Debt Collection Laws And What They Mean To You Creditrepair

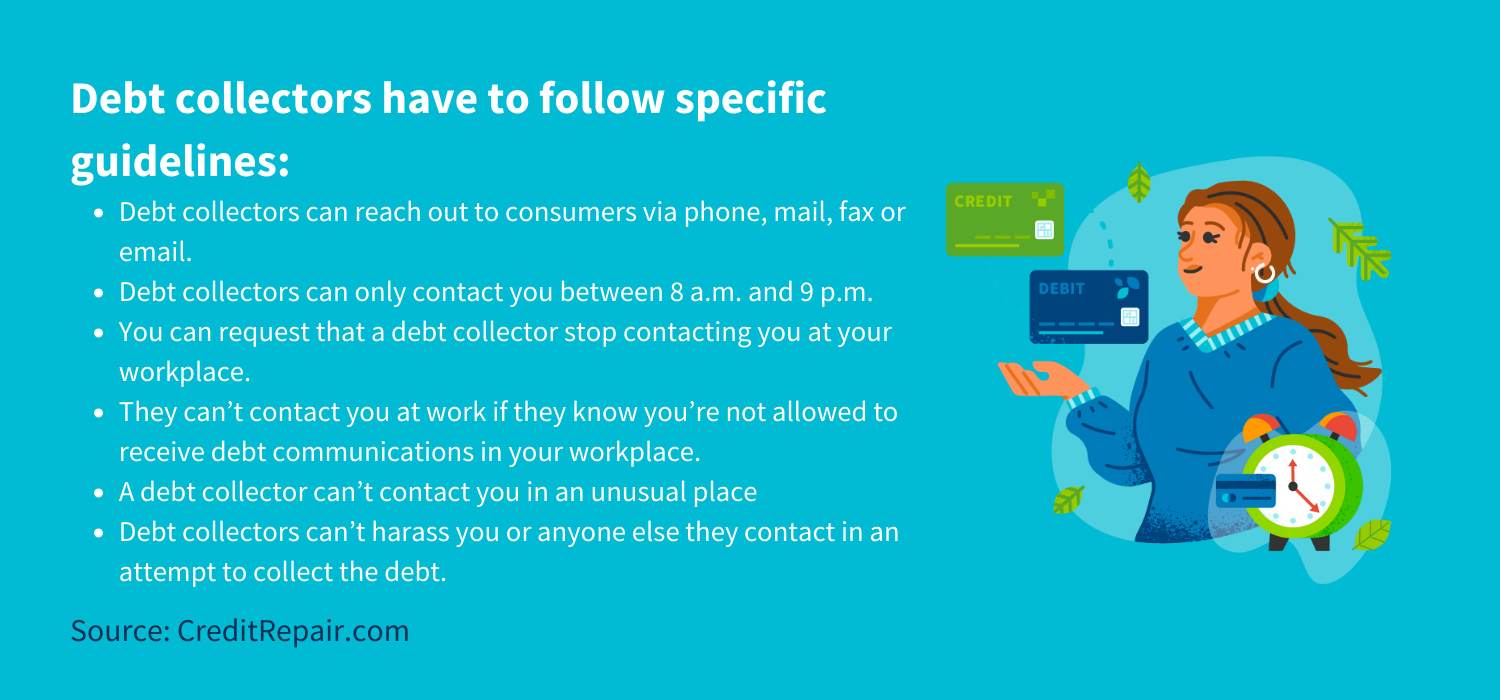

Debt Collection Laws And What They Mean To You Creditrepair When a debt collector contacts a consumer, they have to share specific details about the debt they’re calling about. they must share: the name of the original creditor or lender. the outstanding balance owed. that you have the right to dispute the debt if you send a written request within 30 days of contact. If you are contacted by a debt collector about a debt that you legally owe, the collectors are specifically prohibited from employing certain tactics, such as: (collection agencies, are, however, allowed to report the collection to the credit reporting agencies such as equifax, experian, and transunion.).

Debt Collection Laws And What They Mean To You Creditrepair The statute of limitations is a big piece of the zombie debt puzzle. essentially, if a debt has passed a certain time threshold, you’re no longer required to pay it. this length of time varies from state to state but is generally between three and six years. the shortest is two (for oral agreements in california), while the longest is 20 (for. Right to dispute incorrect debt. steps to take to pay off debt in collections. 1. right to a written notice explaining your debt. the first thing you should do when a debt collector contacts you — before even considering a payment — is to make sure that the debt collector and the debt are legitimate. The fair debt collection practices act makes it illegal for debt collectors to harass or threaten you when trying to collect on a debt. in addition, on november 30, 2021, the cfpb’s new debt collection rule became effective. this rule clarifies how debt collectors can communicate with you, including what information they’re required to. Tell people they contact to find you that they’re a debt collector. send any mail to anyone who knows you that indicates they’re trying to collect a debt. try to get information about you from your employer. call you at work if you tell them not to. pretend to be a government agency or anyone other than who they are.

Comments are closed.