How To Do Fundamental Analysis Examples Stepwise Guide

How To Do Fundamental Analysis Examples Stepwise Guide 1. debt to equity ratio. it is one of the prominent ratios in fundamental analysis and is often referred to as the risk ratio. the debt to equity ratio calculates the weight of a company’s total debt against total shareholders’ liabilities. it is calculated as. debt to equity ratio = total debt shareholders’ equity. This strategy for stock analysis is viewed as a specialized study, which gauges costs by analyzing chronicled market information like cost and volume. in this article, we will discuss the main concepts of fundamental analysis, a stepwise guide on how to do fundamental analysis, its uses, tools, how it helps in investing, examples, faqs, and a.

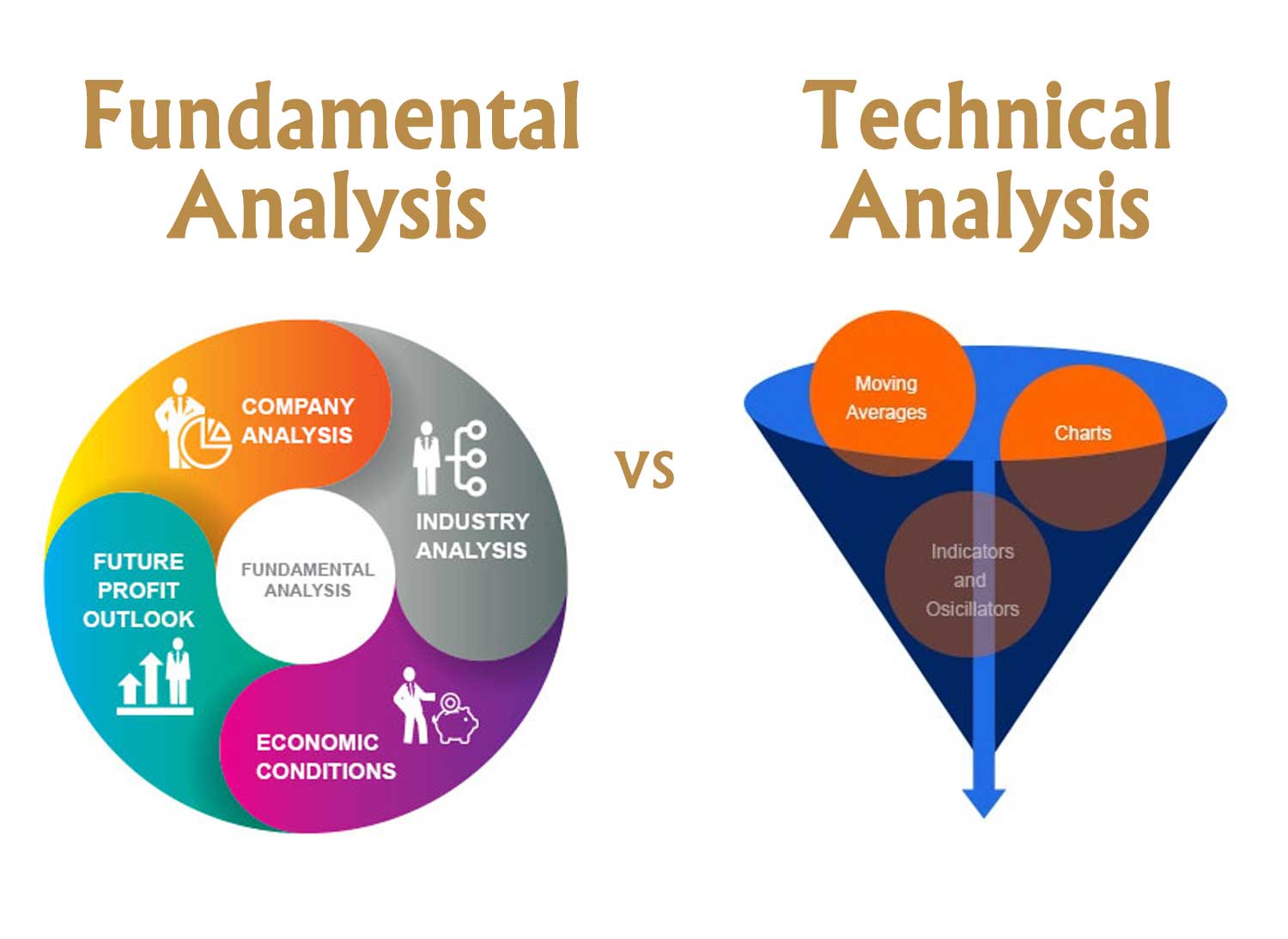

What Is Fundamental And Technical Analysis вђ Stock Phoenix Ultimate step by step guide: fundamental stock analysis. 7 21 2023. i have excellent news: fundamental investing is arguably one of the easiest ways to invest. investing is stressful and hard when you worry about the stock price. because the price keeps moving up and down, you can literally see the value of your investment every minute, and. The bottom line. fundamental analysis is used to value a company and determine whether a stock is over or undervalued by the market. it considers the economic, market, sector specific, and. Fundamental analysis definition. fundamental analysis (fa) is a method that helps to determine whether an asset or a security is trading at a discount or its premium compared to its fair value. it is most often applied to stocks, and other markets, including bonds, currencies, commodities, or even cryptocurrency. Fundamental analysis examples. the disintegration of the auto giant general motors stocks in 2009 is one of the glaring examples of the risks of ignoring fundamental analysis. unfortunately, investors who missed the fundamentals bore the brunt of the massive collapse of the gm stock that led to gm filing bankruptcy protection.

