Five Popular Types Of Insurance Bylmes

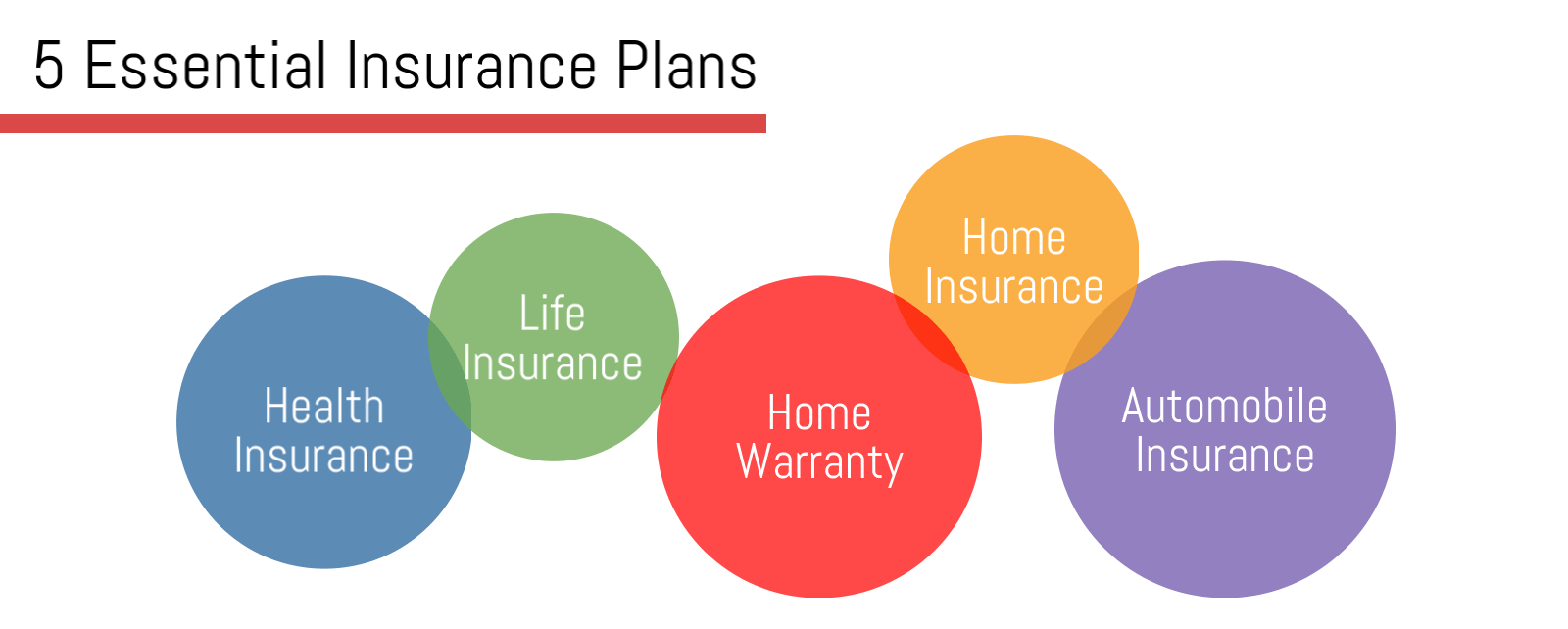

Five Popular Types Of Insurance Bylmes Health insurance. health insurance is a very popular insurance policy that covers the cost of medical dealings. it is an insurance that covers the entire or a part of the hazard of a person incurring medical expenses, scattering the risk over numerous persons dental insurance, is also medical insurance, shields policyholders from dental costs. Homeowners insurance. life insurance. pet insurance. auto insurance. insurance articles. there are several different types of insurance, and it can be hard to know which you need. here's our.

