How Does Life Insurance Work A Complete Guide For Beginners

How Does Life Insurance Work A Complete Guide For Beginners Youtube The concept of life insurance is actually pretty simple: it is basically a contract between a policyholder and an insurance company or an independent agent. this contract signed between both parties guarantees that the insurer will pay a certain amount of money to a designated beneficiary upon the policyholder’s death. Life insurance is a contract between you and the insurance company. in this contract, you agree to pay a premium (regular payments to the insurer) for a death benefit. a death benefit is a tax.

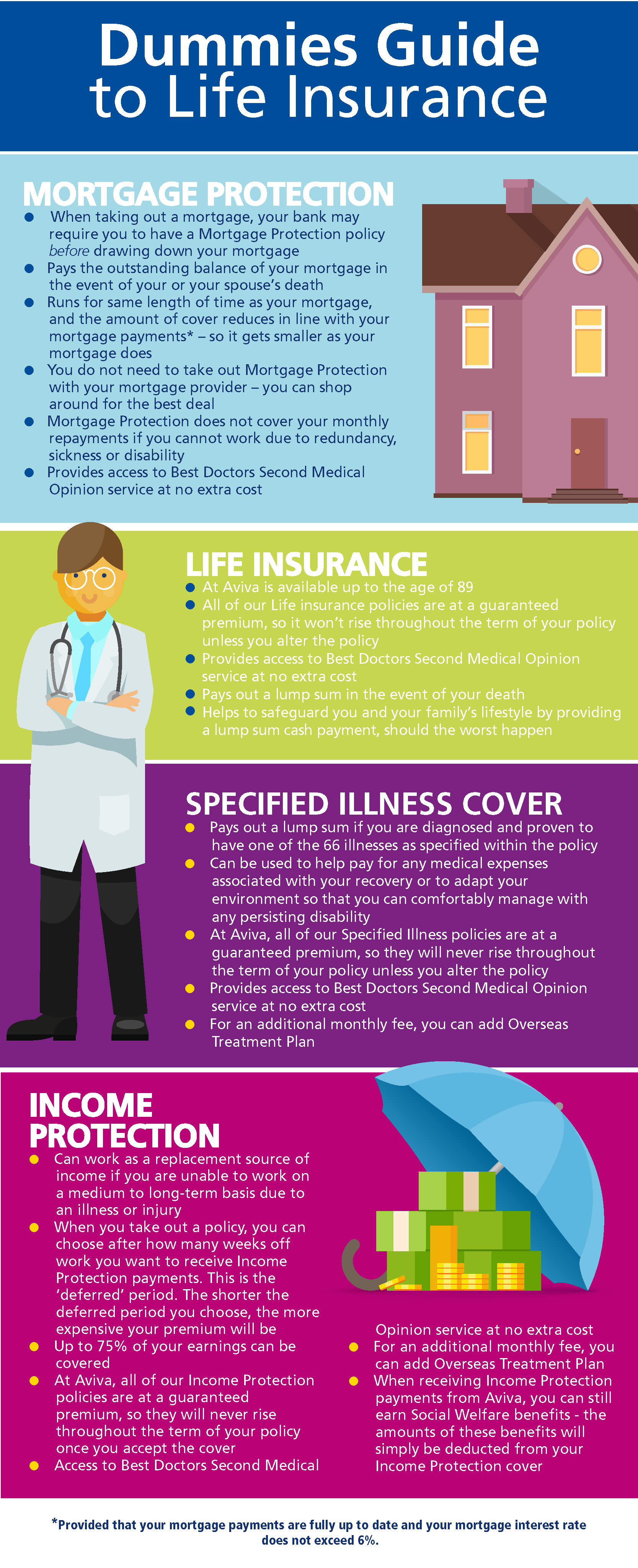

Dummies Guide To Life Insurance Aviva Ireland Coverage is in the form of decreasing term insurance, which means the amount of coverage decreases as the debt decreases. premium — the payment required to keep a life insurance policy in force. rider — an attachment or add on to a life insurance policy that alters the policy’s terms or coverage. Life insurance is a specific type of insurance–one that pays out in the event of your death. you buy life insurance from an insurance company (of course). the payments you make as part of your contract are called “premiums.”. the “death benefit” is the amount of money the policy pays to your “beneficiaries”. The average cost of life insurance is around $27 to $30 per month for a 40 year old individual purchasing a 20 year long, $500,000 term life policy. this is the most common term length and overall amount sold. companies offering life insurance will generally use age as an immediate way of determining a premium. Life insurance is a contract signed with an insurance company wherein the insured person agrees to pay premiums (monthly, quarterly, annually or even a single premium) in exchange for the life insurance company paying out a death benefit to the beneficiaries selected by the insured. also known as: life assurance.

Life Insurance 101 Basics For Beginners The average cost of life insurance is around $27 to $30 per month for a 40 year old individual purchasing a 20 year long, $500,000 term life policy. this is the most common term length and overall amount sold. companies offering life insurance will generally use age as an immediate way of determining a premium. Life insurance is a contract signed with an insurance company wherein the insured person agrees to pay premiums (monthly, quarterly, annually or even a single premium) in exchange for the life insurance company paying out a death benefit to the beneficiaries selected by the insured. also known as: life assurance. 💡get your life insurance sorted today!💡check out life insurance options and receive your quote → dundaslife 💰book a complimentary 30 min. Life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money to one or more named beneficiaries when the insured person dies.

Comments are closed.