How To Calculate Compound Interest Palenciaskafest

How To Calculate Compound Interest Palenciaskafest Compound interest formula with examples by alastair hazell. reviewed by chris hindle compound interest, or 'interest on interest', is calculated using the compound interest formula a = p*(1 r n)^(nt), where p is the principal balance, r is the interest rate (as a decimal), n represents the number of times interest is compounded per year and t is the number of years. To calculate compound interest is necessary to use the compound interest formula, which will show the fv future value of investment (or future balance): fv = p × (1 (r m)) (m × t) this formula takes into consideration the initial balance p , the annual interest rate r , the compounding frequency m , and the number of years t .

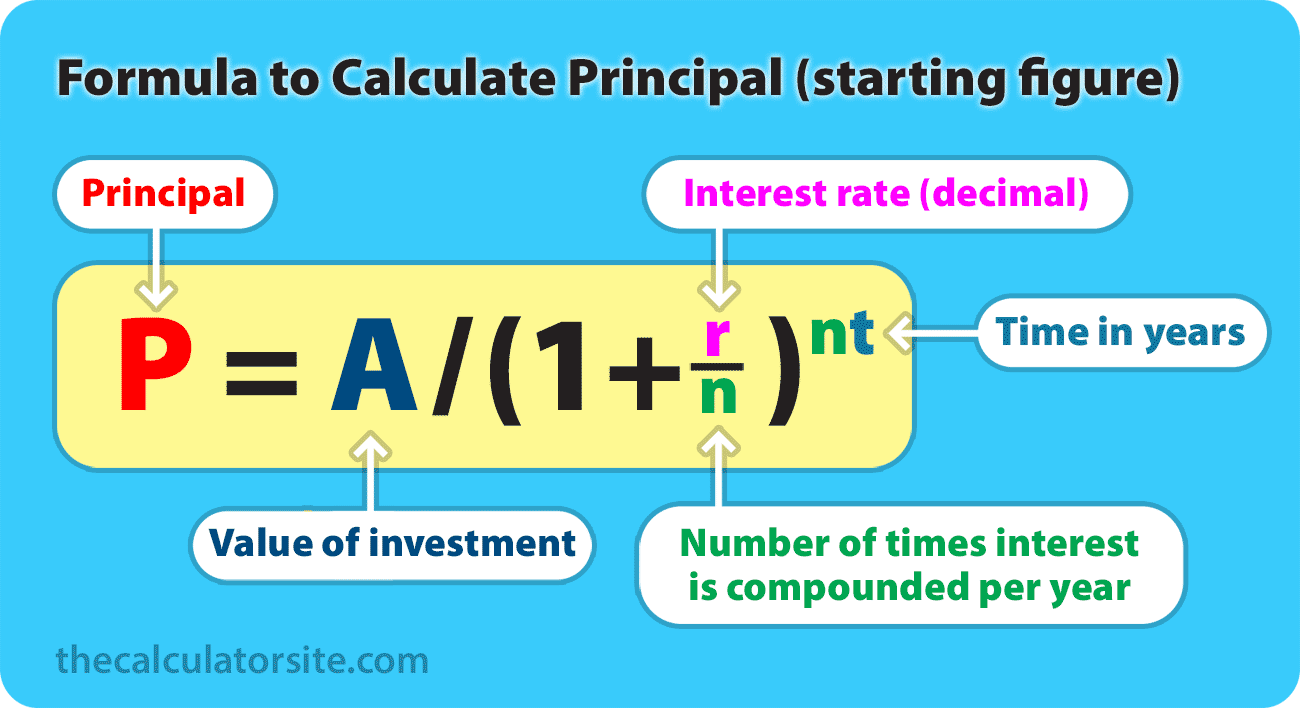

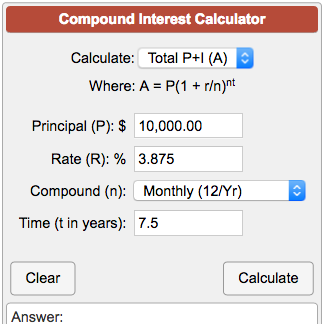

How To Calculate Compound Interest Palenciaskafest Use the formula a=p (1 r n)^nt. for example, say you deposit $5,000 in a savings account that earns a 5% annual interest rate and compounds monthly. you would calculate a = $5,000 (1 0.00416667. The compound interest formula. this calculator uses the compound interest formula to find principal plus interest. it uses this same formula to solve for principal, rate or time given the other known values. you can also use this formula to set up a compound interest calculator in excel ®1. a = p(1 r n) nt. in the formula. The basic formula for compound interest is as follows: a t = a 0 (1 r) n. where: a 0 : principal amount, or initial investment. a t : amount after time t. r : interest rate. n : number of compounding periods, usually expressed in years. in the following example, a depositor opens a $1,000 savings account. Now, to help you understand the concept of compound interest even more, let's have a quick review of the parameters you need to provide to this compound interest rate calculator: initial balance the amount of money at the beginning of the specific term that constitutes the principal amount or, in other words, the present value (pv) of investment;.

How To Calculate Compound Interest Palenciaskafest The basic formula for compound interest is as follows: a t = a 0 (1 r) n. where: a 0 : principal amount, or initial investment. a t : amount after time t. r : interest rate. n : number of compounding periods, usually expressed in years. in the following example, a depositor opens a $1,000 savings account. Now, to help you understand the concept of compound interest even more, let's have a quick review of the parameters you need to provide to this compound interest rate calculator: initial balance the amount of money at the beginning of the specific term that constitutes the principal amount or, in other words, the present value (pv) of investment;. The formula for compound interest is as follows: a = p (1 r ⁄ n ) nt. p = initial principal (e.g. your deposit, initial balance, “current amount saved”) r = interest rate offered by the savings account. n = number of times the money is compounded per year (e.g. annually, monthly) t = number of time periods elapsed how long you plan to save. The rule of 72 helps you estimate the number of years it will take to double your money. the method is simple just divide the number 72 by your annual interest rate. we use a version of the rule of 72 in our calculator. for example, let's say you're earning 3% per annum. divide 72 by 3, which will give you 24.

How To Calculate Compound Interest Palenciaskafest The formula for compound interest is as follows: a = p (1 r ⁄ n ) nt. p = initial principal (e.g. your deposit, initial balance, “current amount saved”) r = interest rate offered by the savings account. n = number of times the money is compounded per year (e.g. annually, monthly) t = number of time periods elapsed how long you plan to save. The rule of 72 helps you estimate the number of years it will take to double your money. the method is simple just divide the number 72 by your annual interest rate. we use a version of the rule of 72 in our calculator. for example, let's say you're earning 3% per annum. divide 72 by 3, which will give you 24.

Comments are closed.