How To Be Wealthy By Age Can You Catch Up

How To Be Wealthy By Age Can You Catch Up Episode Money Guy Learn more about how to be wealthy, mistakes to avoid, and exactly what a little extra saving can do for your retirement income. in this episode, you’ll learn: how to meet your retirement goals by age; how to avoid the common financial traps; how to be wealthy; what you should focus on financially by age; research and resources from this episode:. How to be wealthy by age! (can you catch up?)take your finances to the next level ️ subscribe now: c moneyguyshow?sub confirmation=1.

How To Be Wealthy By Age 2024 Edition Youtube For 2024, you can invest up to $23,000 into your 401(k)—and an extra $7,500 as a "catch up contribution” if you’re age 50 or older. 2 let’s say you woke up at 45 years old with nothing saved for retirement before deciding to max out your 401(k). 1. fully fund your 401 (k) if you're offered a 401 (k) at work, you should consider funding it to the maximum amount. maxing out a 401 (k) can lead to a solid and secure retirement, even if you. To be considered wealthy at age 65 or older, you need a household net worth of $3.2 million, according to finance expert geoffrey schmidt, cpa, who used data from the 2019 survey of consumer finances (scf) to determine the household net worth needed at age 65 or older to determine the various percentiles of wealth in the u.s. So, no matter how much you’re earning right now, by accumulating assets in a roth 401(k), you’ll be able to enjoy tax free withdrawals when you retire. bottom line. catch up contributions can.

How To Become Rich And Save Tons Of Money To be considered wealthy at age 65 or older, you need a household net worth of $3.2 million, according to finance expert geoffrey schmidt, cpa, who used data from the 2019 survey of consumer finances (scf) to determine the household net worth needed at age 65 or older to determine the various percentiles of wealth in the u.s. So, no matter how much you’re earning right now, by accumulating assets in a roth 401(k), you’ll be able to enjoy tax free withdrawals when you retire. bottom line. catch up contributions can. Making a catch up contribution means you contribute between $23,000 and $30,500 to your 401 (k) plan at age 50 or older in 2024. most 401 (k) contributions are deductions from employee paychecks. The bottom line. thanks to the secure 2.0 act, catch up contributions for americans are set to rise to $10,000 by 2025. that boost over the now standard $7,500 catch up contribution amount will only be available to americans who are 60 and are not older than 63. the benefit of catch up contributions cannot be understated.

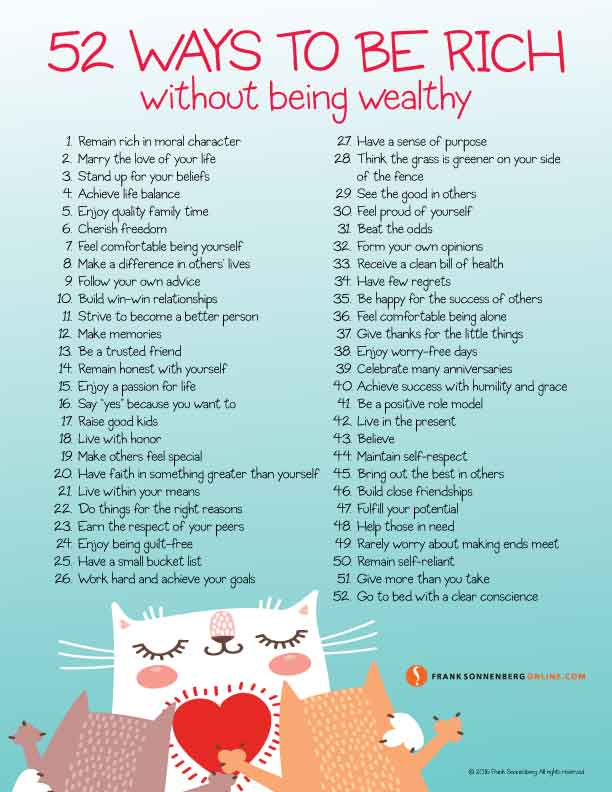

52 Ways To Be Rich Without Being Wealthy Making a catch up contribution means you contribute between $23,000 and $30,500 to your 401 (k) plan at age 50 or older in 2024. most 401 (k) contributions are deductions from employee paychecks. The bottom line. thanks to the secure 2.0 act, catch up contributions for americans are set to rise to $10,000 by 2025. that boost over the now standard $7,500 catch up contribution amount will only be available to americans who are 60 and are not older than 63. the benefit of catch up contributions cannot be understated.

Comments are closed.