How Do 401k Fees Work

Infographic On 401k Plan Fees 401khelpcenter 401 (k) fees can range between 0.5% and 2% or even higher, based on the size of an employer's 401 (k) plan, how many people are participating in the plan, and which provider is offering the plan. A 401(k) plan is a tax advantaged retirement account offered by many employers. how 401(k)s work . introduced in the early 1980s, traditional 401(k) plans allow employees to make pretax.

Self Directed Solo 401k Process Flowchart Illustration Understanding 401 (k) fees. do you know what you pay for your retirement plan? who pays 401 (k) fees? milanvirijevic getty images. the balance is part of the dotdash meredith publishing family. work sponsored 401 (k) plans are a great way to save for retirement, but what fees come with these plans? learn the common expenses to expect. A 401 (k) is a tax advantaged retirement plan that is set up and managed by an employer. basically, you put money into the 401 (k) where it can be invested and potentially grow tax free over time. in most cases, you choose how much money you want to contribute to your 401 (k) based on a percentage of your income. The amount of 401 (k) fees you pay could have an impact on how much you're able to save. for example, say a 40 year old employee with a current 401 (k) account balance of $100,000 plans to save an additional $1,500 per year until age 65. assuming a 6% annual investment return and fees and expenses totaling 1%, the employee can potentially save. This booklet answers some common questions about the fees and expenses that your 401(k) plan may pay. it highlights the most common fees and encourages you, as a 401(k) plan participant, to: make informed investment decisions; consider fees as one of several factors in your decision making; compare all services received with the total cost; and.

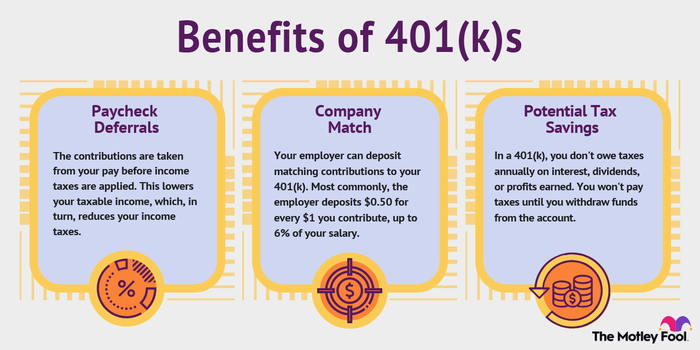

What Is A 401 K And How Do They Work The Motley Fool The amount of 401 (k) fees you pay could have an impact on how much you're able to save. for example, say a 40 year old employee with a current 401 (k) account balance of $100,000 plans to save an additional $1,500 per year until age 65. assuming a 6% annual investment return and fees and expenses totaling 1%, the employee can potentially save. This booklet answers some common questions about the fees and expenses that your 401(k) plan may pay. it highlights the most common fees and encourages you, as a 401(k) plan participant, to: make informed investment decisions; consider fees as one of several factors in your decision making; compare all services received with the total cost; and. The annual employee 401(k) contribution limit is $22,500 in 2023 for those under age 50. this increases to $23,000 in 2024. if you contribute to both a traditional 401(k) and a roth 401(k), the combined contribution limit for both accounts is still $22,500 in 2023. having two different kinds of 401(k)s does not double the contribution limit. Getty. a 401 (k) is an employer sponsored retirement savings plan. commonly offered as part of a job benefits package, employees may save a portion of their salary in a 401 (k) account, subject to.

Comments are closed.