Election 2020 And The Importance Of Stock Performance

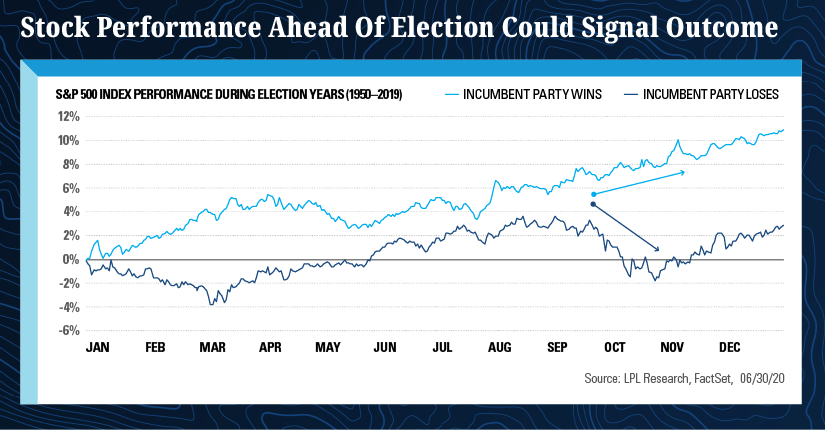

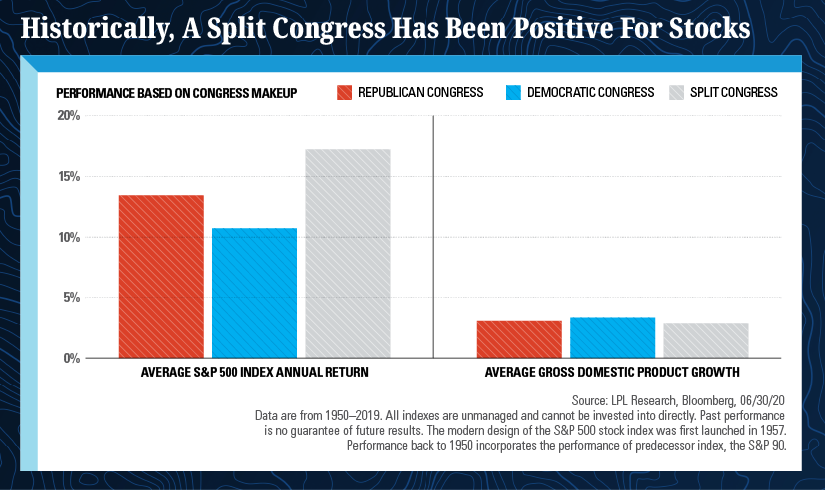

Election 2020 And The Importance Of Stock Performance When democrats have controlled both the house of representatives and the senate, the economy did a little better, with gdp growth of 3.3%, while the s&p 500 was up 10.7% on average. when we’ve had a split congress, however, the average s&p 500 gain climbed to 17.2%, while gdp growth averaged 2.8%, again suggesting markets may prefer split. His research also shows how stock market performance leading up to an election has also been a major indicator of the outcome. the performance of the s&p 500 in the three months before votes are.