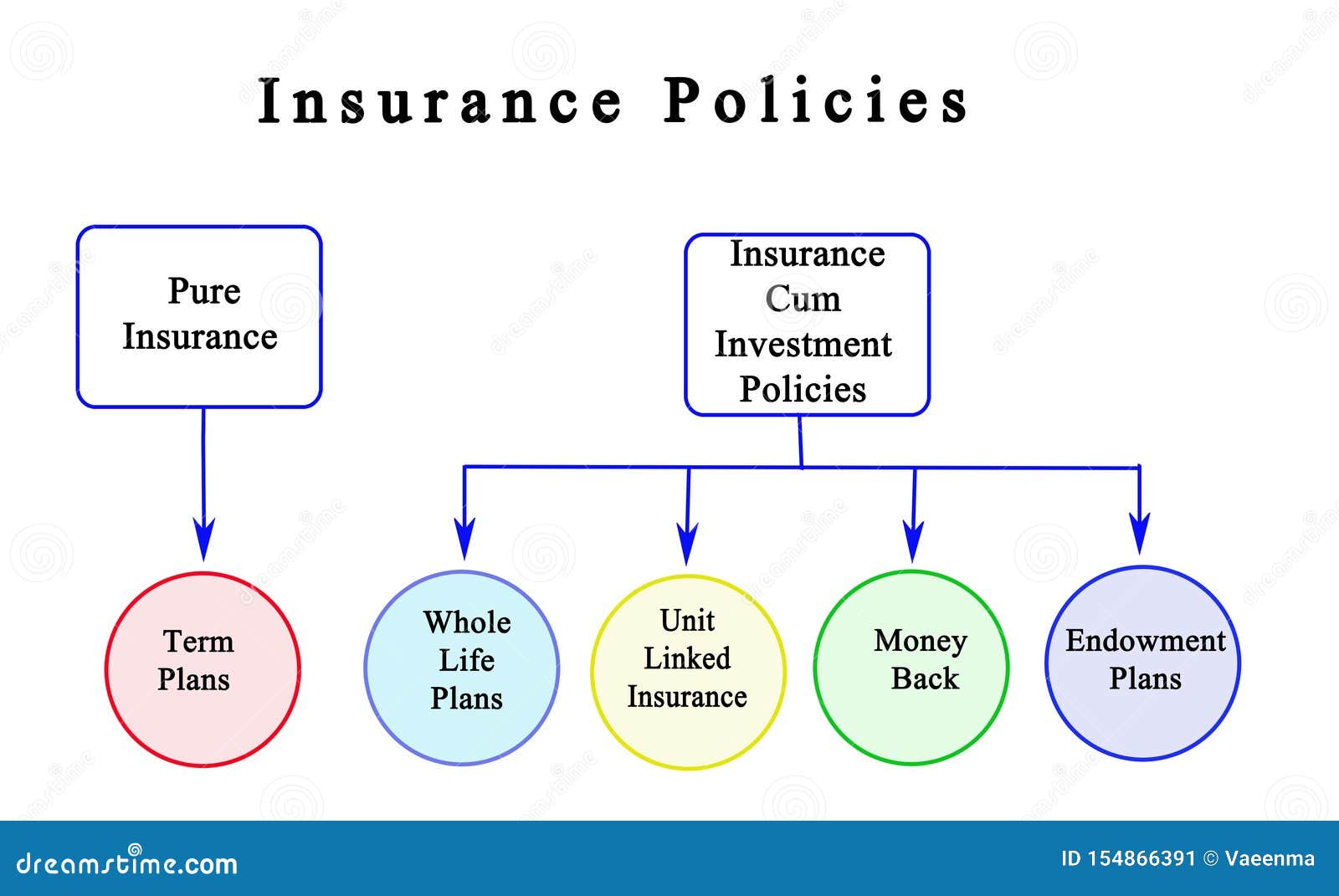

Types Of Insurance Comprehensive Guide To Insurance T Vrogue Co The most important types of insurance are auto, home, renters, umbrella, health, long term care, disability and life. assessing your personal insurance needs and budget constraints with an. Coverage amounts are typically low, usually between $1,000 and $5,000. comprehensive and collision coverage. these coverage types work together to pay for damage to your vehicle. collision. How it works: term life insurance is typically sold in lengths of one, five, 10, 15, 20, 25 or 30 years. coverage amounts vary depending on the policy but can go into the millions. most people buy. Whole life insurance is a popular type of permanent life insurance because it’s relatively simple and your premiums remain the same for the length of the policy. like most permanent policies, it comes with a cash value account, which acts as a tax deferred savings account and earns interest at a fixed rate set by the insurer.

Five Must Have Insurances How it works: term life insurance is typically sold in lengths of one, five, 10, 15, 20, 25 or 30 years. coverage amounts vary depending on the policy but can go into the millions. most people buy. Whole life insurance is a popular type of permanent life insurance because it’s relatively simple and your premiums remain the same for the length of the policy. like most permanent policies, it comes with a cash value account, which acts as a tax deferred savings account and earns interest at a fixed rate set by the insurer. There are two forms of private coverage for partial disability: short term disability insurance, which pays out a percentage of your salary (often 50% or more) for a few weeks or months. employers frequently provide this for free or a relatively small copay. (five states—california, hawaii, new jersey, new york, and rhode island—and puerto. A policy that guarantees income replacement is optimal. many policies pay 40% to 70% of your income. the cost of disability insurance is based on many factors, including age, lifestyle, and health.

Comments are closed.