How Does Inflation Affect The Price Of Gold

Gold Price Vs Inflation How Is It Affected In The Uk Correspondingly, gold prices climbed from under £500 to over £1,000 per ounce. similar dynamics occurred during the covid 19 pandemic, where massive stimulus packages raised inflation concerns, and annual uk inflation peaked at 5.4% in 2021. during recessions and crises, gold provides stability as fiat currencies weaken. Gold’s track record during high inflation highlights its role as a safe haven asset. from the inflation of the 1970s to the economic challenges of the 2008 financial crisis and the covid 19 pandemic, gold has shown it can preserve value and provide security for investors. in short, to conclude, when inflation rises, so does the price of gold.

Inflation Vs Gold Price Expert Insights On The Impact Gold prices soared in the 1970s era of inflation, but the root causes of inflation are different today. in six of the last eight recessions, gold outperformed the s&p 500 by 37% on average. getty. Inflation can have a major impact on gold prices. the demand for gold tends to increase during times of high inflation as investors seek out safe haven assets. similarly, weakened purchasing power. A rise in inflation or inflationary expectations increases investors’ interest in purchasing gold and, therefore, drives up its price; in contrast, disinflation or a drop in inflationary expectations does the opposite. we will measure the “inflation hedge” motive for holding gold with ptr—which is the mnemonic for the survey based ten. During the early 1980s, annual inflation averaged 6.5%, but gold prices actually dropped by 10% each year. in fact, gold underperformed real estate, commodities, and even the s&p 500 during the period. similarly, from 1988 to 1991, annual inflation was 4.6% on average, but gold averaged an annual drop of 7.6% during the same period.

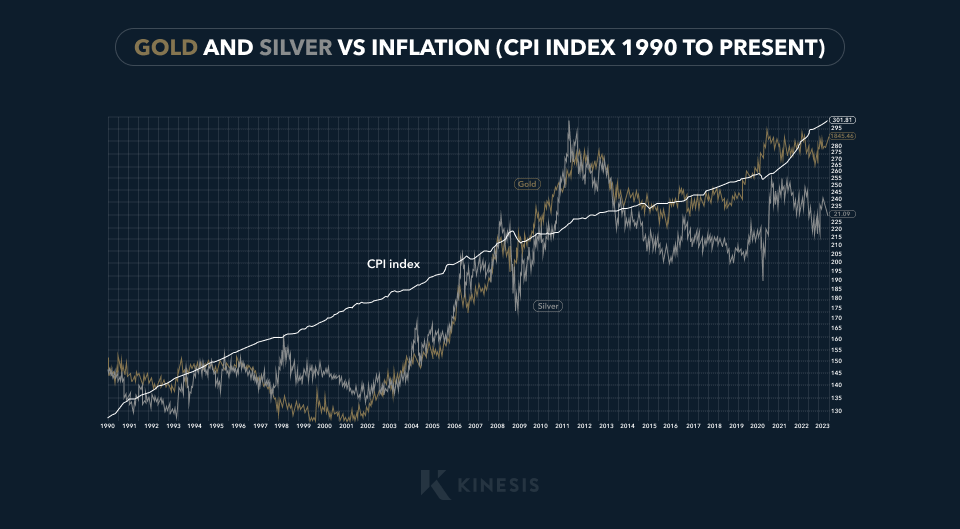

How Does Inflation Affect The Price Of Gold Silver Kinesis A rise in inflation or inflationary expectations increases investors’ interest in purchasing gold and, therefore, drives up its price; in contrast, disinflation or a drop in inflationary expectations does the opposite. we will measure the “inflation hedge” motive for holding gold with ptr—which is the mnemonic for the survey based ten. During the early 1980s, annual inflation averaged 6.5%, but gold prices actually dropped by 10% each year. in fact, gold underperformed real estate, commodities, and even the s&p 500 during the period. similarly, from 1988 to 1991, annual inflation was 4.6% on average, but gold averaged an annual drop of 7.6% during the same period. Real and expected inflation rates also affect the price of the metal. gold purchases by central banks have an impact on the price, as does the demand for gold to be used in jewelry and. Gold prices are affected by inflation, alongside interest rate moves and the value of the u.s. dollar. getty images. after more than a year of steep inflation, prices are finally showing signs of.

How Does Inflation Affect The Price Of Gold Real and expected inflation rates also affect the price of the metal. gold purchases by central banks have an impact on the price, as does the demand for gold to be used in jewelry and. Gold prices are affected by inflation, alongside interest rate moves and the value of the u.s. dollar. getty images. after more than a year of steep inflation, prices are finally showing signs of.

Comments are closed.