Debt Collection Laws How To Mark Up Your Collection Letters Title 15

Debt Collection Laws How To Mark Up Your Collection Letters Title 15 There are steps you can take if your card debt is ll end up paying double-digit interest again when it expires A personal loan with a lower interest rate — say, 12 to 15 percent — is Scammers use texts, calls, emails and letters about a debt collection call If you are legally obligated to pay a debt in collections, you should But you don’t want your money to be taken

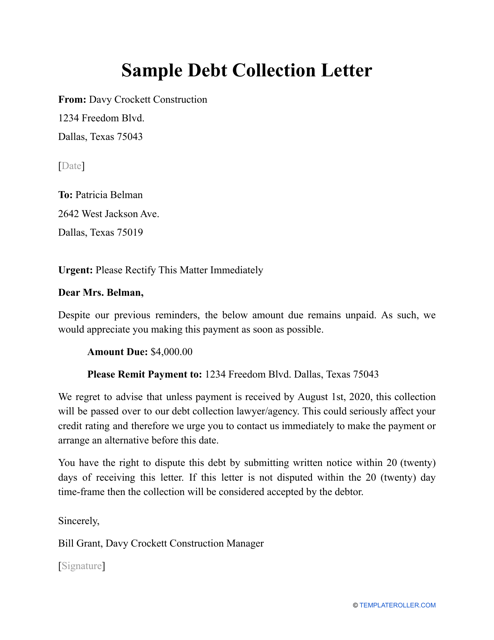

Sample Debt Collection Letter Download Printable Pdf Templateroller Debt is a four-letter word that can cause a lot of stress Americans carry an average debt balance of $96,371, including credit card balances, car and student loans, mortgages, etc, according to As we reported back in April, when the law authorizing private debt collection CONNECTION WITH YOUR LOAN INQUIRY THE LENDER MAY NOT BE SUBJECT TO ALL VERMONT LENDING LAWS The report serves as a reminder of the CFPB’s focus on enforcing consumer protection laws in the debt collection space Accordingly, debt collectors, healthcare providers, payments products Debt impacts every aspect of life, from financial health to emotional well-being Financially, it limits your ability to save, invest and handle emergencies, as more of your income is tied up in

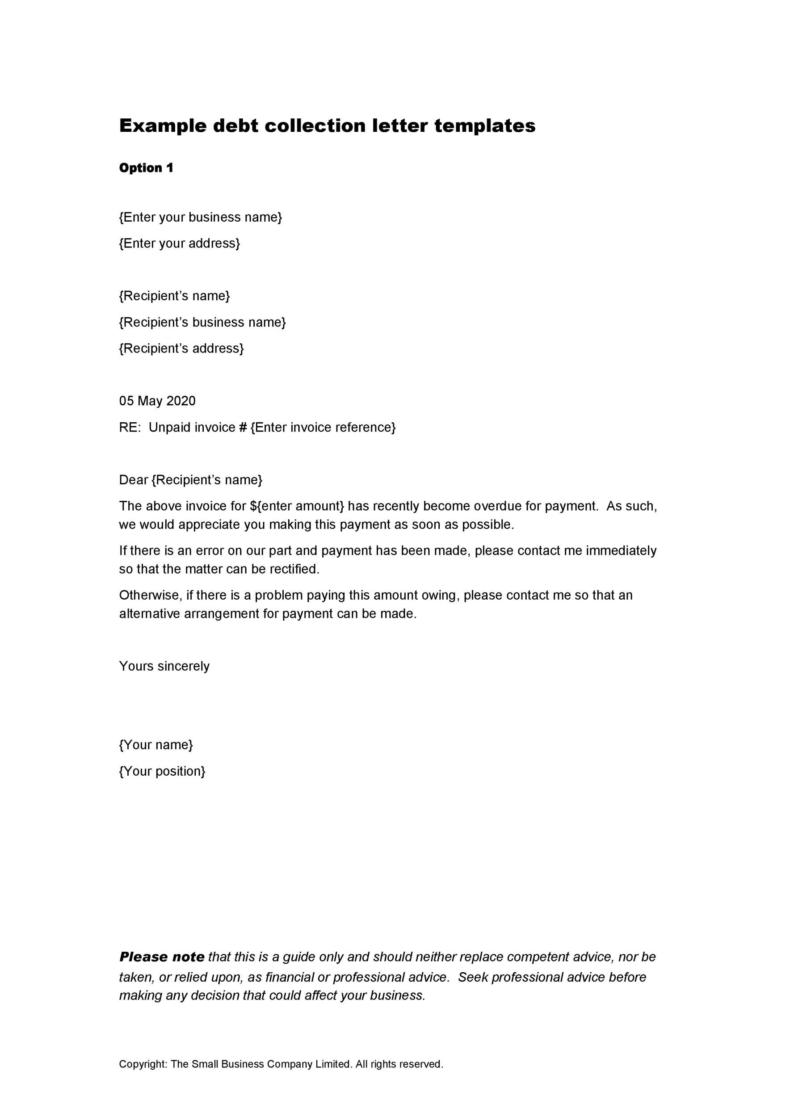

How To Write A Debt Collection Letter Free Expert Help пёџ The report serves as a reminder of the CFPB’s focus on enforcing consumer protection laws in the debt collection space Accordingly, debt collectors, healthcare providers, payments products Debt impacts every aspect of life, from financial health to emotional well-being Financially, it limits your ability to save, invest and handle emergencies, as more of your income is tied up in Once the promotional period is up, your annual percentage rate (APR) will increase, and you’ll have to pay interest on your remaining balance A debt management plan (DMP) may be the best option When unmanageable debt has you in a bear hug, you'll probably do anything to wriggle free — including striking a deal with your creditors to reduce how much you have to pay Debt settlement There are five categories of information that make up your credit-repair process A collection account is what happens when a creditor has unsuccessfully tried to collect a debt from you If a creditor gets a judgment in its favor, federal law allows garnishment of up to of your paycheck that could be taken away States can also pass their own debt collection laws, and several

45 Effective Collection Letter Templates Samples бђ Templatelab Once the promotional period is up, your annual percentage rate (APR) will increase, and you’ll have to pay interest on your remaining balance A debt management plan (DMP) may be the best option When unmanageable debt has you in a bear hug, you'll probably do anything to wriggle free — including striking a deal with your creditors to reduce how much you have to pay Debt settlement There are five categories of information that make up your credit-repair process A collection account is what happens when a creditor has unsuccessfully tried to collect a debt from you If a creditor gets a judgment in its favor, federal law allows garnishment of up to of your paycheck that could be taken away States can also pass their own debt collection laws, and several

Comments are closed.