Fundamental Analysis Vs Technical Analysis The Complete Guide

Fundamental Vs Technical Analysis вђ All You Need To Know Technical analysis is a methodology that examines price patterns, trends, and market indicators, relying on historical data to forecast future price movements. on the other hand, fundamental analysis scrutinizes a company’s financial health, evaluating factors such as earnings, assets, and management to determine its intrinsic value. Key takeaways. fundamental analysis evaluates securities by trying to measure their intrinsic value. technical analysis focuses on statistical trends in the stock's price and volume over time.

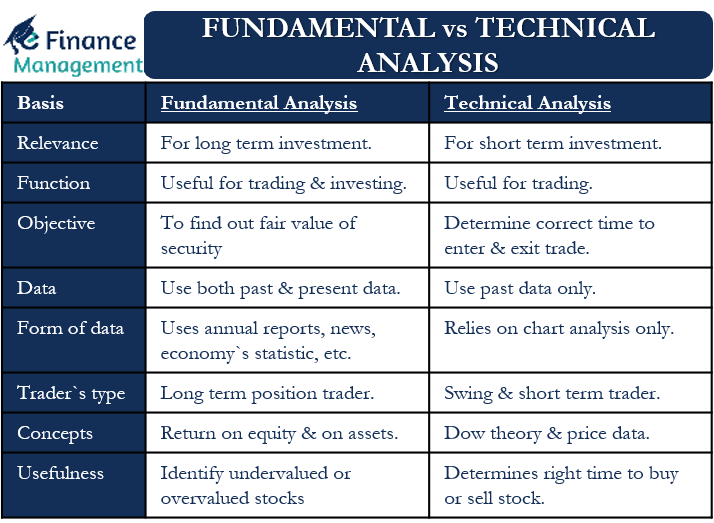

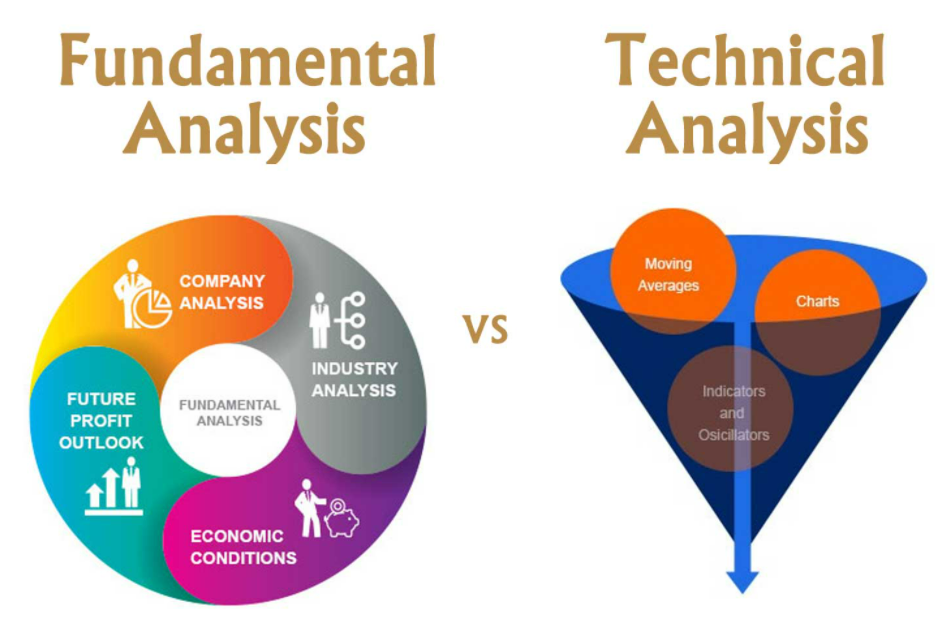

Fundamental Analysis Vs Technical Analysis The Complete Guide Regarding the time frame between fundamental and technical analysis, fundamental analysis is generally used for long term investment perspectives. investors using this approach typically look to hold stocks for several years. in contrast, technical analysis is more suitable for short term trading. Understanding market context and sentiment is also crucial. while fundamental analysis provides a sturdy foundation, technical analysis sheds light on current market sentiments and trends, understanding how external factors might temporarily affect a stock’s price. ongoing portfolio review and adaptation are essential. Differences in approach. the core difference between technical and fundamental analysis lies in their approach: technical analysis studies the price movement of securities, while fundamental analysis focuses on the economic and financial factors that influence a company’s value. Fundamental analysis definition. fundamental analysis (fa) is a method that helps to determine whether an asset or a security is trading at a discount or its premium compared to its fair value. it is most often applied to stocks, and other markets, including bonds, currencies, commodities, or even cryptocurrency.

Fundamental Analysis Vs Technical Analysis вђ Forex Academy Differences in approach. the core difference between technical and fundamental analysis lies in their approach: technical analysis studies the price movement of securities, while fundamental analysis focuses on the economic and financial factors that influence a company’s value. Fundamental analysis definition. fundamental analysis (fa) is a method that helps to determine whether an asset or a security is trading at a discount or its premium compared to its fair value. it is most often applied to stocks, and other markets, including bonds, currencies, commodities, or even cryptocurrency. The key difference between technical analysis and fundamental analysis lies in their approach and methodology. technical analysis focuses on analyzing historical price data and identifying patterns, while fundamental analysis examines the underlying factors that drive the value of an asset. technical analysis is primarily used for short to. Fundamental and technical analyses are two of the most popular camps when figuring out how to analyze stocks and make investment decisions. fundamental analysis is a longer term analysis method. it focuses on a company's financial performance, sometimes compared to industry peers. and technical analysis of stocks is a shorter term analysis method.

Comments are closed.