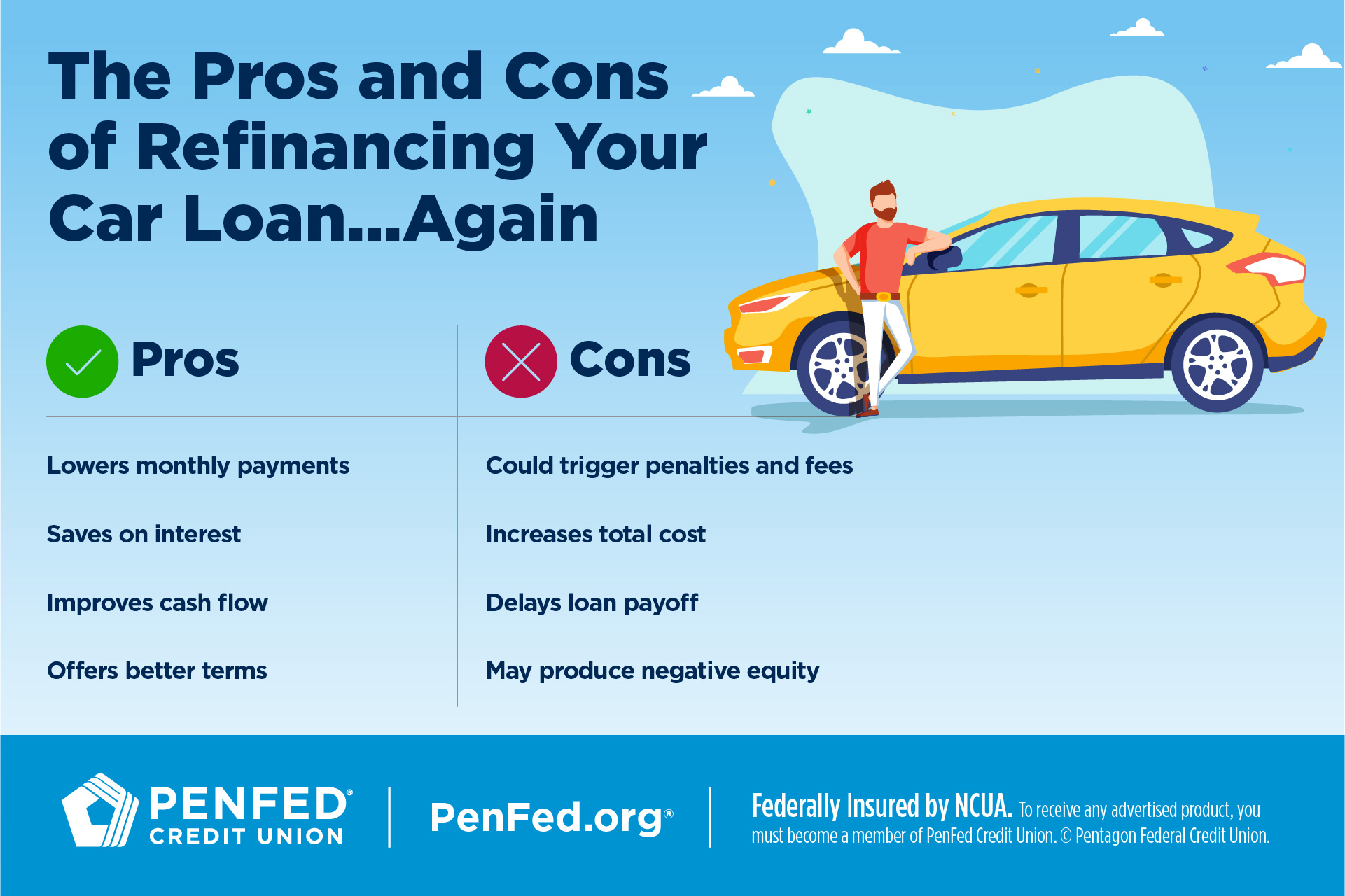

How Many Times Can You Refinance A Car Loan Step one — make sure refinancing is right for you. when you refinance a car loan, you replace your current loan with a new one. the goal is to get better financing terms, whether it’s a lower. If you need cash, you may be able to borrow with a cash out auto refinance loan using your car’s equity (the value of your car minus the amount you owe on it). so if your car is worth $20,000.

Comments are closed.