Examples Of Meals And Entertainment Expenses

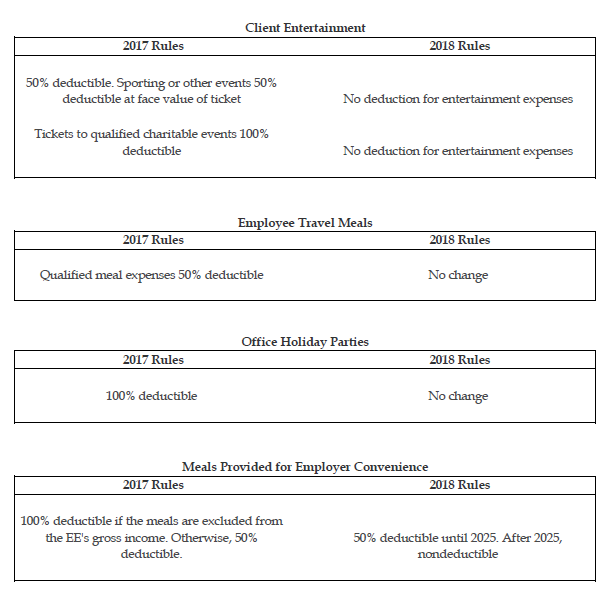

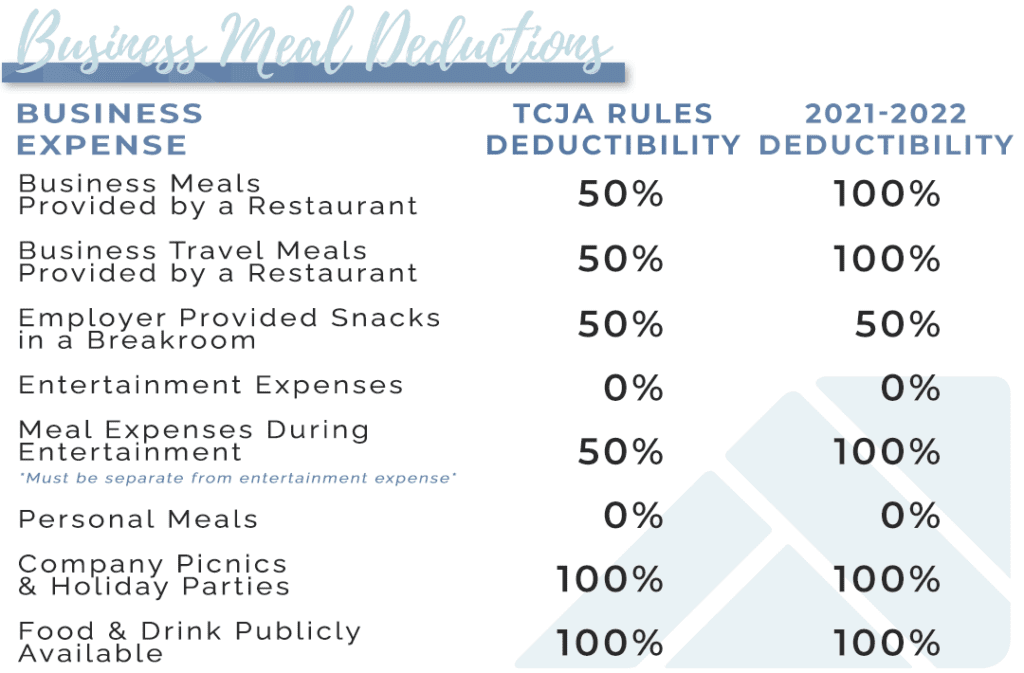

2022 Meal Entertainment Deductions Explained вђ Spiegel Accountancy Here are some common examples of 100% deductible meals and entertainment expenses: a company wide holiday party; food and drinks provided free of charge for the public; food included as taxable compensation to employees and included on the w 2; 50% deductible expenses. here are some of the most common 50% deductible expenses: a meal with a. Meals: ensure that meal expenses are separate from entertainment expenses. only 50% of meal expenses are deductible when they are directly associated with the active conduct of a trade or business. entertainment: entertainment expenses, in general, are no longer deductible as of the tax cuts and jobs act (tcja).

Entertainment Expenses For Employees For example, if a bar owner pays a band to perform for customers, this would likely be a deductible business expense. forbes irs announces new tax brackets and standard deduction for 2023 by david rae. The objective of the temporary deduction was to stimulate the restaurant industry. in 2023, however, the deductions for business meals and entertainment have reverted to the values outlined in the 2017 tax cuts and jobs act (tcja): most business meals are now 50% deductible instead of 100% deductible as they were in 2021 and 2022. As you record and document the expenses in your business, a common sticking point occurs when trying to determine meal and entertainment expenses that are nondeductible, 50 percent deductible and 100 percent deductible. to help ease record keeping for both you and your employees, consider establishing these three separate expense categories. Federal register. "meals and entertainment expenses under section 274." internal revenue service. "treasury, irs provide guidance on tax relief for deductions for food or beverages from restaurants." internal revenue service. "temporary 100 percent deduction for business meal expenses." page 1.

Meals And Entertainment Expenses In 2018 вђ Stephano Slack As you record and document the expenses in your business, a common sticking point occurs when trying to determine meal and entertainment expenses that are nondeductible, 50 percent deductible and 100 percent deductible. to help ease record keeping for both you and your employees, consider establishing these three separate expense categories. Federal register. "meals and entertainment expenses under section 274." internal revenue service. "treasury, irs provide guidance on tax relief for deductions for food or beverages from restaurants." internal revenue service. "temporary 100 percent deduction for business meal expenses." page 1. Entertainment expenses (meaning those of a type generally considered to be entertainment, amusement, or recreation) are fully nondeductible even if there is a business connection for the expense unless it falls into one of the exceptions listed below. the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. Entertainment expenses include the cost of meals you provide to customers or clients, whether the meal alone is the entertainment or it's a part of other entertainment (for example, refreshments at a football game). a meal expense includes the cost of food, beverages, taxes, and tips.

Examples Of Meals And Entertainment Expenses Entertainment expenses (meaning those of a type generally considered to be entertainment, amusement, or recreation) are fully nondeductible even if there is a business connection for the expense unless it falls into one of the exceptions listed below. the 50% disallowance rule limits the business deduction for certain otherwise deductible meals. Entertainment expenses include the cost of meals you provide to customers or clients, whether the meal alone is the entertainment or it's a part of other entertainment (for example, refreshments at a football game). a meal expense includes the cost of food, beverages, taxes, and tips.

Comments are closed.