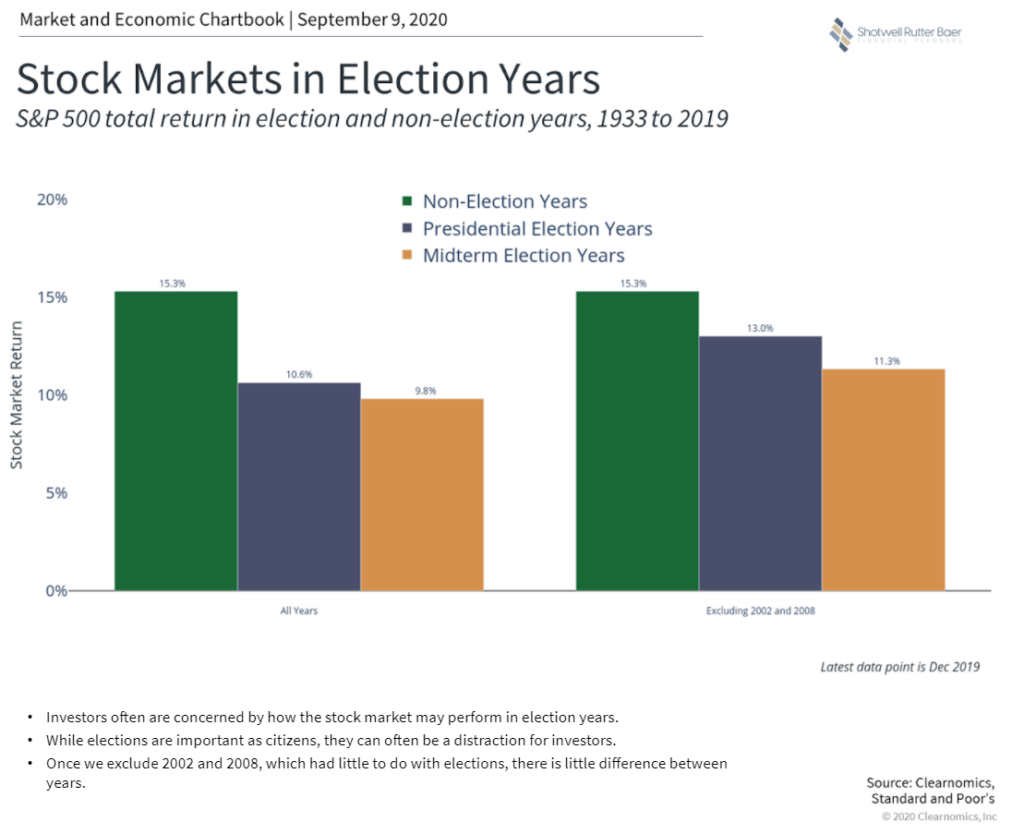

Election 2020 And The Importance Of Stock Performance The health of the u.s. economy appears to have played an important role in whether the incumbent party retained the presidency in an election year. in turn, whether the incumbent party won the white house seemed to influence trends in market volatility before and after past elections. Case in point: the 2020 election, conducted amid the covid 19 pandemic, was marked by tremendous market volatility. the “coronavirus crash” saw steep, rapid declines in stock prices in march 2020, but many investors were surprised to see the economy begin to rebound the following month, and the s&p 500 ended the year up by 15.6%. Generally, they found that the stock market’s performance is more muted in the 12 months leading up to the election. that effect is true for both the equities market and bond markets: equities. For years, trump has taken credit for the stock market’s performance — at least when it’s up. in the lead up to the 2020 election, he consistently claimed that if he were to lose, stocks.

Episode 1 How Will The 2020 Election Affect The Stock Market Generally, they found that the stock market’s performance is more muted in the 12 months leading up to the election. that effect is true for both the equities market and bond markets: equities. For years, trump has taken credit for the stock market’s performance — at least when it’s up. in the lead up to the 2020 election, he consistently claimed that if he were to lose, stocks. Biden and trump have been jousting in recent months over the stock market's performance as november's presidential election nears. given that by election day in 2020, the s&p 500 was up about. Also evident in this table is that the market’s initial reaction to an election’s outcome is often misleading. in six of the last 10 elections, stocks declined the day after election day, but the drop was quickly reversed. 1 this is not to downplay the importance of the u.s. presidency or the gravity of this election. but the key takeaway.

How Could The 2020 Presidential Election Affect The Stock Market Biden and trump have been jousting in recent months over the stock market's performance as november's presidential election nears. given that by election day in 2020, the s&p 500 was up about. Also evident in this table is that the market’s initial reaction to an election’s outcome is often misleading. in six of the last 10 elections, stocks declined the day after election day, but the drop was quickly reversed. 1 this is not to downplay the importance of the u.s. presidency or the gravity of this election. but the key takeaway.

Comments are closed.