Final Irs Rules For Meal And Entertainment Expenses

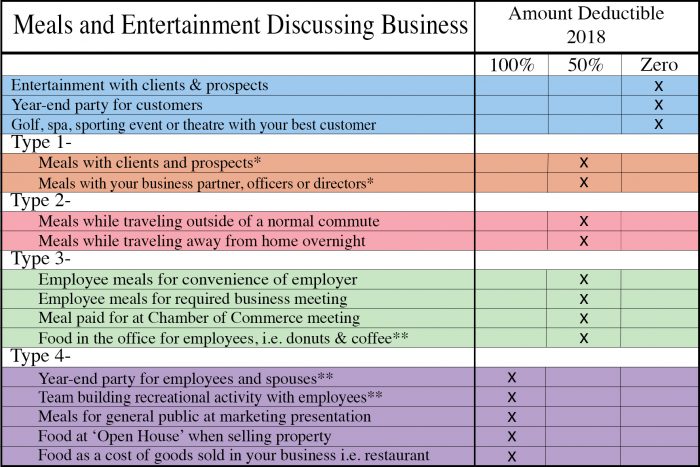

Final Irs Rules For Meal And Entertainment Expenses Youtube In general, section 274 limits or. disallows deductions for certain meal and entertainment expenditures that otherwise. would be allowable under chapter 1 of the code (chapter 1), primarily under section. 162(a), which allows a deduction for ordinary and necessary expenses paid or incurred. On sept. 30, 2020, the irs issued regs. secs. 1.274 11 and 1.274 12 to address the changes made to the meals and entertainment deduction under the tcja. business meals. regs. sec. 1.274 11 disallows the deduction for certain entertainment, amusement, or recreation expenditures paid or incurred after dec. 31, 2017.

Irs Final Guidance Meals Entertainment Expenses Pa Nj Md The cost of transportation to and from the meal isn't part of the cost of a business meal. entertainment events. business owners may be able to deduct the costs of meals and beverages provided during an entertainment event if either of these apply: the purchase of the food and beverages occurs separately from the entertainment. Topics. the irs on wednesday issued final regulations (t.d. 9925) implementing provisions of the law known as the tax cuts and jobs act (tcja), p.l. 115 97, that disallow a business deduction for most entertainment expenses. the regulations also clarify the treatment of business deductions for food and beverages that remain deductible. The irs has issued final regulations under code § 274 addressing the effects of the tax cuts and jobs act (tcja) on business expense deductions for meals and entertainment. effective after 2017, the tcja eliminated deductions for entertainment expenses and reduced the deduction for certain food and beverage expenses to 50% (see our checkpoint. Nondeductible entertainment expense. food or beverage expenses . business meal expenses . concerning business meal expenses, the final regulations add a new reg. section 1.274 12 that: • substantially incorporates the proposed regulations addressing business meals provided during or at an entertainment activity.

Update On Irs Rules For Meals And Entertainment Acec The irs has issued final regulations under code § 274 addressing the effects of the tax cuts and jobs act (tcja) on business expense deductions for meals and entertainment. effective after 2017, the tcja eliminated deductions for entertainment expenses and reduced the deduction for certain food and beverage expenses to 50% (see our checkpoint. Nondeductible entertainment expense. food or beverage expenses . business meal expenses . concerning business meal expenses, the final regulations add a new reg. section 1.274 12 that: • substantially incorporates the proposed regulations addressing business meals provided during or at an entertainment activity. The irs issued final regulations (t.d. 9925) clarifying amendments to the deductibility of certain business meals and entertainment expenses under the law known as the tax cuts and jobs act (tcja), p.l. 115 97, enacted in december 2017. these final regulations apply to tax years beginning on or after oct. 9, 2020. For example, a theatrical performance is not entertainment for a professional theater critic attending the performance in a professional capacity, and a fashion show by a dress manufacturer to introduce its products to a group of store buyers generally would not constitute entertainment. meal expense deduction rules in final regulations: under.

Irs Final Rules Meals And Entertainment Deductions Zetter Healthcare The irs issued final regulations (t.d. 9925) clarifying amendments to the deductibility of certain business meals and entertainment expenses under the law known as the tax cuts and jobs act (tcja), p.l. 115 97, enacted in december 2017. these final regulations apply to tax years beginning on or after oct. 9, 2020. For example, a theatrical performance is not entertainment for a professional theater critic attending the performance in a professional capacity, and a fashion show by a dress manufacturer to introduce its products to a group of store buyers generally would not constitute entertainment. meal expense deduction rules in final regulations: under.

Irs Rules On Entertainment Expenses

Comments are closed.