How To Deduct Business Meals In 2023 Ultimate Guide

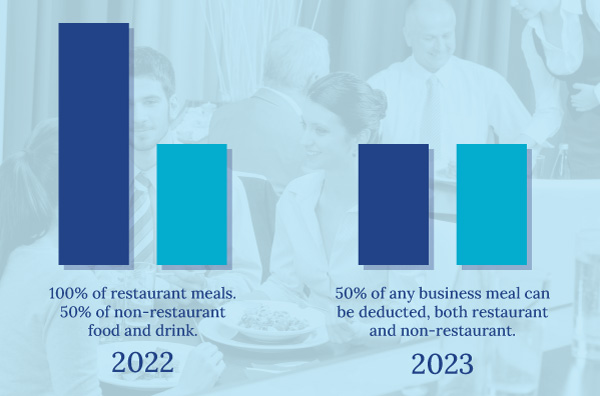

How To Deduct Business Meals In 2023 Ultimate Guide The 2017 tax cuts and jobs act has left some folks confused about the rules of deducting business meals. the truth is, there are no new restrictions on business meals. what got cut was client entertainment expenses — think concert tickets, or a round of golf. meals are still tax deductible. (50% of their cost can be deducted.). On the other hand, if you go out for a meal with a client with no business purpose, the meal is not deductible. to add to the confusion, meals were 100% deductible in 2021 and 2022.

How To Deduct Business Meals In 2023 Youtube For 2023, you received one credit, up to a maximum of four credits, for each $1,640 ($1,730 for 2024) of income subject to social security tax. therefore, for 2023, if you had income (self employment and wages) of $6,560 that was subject to social security tax, you received four credits ($6,560 ÷ $1,640). Temporary deduction of 100% business meals. the 100% deduction on certain business meals expenses as amended under the taxpayer certainty and disaster tax relief act of 2020, and enacted by the consolidated appropriations act, 2021, has expired. generally, the cost of business meals remains deductible, subject to the 50% limitation. The entertainment and meals tax deduction has been a great way for successful business owners or self employed people to maximize their tax deductions yearly. unfortunately, the trump tax plan cut. To be eligible, a business owner or employee must be traveling away from home for business. in 2023, the meal per diem is $74 a day for high cost areas in the continental united states and $64 a day for lower cost areas. tonneson co can help. many lucrative and long lasting business relationships are nurtured over personal interactions that.

Meals Entertainment Deduction 2023 5 Must Know Tips Flyfin The entertainment and meals tax deduction has been a great way for successful business owners or self employed people to maximize their tax deductions yearly. unfortunately, the trump tax plan cut. To be eligible, a business owner or employee must be traveling away from home for business. in 2023, the meal per diem is $74 a day for high cost areas in the continental united states and $64 a day for lower cost areas. tonneson co can help. many lucrative and long lasting business relationships are nurtured over personal interactions that. Food and beverages were 100% deductible if purchased from a restaurant in 2021 and 2022. but for purchases made in 2023 onwards, the rules revert back to how they were defined in the tax cuts and jobs act. this means purchases at restaurants are no longer 100% deductible. here’s a breakdown of meal deductions using examples:. On. october 23, 2023. in the bustling world of business, meals and entertainment expenses are a common occurrence. however, understanding the tax deductions associated with these expenses is crucial for business owners. this comprehensive guide aims to illuminate the intricacies of meal and entertainment deductions in 2023, equipping business.

Deducting Business Meals And Entertainment In 2023 Tremonte Financial Food and beverages were 100% deductible if purchased from a restaurant in 2021 and 2022. but for purchases made in 2023 onwards, the rules revert back to how they were defined in the tax cuts and jobs act. this means purchases at restaurants are no longer 100% deductible. here’s a breakdown of meal deductions using examples:. On. october 23, 2023. in the bustling world of business, meals and entertainment expenses are a common occurrence. however, understanding the tax deductions associated with these expenses is crucial for business owners. this comprehensive guide aims to illuminate the intricacies of meal and entertainment deductions in 2023, equipping business.

Comments are closed.