Difference Between Fundamental And Technical Analysis In Trading Full

Technical Analysis Vs Fundamental Analysis What S The Difference Fundamental vs. technical analysis: an overview . there are two main schools of thought when evaluating investments and making trading decisions: fundamental analysis and technical analysis. Understanding market context and sentiment is also crucial. while fundamental analysis provides a sturdy foundation, technical analysis sheds light on current market sentiments and trends, understanding how external factors might temporarily affect a stock’s price. ongoing portfolio review and adaptation are essential.

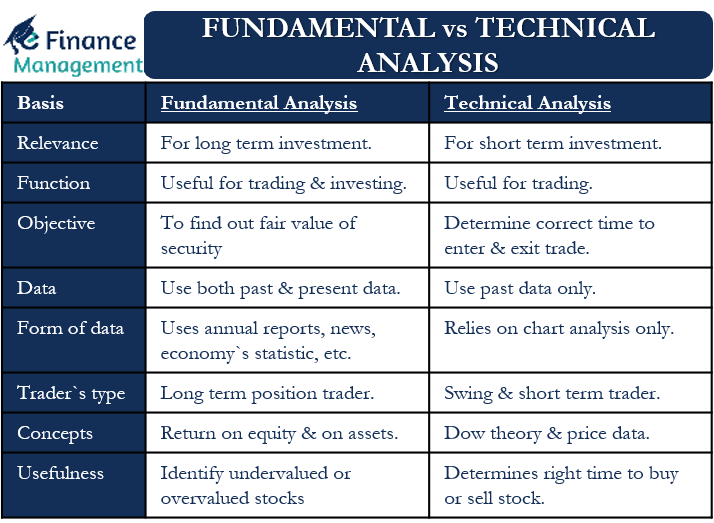

Difference Between Fundamental And Technical Analysis In Trading Full Technical analysis is the study of price and market sentiment. technical analysts focus on what's known as the “price action”, a combination of the price history and the volume traded in a security, alongside key information contained within that data. an example of this is the high, low, open, and closing prices for a security, posted. Long term perspective: fundamental analysis offers a deeper understanding of a company's financial health, making it a good option for traders who are on the lookout for more stable stocks. real time data: the analysis is based on financial data in real time, making it a timely and accurate source of data. In summary, while fundamental analysis dives into the ‘what’ and ‘why’ of a company’s value, technical analysis focuses on the ‘when’ and ‘how’ of trading it. both fundamental vs technical analysis, though distinct in their strategies, offer invaluable insights and are powerful weapons in an investor’s arsenal. This article explains the difference between fundamental and technical analysis so you can pick a form of analysis that is best suited to your trading personality. fundamental analysis some traders will want to weigh up economic factors such as a country’s gdp, unemployment levels, company profitability and the health of a sector before taking a decision to buy or sell.

Comments are closed.