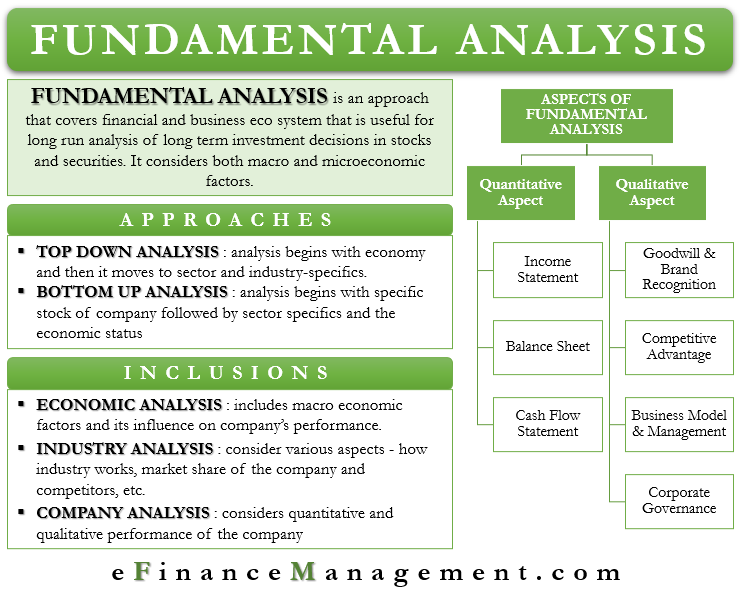

Fundamental Analysis Brief Guide On Approach Tools Pros Cons Efm Fundamental analysis definition. fundamental analysis (fa) is a method that helps to determine whether an asset or a security is trading at a discount or its premium compared to its fair value. it is most often applied to stocks, and other markets, including bonds, currencies, commodities, or even cryptocurrency. Fundamental analysis examples. the disintegration of the auto giant general motors stocks in 2009 is one of the glaring examples of the risks of ignoring fundamental analysis. unfortunately, investors who missed the fundamentals bore the brunt of the massive collapse of the gm stock that led to gm filing bankruptcy protection. Key takeaways: perform fundamental analysis to evaluate the financial health and future prospects of a company. start by examining the company’s income statement, balance sheet, and cash flow statement. use financial ratios like price to earnings (p e), return on equity (roe), and debt to equity (d e) to assess the company’s profitability. Here’s the formula for calculating the d e ratio: (total liabilities shareholders’ equity) for example, let’s compute the debt to equity ratio of infosys ltd. for the year ending 2023 as per the data available on yahoo finance. total debt = 1,010,000. shares issued = 4,148,560.

How To Do Fundamental Analysis Examples Stepwise Guide Key takeaways: perform fundamental analysis to evaluate the financial health and future prospects of a company. start by examining the company’s income statement, balance sheet, and cash flow statement. use financial ratios like price to earnings (p e), return on equity (roe), and debt to equity (d e) to assess the company’s profitability. Here’s the formula for calculating the d e ratio: (total liabilities shareholders’ equity) for example, let’s compute the debt to equity ratio of infosys ltd. for the year ending 2023 as per the data available on yahoo finance. total debt = 1,010,000. shares issued = 4,148,560.

Comments are closed.