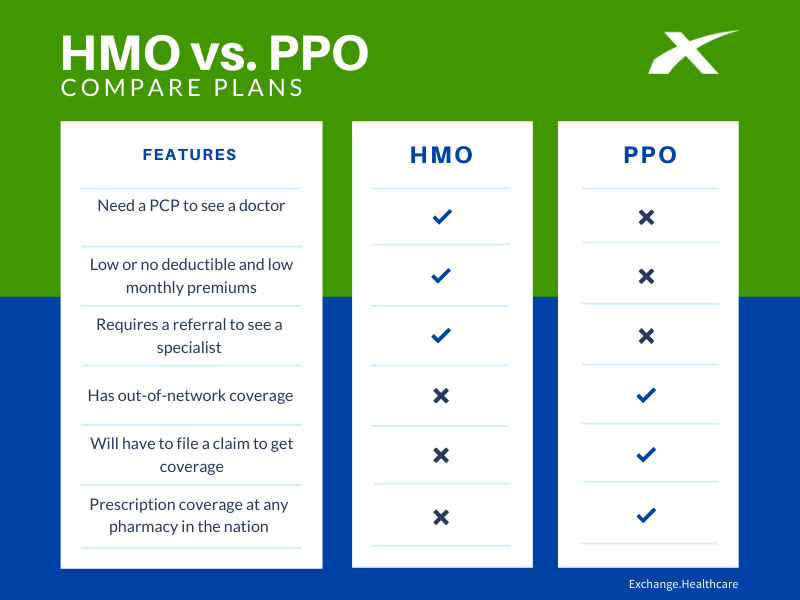

Hmo Vs Ppo Exchange Healthcare

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical Hmos will usually have smaller copays as well as deductibles. in general, most costs are lower with an hmo. you must use a pcp with an hmo, so if you do see specialists regularly, you may want to enroll in a ppo plan. ppo hmo price chart here in short when it comes to overall cost, while ppos may cost slightly more, lower premiums usually mean. Cheaper health insurance rates: hmo plans are usually a lower cost alternative to ppos. the average hmo rate is $427 monthly for an affordable care act (aca) plan for someone who is 30 years old.

Hmo Vs Ppo Exchange Healthcare Hmos offered by employers often have lower cost sharing requirements (i.e., lower deductibles, copays, and out of pocket maximums) than ppo options offered by the same employer. however, hmos sold in the individual insurance market often have out of pocket costs that are just as high as the available ppos. how hmos work. Providers or doctors either work for the hmo or contract for set rates. networks include providers and facilities that have negotiated lower rates on the services they perform. ppo health plans have access to those negotiated rates. doctors and facilities that participate in an epo are paid per service. But unlike hmo plans, ppos will pay some of the cost for out of network healthcare, typically 50%. to summarize, here's a breakdown of the pros and cons for hmo versus ppo plans: hmo. ppo. pros. On the flip side, hmos are structured to minimize costs. monthly premiums are often lower, but the trade off is in the limited choice of health care providers and the necessity for referrals. the pros and cons of choosing ppo over hmo and vice versa: ppo pros: greater flexibility in choosing a healthcare provider or specialist. no need for.

Comments are closed.