How To Protect Your Business From Buy Now Pay Later Fraud Fraud

Buy Now Pay Later Fraud How It Works How To Prevent It Outseer Buy now pay later fraud. [noun] bī • nou • pā • lā • tər • frôd . buy now pay later fraud, or bnpl fraud, refers to any fraudulent activity in the “buy now pay later” space. in other words, it’s a scam by which a fraudster abuses a bnpl payment option to conduct a payment fraud attack. bnpl fraud incidents could cover a. Buy now, pay later fraud is on the rise, with fraudsters deploying ever more ingenious ways to take advantage of businesses and consumers. to fight it, you need to know how it works. below, we explain the different types of bnpl fraud you need to be on the lookout for, which party is liable for the loss when it occurs, and we give you our top.

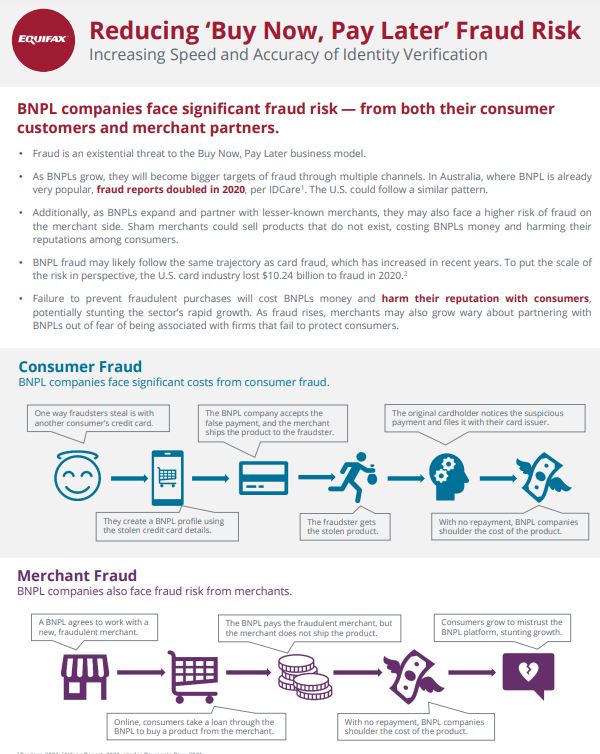

Reducing Buy Now Pay Later Fraud Risks February 27, 2023. “buy now pay later” offers are extremely enticing to customers, as it allows them to gain access to goods and services without having to pay the full cost upfront. it’s no surprise that retailers want to leverage these offers to attract more business and keep customers happy. . The motley fool: study: buy now, pay later services continue explosive growth; help net security: how buy now, pay later is being targeted by fraudsters; emarketer: bnpl is the latest fraud target—and providers should act quickly to avoid losses; globenewswire: buy now pay later market size to hit us$ 3268.26 bn by 2030. If your business offers bnpl payment options as a retailer or bnpl company – or if you play a role in the bnpl ecosystem as a marketer, collector, etc. – remember that basic consumer protection ground rules of the ftc act apply. in conducting a bnpl compliance check at your company, here are three key principles to keep in mind. The number of complaints involving the buy now pay later payment method has doubled to a record number in 2020, and it will continue to grow as long as more businesses implement it. fraud prevention is no longer an option; if you want to protect your business and its customers, you need to take steps in the right direction. 1.

Buy Now Pay Later Fraud What It Is How To Prevent It Blog Unit21 If your business offers bnpl payment options as a retailer or bnpl company – or if you play a role in the bnpl ecosystem as a marketer, collector, etc. – remember that basic consumer protection ground rules of the ftc act apply. in conducting a bnpl compliance check at your company, here are three key principles to keep in mind. The number of complaints involving the buy now pay later payment method has doubled to a record number in 2020, and it will continue to grow as long as more businesses implement it. fraud prevention is no longer an option; if you want to protect your business and its customers, you need to take steps in the right direction. 1. Types of buy now pay later (bnpl) fraud. identity theft. fraudsters often use stolen identities of good consumers to open new bnpl accounts. account takeover. account takeover (ato) is even more insidious as it involves hijacking an existing account with its established access to credit and using that line of credit to purchase goods and services. No less important, customer experience must not be affected. managing the risk of buy now, pay later fraud requires a holistic approach to online fraud prevention. you need an advanced bot management solution that not only excels at detecting and mitigating automated fraud, but also helps fraud teams prevent fraudulent activity on user accounts.

Buy Now Pay Later Fraud Bnpl Prevention Risks Seon Types of buy now pay later (bnpl) fraud. identity theft. fraudsters often use stolen identities of good consumers to open new bnpl accounts. account takeover. account takeover (ato) is even more insidious as it involves hijacking an existing account with its established access to credit and using that line of credit to purchase goods and services. No less important, customer experience must not be affected. managing the risk of buy now, pay later fraud requires a holistic approach to online fraud prevention. you need an advanced bot management solution that not only excels at detecting and mitigating automated fraud, but also helps fraud teams prevent fraudulent activity on user accounts.

Buy Now Pay Later Fraud How It Works How To Prevent It Outseerв

Comments are closed.